Dell 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

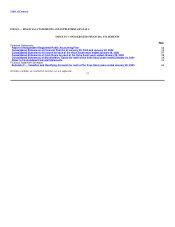

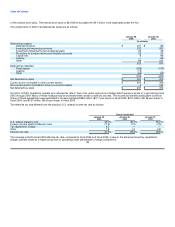

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 — Description of Business and Summary of Significant Accounting Policies

Description of Business — Dell Inc., a Delaware corporation, and its consolidated subsidiaries (collectively referred to as "Dell") designs, develops,

manufactures, markets, sells, and supports a wide range of computer systems and services that are customized to customer requirements. These include

enterprise systems (servers, storage, workstations, and networking products), client systems (notebook and desktop computer systems), printing and imaging

systems, software and peripherals, and global services. Dell markets and sells its products and services directly to its customers, which include large

corporate, government, healthcare, and education accounts, as well as small-to-medium businesses and individual customers.

Fiscal Year — Dell's fiscal year is the 52- or 53-week period ending on the Friday nearest January 31. Fiscal 2005, 2004, and 2003 all included 52 weeks.

Principles of Consolidation — The accompanying consolidated financial statements include the accounts of Dell and its wholly-owned and controlled

majority-owned subsidiaries and have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP").

All significant intercompany transactions and balances have been eliminated.

Dell is currently a partner in Dell Financial Services L.P. ("DFS"), a joint venture with CIT Group Inc. ("CIT"). The joint venture allows Dell to provide its

customers with various financing alternatives while CIT provides the financing between DFS and the customer for certain transactions. Dell began

consolidating DFS's financial results at the beginning of the third quarter of fiscal 2004 due to the adoption of Financial Accounting Standards Board

("FASB") Interpretation No. 46R ("FIN 46R"). The consolidation of DFS had no impact on Dell's net income or earnings per share because Dell had

historically been recording its 70% equity interest in DFS under the equity method. See Note 6 of "Notes to Consolidated Financial Statements."

Use of Estimates — The preparation of financial statements in accordance with GAAP requires the use of management's estimates. These estimates are

subjective in nature and involve judgments that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at fiscal

year end, and the reported amounts of revenues and expenses during the fiscal year. Actual results could differ from those estimates.

Cash and Cash Equivalents — All highly liquid investments with original maturities of three months or less at date of purchase are carried at cost plus

accrued interest, which approximates fair value, and are considered to be cash equivalents. All other investments not considered to be cash equivalents are

separately categorized as investments.

Investments — Dell's investments in debt securities and publicly traded equity securities are classified as available-for-sale and are reported at fair market

value (based on quoted market prices) using the specific identification method. Unrealized gains and losses, net of taxes, are reported as a component of

stockholders' equity. Realized gains and losses on investments are included in investment and other income, net when realized. All other investments are

initially recorded at cost and charged against income when a decline in the fair market value of an individual security is determined to be other-than-

temporary.

Inventories — Inventories are stated at the lower of cost or market with cost being determined on a first-in, first-out basis.

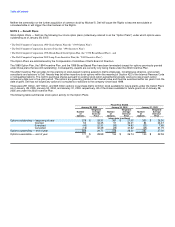

Property, Plant, and Equipment — Property, plant, and equipment are carried at depreciated cost. Depreciation is provided using the straight-line method over

the estimated economic lives of the assets, which range from 10 to 30 years for buildings and two to five years for all other assets. Leasehold improvements

are amortized over the shorter of five years or the lease term. Gains or 40