Dell 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

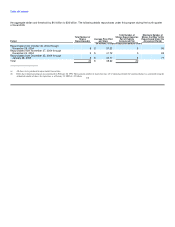

Investment and Other Income, net

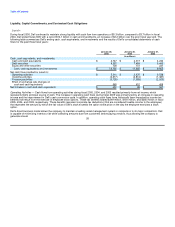

The following table summarizes Dell's investment and other income, net for each of the past three fiscal years:

Fiscal Year Ended

January 28, January 30, January 31,

2005 2004 2003

(in millions)

Investment income, primarily interest $ 226 $ 200 $ 227

Gains (losses) on investments, net 6 16 (6)

Interest expense (16) (14) (17)

Other (25) (22) (21)

Investment and other income, net $ 191 $ 180 $ 183

Investment income increased from fiscal 2004 to fiscal 2005 primarily due to an increase in investment income earned on higher average

balances of cash equivalents and investments. Investment income decreased from fiscal 2003 to fiscal 2004 primarily from a decline in interest

rates on investments, which was partially offset by an increase in cash equivalents and investments during the year.

Income Taxes

Dell's reported effective tax rate was 31.5% in fiscal 2005, compared to 29.0% for fiscal 2004 and 29.9% for fiscal 2003. The fiscal 2005

effective tax rate includes a tax repatriation charge of $280 million pursuant to a favorable tax incentive provided by the American Jobs Creation

Act of 2004 (the "Act"), which was signed into law on October 22, 2004. This tax repatriation charge increased Dell's effective tax rate by 6.3%

for fiscal 2005. The increase in Dell's fiscal 2005 effective tax rate, compared to fiscal 2004 and fiscal 2003, is due to the aforementioned tax

repatriation charge, partially offset by a higher proportion of operating profits attributable to foreign jurisdictions.

Among other items, the Act creates a temporary incentive for U.S. multinationals to repatriate accumulated income earned outside the U.S. at a

tax rate of 5.25%, versus the U.S. federal statutory rate of 35%. Although the Act contains a number of limitations related to the repatriation and

some uncertainty remains, as of January 28, 2005 Dell believes that it has the information necessary to make an informed decision regarding

the impact of the Act on its repatriation plans. Based on this new legislation, and subsequent guidance issued by the Department of Treasury,

Dell determined during the fourth quarter of fiscal 2005 that it will repatriate $4.1 billion in foreign earnings. Accordingly, Dell recognized a tax

repatriation charge of $280 million in accordance with Statement of Financial Accounting Standards ("SFAS") No. 109, Accounting for Income

Taxes. This tax charge includes an amount relating to an apparent drafting oversight that Congressional leaders indicate will be fixed by a

Technical Corrections Bill sometime during calendar year 2005. The fiscal 2005 tax repatriation charge will be reduced in the quarter that the

Technical Corrections Bill becomes law. In addition, at the time of repatriation further adjustment may be required depending upon a number of

factors, including geographic location of cash, mix of foreign earnings, and statutory tax rates in effect at the time of the repatriation. The

repatriation is required to be completed by the end of fiscal 2006.

Differences between Dell's fiscal 2005 effective tax rate and the U.S. federal statutory rate of 35% principally result from Dell's geographical

distribution of taxable income and losses, partially offset by the impact of the Act. During fiscal 2004 and 2003, the differences between Dell's

effective and statutory tax rates were attributable to the geographic distribution of taxable income and losses. Dell's effective tax rate may

decline in future periods as the company's business outside the 24