Dell 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

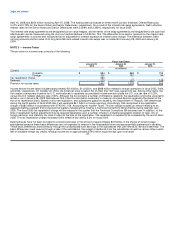

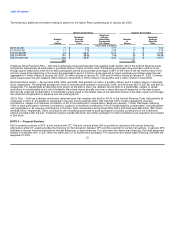

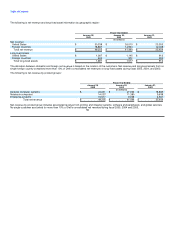

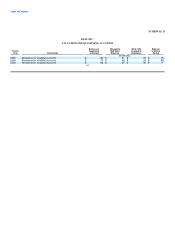

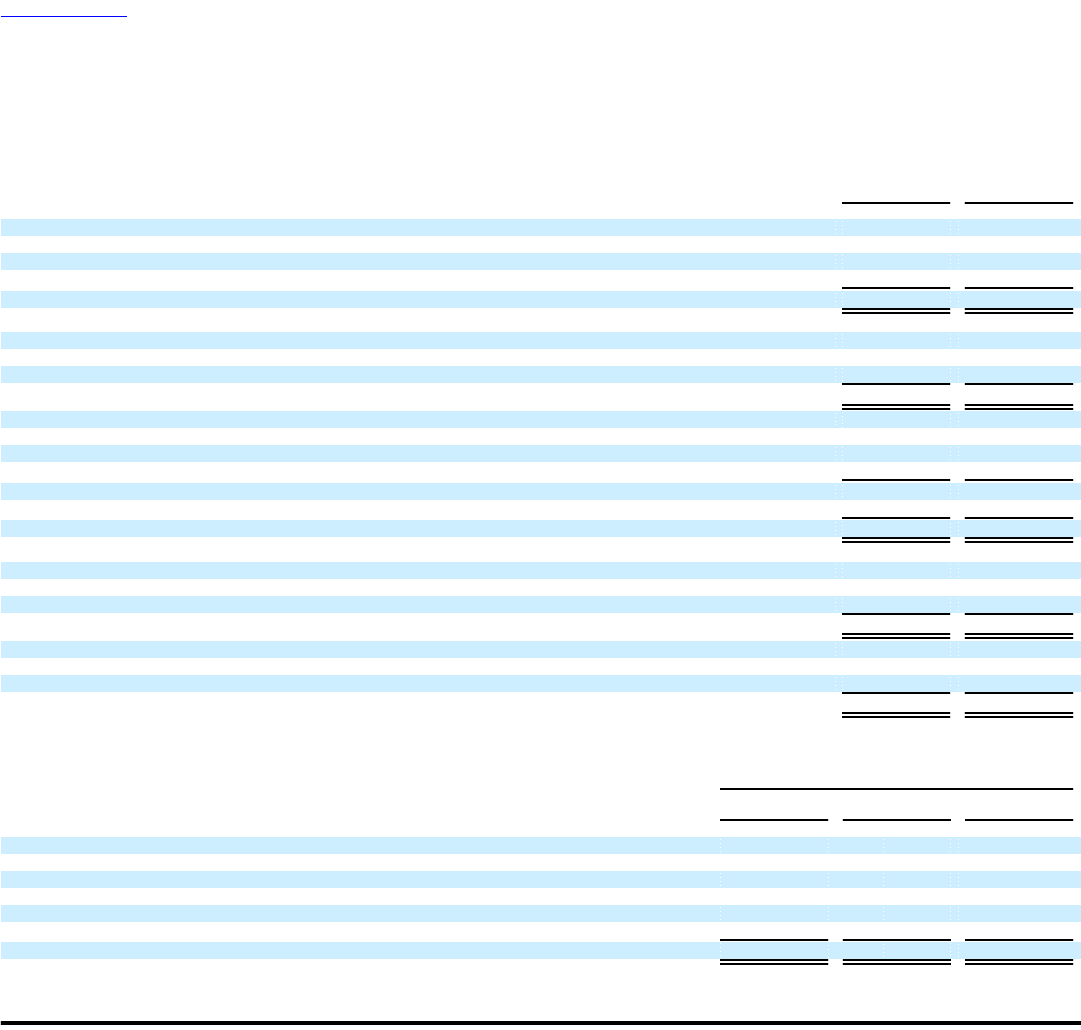

NOTE 10 — Supplemental Consolidated Financial Information

January 28, January 30,

2005 2004

(in millions)

Supplemental Consolidated Statements of Financial Position Information:

Accounts receivable:

Gross accounts receivable $ 4,492 $ 3,719

Allowance for doubtful accounts (78) (84)

$ 4,414 $ 3,635

Inventories:

Production materials $ 228 $ 161

Work-in-process 58 69

Finished goods 173 97

$ 459 $ 327

Property, plant and equipment:

Land and buildings $ 1,207 $ 1,158

Computer equipment 1,053 898

Machinery and other equipment 757 594

Total property, plant and equipment 3,017 2,650

Accumulated depreciation and amortization (1,326) (1,133)

$ 1,691 $ 1,517

Accrued and other current liabilities:

Deferred revenue $ 1,389 $ 961

Compensation 753 603

Other 3,099 2,016

$ 5,241 $ 3,580

Other non-current liabilities:

Deferred revenue $ 1,415 $ 1,092

Other 674 538

$ 2,089 $ 1,630

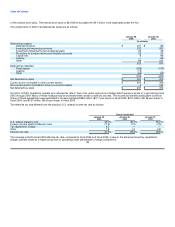

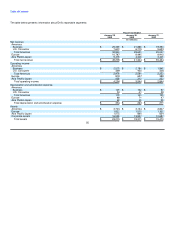

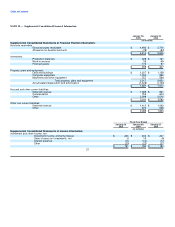

Fiscal Year Ended

January 28, January 30, January 31,

2005 2004 2003

(in millions)

Supplemental Consolidated Statements of Income Information:

Investment and other income, net:

Investment income, primarily interest $ 226 $ 200 $ 227

Gains (losses) on investments, net 6 16 (6)

Interest expense (16) (14) (17)

Other (25) (22) (21)

$ 191 $ 180 $ 183

57