Dell 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

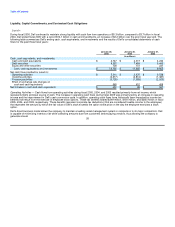

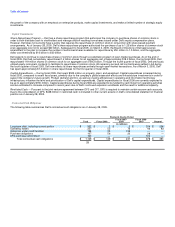

strong liquidity with record operating cash flow of $5.3 billion and ended the year with record cash and investments of $14.1 billion.

Dell's objective is to maximize stockholder value while maintaining a balance of three key financial metrics: liquidity, profitability, and growth.

Dell's strategy combines its direct business model with a highly efficient manufacturing and supply chain management organization and an

emphasis on standards-based technologies. Dell's business model provides the company with a constant flow of information about trends in

customers' plans and requirements. These trends have shown an increased use of standards-based technologies as well as a push towards

standardization of services. Unlike proprietary technologies promoted by some of Dell's top competitors, standards-based technologies provide

customers with flexibility and choice while allowing their purchasing decisions to be based on performance, cost, and customer service. Dell's

business strategy continues to focus on the company's enterprise business and expanding its capabilities in that product group. Dell is also

expanding into consumer electronics products such as plasma televisions while maintaining its leadership position in desktops and notebooks.

Dell's superior execution in all product and service offerings has been demonstrated by progress in customer satisfaction ratings during the

year, which is a key performance metric for the company.

Management believes that growth opportunities exist for Dell as the use of standards-based technologies becomes more prevalent and the

company increases its presence in existing geographical regions, expands into new regions, and pursues additional product and service

opportunities. During the year, Dell opened new facilities in the U.S., Canada, India, and El Salvador and expects to continue its global

expansion in years ahead. Dell's investment in international growth opportunities contributed to an increase in Dell's non-U.S. revenue, as a

percentage of consolidated net revenue, from 36% in fiscal 2004 to 38% during fiscal 2005.

While the current competitive environment continues to be challenging, management believes that there has been a steady improvement in

business technology spending since the end of fiscal 2004. Management expects that the competitive pricing environment will continue to be

challenging, and expects to continue to reduce its pricing as necessary in response to future competitive and economic conditions.

Management is also focused on attracting and retaining key personnel as well as further investing in the company's global information

technology infrastructure in order to address challenges that may arise with Dell's rapid global growth and the increased complexity of the

company's product and service offerings.

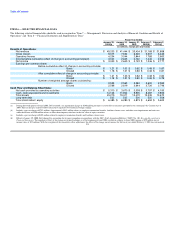

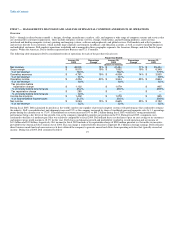

Results of Operations

Net Revenue

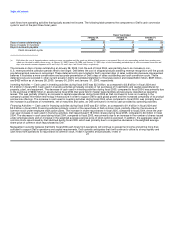

During fiscal 2005, Dell's strategy and execution extended the company's number one worldwide position for the calendar year. Dell produced

net revenue of $49.2 billion in fiscal 2005, compared to $41.4 billion in fiscal 2004 and $35.4 billion in fiscal 2003. The year-over-year increases

in net revenue during both fiscal 2005 and 2004 were driven by strong unit growth across most regions and product lines. Specifically, Dell's

Europe and Asia Pacific-Japan segments produced revenue growth in excess of 25% during fiscal 2005, while notebooks produced

consolidated revenue growth of 24%. During fiscal 2005, Dell's net unit growth continued to exceed industry growth as consolidated net unit

shipments increased 21% while total PC industry growth increased only 15% for the calendar year. During fiscal 2004, Dell produced net unit

growth of 26%, while the total PC industry increased only 12% for the calendar year.

During fiscal 2005, management continued to focus on Dell's enterprise business. Net revenue for enterprise systems increased 16% and 31%

during fiscal 2005 and 2004, respectively, with fiscal 2005 growth being led by 18% server growth. Dell gained 1.5 share percentage points in

shipments of x86 servers (based on standard Intel architecture) and improved its number two position to 24.8% for calendar 2004. Dell's four-

year running partnership with EMC Corporation, and management's continued focus on mid-range Dell/ EMC storage area network ("SAN")

products, produced 20