Dell 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Neither the ownership nor the further acquisition of common stock by Michael S. Dell will cause the Rights to become exercisable or

nonredeemable or will trigger the other features of the Rights.

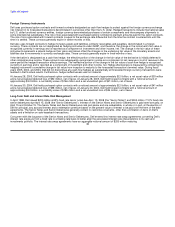

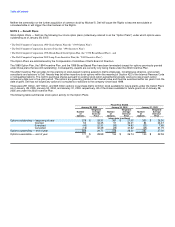

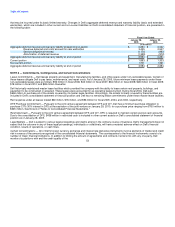

NOTE 5 — Benefit Plans

Stock Option Plans — Dell has the following four stock option plans (collectively referred to as the "Option Plans") under which options were

outstanding as of January 28, 2005:

• The Dell Computer Corporation 1989 Stock Option Plan (the "1989 Option Plan")

• The Dell Computer Corporation Incentive Plan (the "1994 Incentive Plan")

• The Dell Computer Corporation 1998 Broad-Based Stock Option Plan (the "1998 Broad-Based Plan"), and

• The Dell Computer Corporation 2002 Long-Term Incentive Plan (the "2002 Incentive Plan")

The Option Plans are administered by the Compensation Committee of Dell's Board of Directors.

The 1989 Option Plan, the 1994 Incentive Plan, and the 1998 Broad-Based Plan have been terminated (except for options previously granted

under those plans that are still outstanding). Consequently, awards are currently only being made under the 2002 Incentive Plan.

The 2002 Incentive Plan provides for the granting of stock-based incentive awards to Dell's employees, nonemployee directors, and certain

consultants and advisors to Dell. Awards may be either incentive stock options within the meaning of Section 422 of the Internal Revenue Code

or nonqualified options. The right to purchase shares pursuant to existing stock option agreements typically vests pro-rata at each option

anniversary date over a five-year period. The options are generally granted at fair market value and must be exercised within ten years from the

date of grant. Dell has not issued any options to consultants or advisors to the company since fiscal 1999.

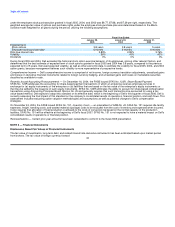

There were 291 million, 327 million, and 365 million options to purchase Dell's common stock available for future grants under the Option Plans

as of January 28, 2005, January 30, 2004, and January 31, 2003, respectively. All of the shares available for future grants as of January 28,

2005 are under the 2002 Incentive Plan.

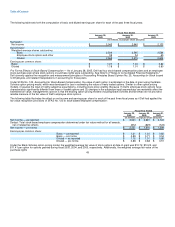

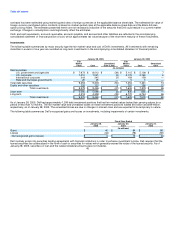

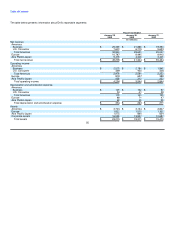

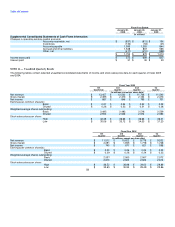

The following table summarizes stock option activity for the Option Plans:

Fiscal Year Ended

January 28, 2005 January 30, 2004 January 31, 2003

Weighted- Weighted- Weighted-

Number Average Number Average Number Average

of Exercise of Exercise of Exercise

Options Price Options Price Options Price

(share data in millions)

Options outstanding — beginning of year 378 $ 28.30 387 $ 27.09 350 $ 26.36

Granted 52 34.35 51 30.01 84 26.37

Exercised (45) 22.30 (35) 14.92 (22) 7.69

Cancelled (16) 32.39 (25) 31.62 (25) 31.75

Options outstanding — end of year 369 29.70 378 28.30 387 27.09

Options exercisable — end of year 171 $ 28.99 154 $ 26.74 130 $ 22.59

50