Dell 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

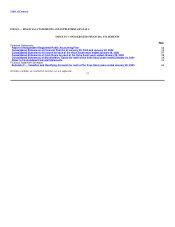

Table of Contents

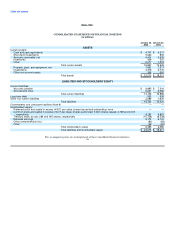

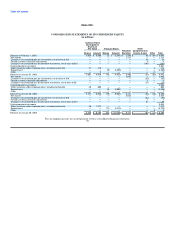

DELL INC.

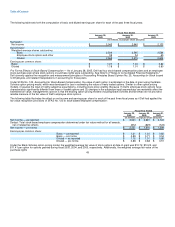

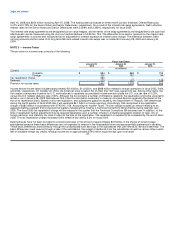

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions)

Common Stock

and Capital in

Excess of

Par Value Treasury Stock Other

Retained Comprehensive

Shares Amount Shares Amount Earnings Income (Loss) Other Total

Balances at February 1, 2002 2,654 $ 5,605 52 $ (2,249) $ 1,364 $ 38 $ (64) $ 4,694

Net income — — — — 2,122 — — 2,122

Change in net unrealized gain on investments, net of taxes of $14 — — — — — 26 — 26

Foreign currency translation adjustments — — — — — 4 — 4

Change in net unrealized loss on derivative instruments, net of taxes of $42 — — — — — (101) — (101)

Total comprehensive income 2,051

Stock issuances under employee plans, including tax benefits 27 410 — — — — 6 416

Repurchases — — 50 (2,290) — — — (2,290)

Other — 3 — — — — (1) 2

Balances at January 31, 2003 2,681 6,018 102 (4,539) 3,486 (33) (59) 4,873

Net income — — — — 2,645 — — 2,645

Change in net unrealized gain on investments, net of taxes of $19 — — — — — (35) — (35)

Foreign currency translation adjustments — — — — — 6 — 6

Change in net unrealized loss on derivative instruments, net of taxes of $5 — — — — — (21) — (21)

Total comprehensive income 2,595

Stock issuances under employee plans, including tax benefits 40 805 — — — — — 805

Repurchases — — 63 (2,000) — — — (2,000)

Other — — — — — — 7 7

Balances at January 30, 2004 2,721 6,823 165 (6,539) 6,131 (83) (52) 6,280

Net income — — — — 3,043 — — 3,043

Change in net unrealized gain on investments, net of taxes of $16 — — — — — (52) — (52)

Foreign currency translation adjustments — — — — — 1 — 1

Change in net unrealized loss on derivative instruments, net of taxes of $21 — — — — — 52 — 52

Total comprehensive income 3,044

Stock issuances under employee plans, including tax benefits 48 1,372 — — — — — 1,372

Repurchases — — 119 (4,219) — — — (4,219)

Other — — — — — — 8 8

Balances at January 28, 2005 2,769 $ 8,195 284 $ (10,758) $ 9,174 $ (82) $ (44) $ 6,485

The accompanying notes are an integral part of these consolidated financial statements.

39