Columbia Sportswear 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

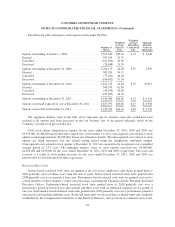

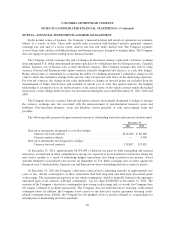

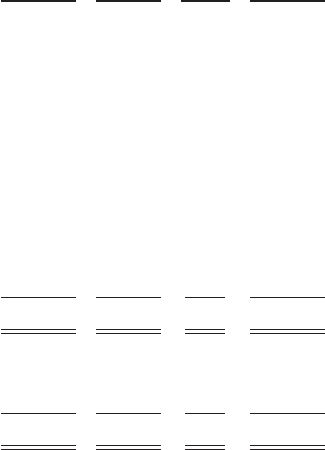

Assets and liabilities measured at fair value on a recurring basis at December 31, 2010 are as follows (in

thousands):

Level 1 Level 2 Level 3 Total

Assets:

Cash equivalents

Money market funds ................................ $177,104 $ — $— $177,104

Time deposits ..................................... 7,510 — — 7,510

U.S. Government-backed municipal bonds .............. — 5,560 — 5,560

Available-for-sale short-term investments

Short-term municipal bond fund ...................... 15,624 — — 15,624

U.S. Government-backed municipal bonds .............. — 53,188 — 53,188

Other current assets

Derivative financial instruments (Note 19) .............. — 1,166 — 1,166

Non-current assets

Mutual fund shares ................................. 1,670 — — 1,670

Total assets measured at fair value ................. $201,908 $59,914 $— $261,822

Liabilities:

Accrued liabilities

Derivative financial instruments (Note 19) .............. $ — $ 7,003 $— $ 7,003

Total liabilities measured at fair value .............. $ — $ 7,003 $— $ 7,003

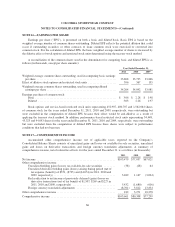

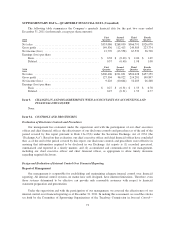

Level 1 instrument valuations are obtained from real-time quotes for transactions in active exchange

markets involving identical assets. Level 2 instrument valuations are obtained from inputs, other than quoted

market prices in active markets, that are directly or indirectly observable in the marketplace and quoted prices in

markets with limited volume or infrequent transactions.

There were no material assets and liabilities measured at fair value on a nonrecurring basis at December 31,

2011 or 2010.

72