Dell 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

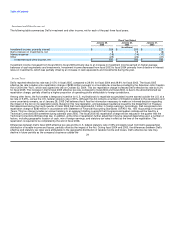

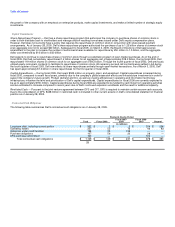

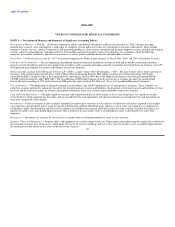

support, repair parts, labor, and a period ranging from 90 days to three years. Factors that affect Dell's warranty liability include the number of

installed units currently under warranty, historical and anticipated rates of warranty claims on those units, and cost per claim to satisfy Dell's

warranty obligation. The anticipated rate of warranty claims is the primary factor impacting Dell's estimated warranty obligation. The other

factors are relatively insignificant because the average remaining aggregate warranty period of the covered installed base is approximately

20 months, repair parts are generally already in stock or available at pre-determined prices, and labor rates are generally arranged at pre-

established amounts with service providers. Warranty claims are relatively predictable based on historical experience of failure rates. Each

quarter, Dell reevaluates its estimates to assess the adequacy of its recorded warranty liabilities and adjusts the amounts as necessary.

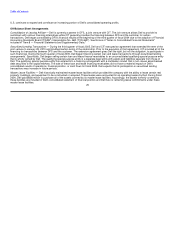

Income Taxes — Dell calculates a provision for income taxes using the asset and liability method, under which deferred tax assets and

liabilities are recognized by identifying the temporary differences arising from the different treatment of items for tax and accounting purposes.

In determining the future tax consequences of events that have been recognized in Dell's financial statements or tax returns, judgment is

required. Differences between the anticipated and actual outcomes of these future tax consequences could have a material impact on Dell's

consolidated results of operations or financial position.

Recently Issued Accounting Pronouncements

On December 16, 2004, the FASB issued SFAS No. 123R, Share-Based Payment. SFAS No. 123R addresses the accounting for share-based

payment transactions in which an enterprise receives employee services in exchange for (a) equity instruments of the enterprise or (b) liabilities

that are based on the fair value of the enterprise's equity instruments or that may be settled by the issuance of such equity instruments.

SFAS No. 123R eliminates the ability to account for share-based compensation transactions using Accounting Principles Board Opinion No. 25

and generally requires that such transactions be accounted for using a fair-value-based method. Dell expects to adopt this standard on its

effective date, which is the beginning of Dell's third quarter of fiscal 2006. Dell is currently assessing the final impact of this standard on the

company's consolidated results of operations, financial position, and cash flows. This assessment includes evaluating option valuation

methodologies and assumptions as well as potential changes to Dell's compensation strategies.

On November 24, 2004, the FASB issued SFAS No. 151, Inventory Costs — an amendment of ARB No. 43. SFAS No. 151 requires idle facility

expenses, freight, handling costs, and wasted material (spoilage) costs to be excluded from the cost of inventory and expensed when incurred.

It also requires that allocation of fixed production overheads to the costs of conversion be based on the normal capacity of the production

facilities. SFAS No. 151 will be effective at the beginning of Dell's fiscal 2007. SFAS No. 151 is not expected to have a material impact on Dell's

consolidated results of operations or financial position.

ITEM 7A — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Response to this item is included in "Item 7 — Management's Discussion and Analysis of Financial Condition and Results of Operations — Market Risk."

32