Dell 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of this excess book basis. The excess book basis of $2.9 billion excludes the $4.1 billion to be repatriated under the Act.

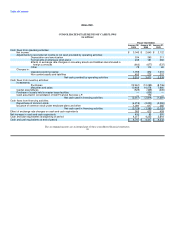

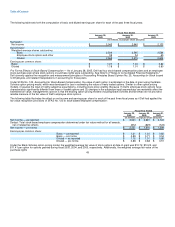

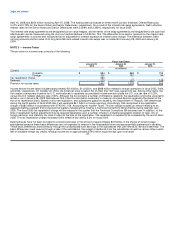

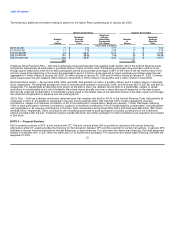

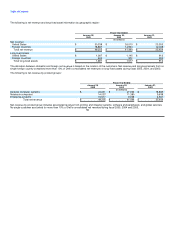

The components of Dell's net deferred tax asset are as follows:

January 28, January 30,

2005 2004

(in millions)

Deferred tax assets:

Deferred revenue $ 241 $ 86

Inventory and warranty provisions 232 260

Investment impairments and unrealized gains 23 39

Provisions for product returns and doubtful accounts 22 21

Capital loss 6 96

Leasing — 69

Other 99 104

623 675

Deferred tax liabilities:

Fixed assets (156) (129)

Leasing (10) —

Other (26) (74)

(192) (203)

Net deferred tax asset $ 431 $ 472

Current portion (included in other current assets) $ 425 $ 339

Non-current portion (included in other non-current assets) 6 133

Net deferred tax asset $ 431 $ 472

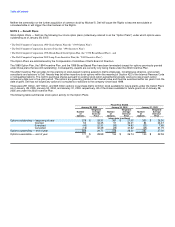

A portion of Dell's operations operate at a reduced tax rate or free of tax under various tax holidays which expire in whole or in part during fiscal

2012 through 2019. Many of these holidays may be extended when certain conditions are met. The income tax benefits attributable to the tax

status of these subsidiaries were estimated to be approximately $280 million ($0.11 per share) in fiscal 2005, $210 million ($0.08 per share) in

fiscal 2004, and $137 million ($0.05 per share) in fiscal 2003.

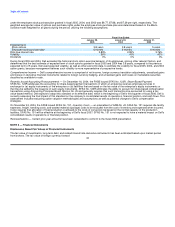

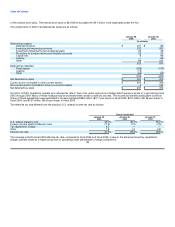

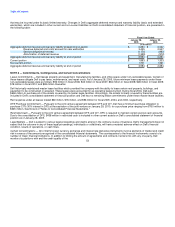

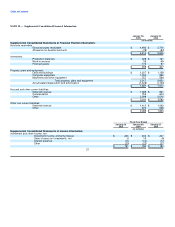

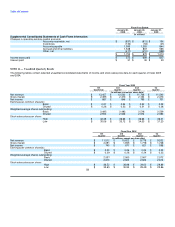

The effective tax rate differed from the statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

January 28, January 30, January 31,

2005 2004 2003

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (11.6) (7.3) (7.9)

Tax repatriation charge 6.3 — —

Other 1.8 1.3 2.8

Effective tax rate 31.5% 29.0% 29.9%

The increase in Dell's fiscal 2005 effective tax rate, compared to fiscal 2004 and fiscal 2003, is due to the aforementioned tax repatriation

charge, partially offset by a higher proportion of operating profits attributable to foreign jurisdictions.

48