Columbia Sportswear 2011 Annual Report Download - page 45

Download and view the complete annual report

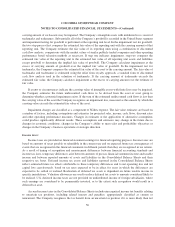

Please find page 45 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.creditworthiness of customers based on ongoing credit evaluations. We analyze specific customer accounts,

customer concentrations, credit insurance coverage, standby letters of credit, current economic trends, and changes

in customer payment terms. Continued uncertainty in credit and market conditions may slow our collection efforts if

customers experience difficulty accessing credit and paying their obligations, leading to higher than normal

accounts receivable and increased bad debt expense. Because we cannot predict future changes in the financial

stability of our customers, actual future losses from uncollectible accounts may differ from our estimates and may

have a material effect on our consolidated financial position, results of operations or cash flows. If the financial

condition of our customers deteriorates and results in their inability to make payments, a larger allowance may be

required. If we determine that a smaller or larger allowance is appropriate, we will record a credit or a charge to

SG&A expense in the period in which we make such a determination.

Excess, Close-Out and Slow Moving Inventory

We make ongoing estimates of potential excess, close-out or slow moving inventory. We evaluate our

inventory on hand considering our purchase commitments, sales forecasts, and historical experience to identify

excess, close-out or slow moving inventory and make provisions as necessary to properly reflect inventory value at

the lower of cost or estimated market value. If we determine that a smaller or larger reserve is appropriate, we will

record a credit or a charge to cost of sales in the period in which we make such a determination.

Product Warranty

We make ongoing estimates of potential future product warranty costs. When we evaluate our reserve for

warranty costs, we consider our product warranty policies, historical claim rates by season, product category and

mix, current economic trends, and the historical cost to repair, replace, or refund the original sale. If we determine

that a smaller or larger reserve is appropriate, we will record a credit or a charge to cost of sales in the period in

which we make such a determination.

Income Taxes

We use the asset and liability method of accounting for income taxes. Under this method, we recognize income

tax expense for the amount of taxes payable or refundable for the current year and for the amount of deferred tax

liabilities and assets for the future tax consequences of events that have been recognized in our financial statements

or tax returns. We make assumptions, judgments and estimates to determine our current provision for income taxes,

our deferred tax assets and liabilities, and our uncertain tax positions. Our judgments, assumptions and estimates

relative to the current provision for income tax take into account current tax laws, our interpretation of current tax

laws and possible outcomes of current and future audits conducted by foreign and domestic tax authorities. Changes

in tax law or our interpretation of tax laws and the resolution of current and future tax audits could significantly

affect the amounts provided for income taxes in our consolidated financial statements. Our assumptions, judgments

and estimates relative to the value of a deferred tax asset take into account predictions of the amount and category of

future taxable income. Actual operating results and the underlying amount and category of income in future years

could cause our current assumptions, judgments and estimates of recoverable net deferred taxes to be inaccurate.

Changes in any of the assumptions, judgments and estimates mentioned above could cause our actual income tax

obligations to differ from our estimates, which could materially affect our financial position and results of

operations.

Our tax provision for interim periods is determined using an estimate of our annual effective tax rate, adjusted

for discrete items, if any, that are taken into account in the relevant period. As the calendar year progresses, we

periodically refine our estimate based on actual events and earnings by jurisdiction. This ongoing estimation process

can result in changes to our expected effective tax rate for the full calendar year. When this occurs, we adjust the

income tax provision during the quarter in which the change in estimate occurs so that our year-to-date provision

equals our expected annual effective tax rate.

40