Columbia Sportswear 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and equipment, followed by a net sales increase in footwear. By brand, the increase in net sales was led by the

Columbia brand, followed by the Sorel and Mountain Hardwear brands. The increase in net sales was

concentrated in our wholesale business.

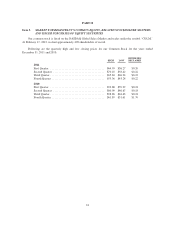

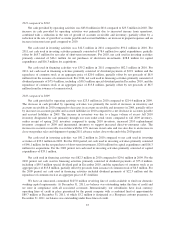

Sales by Product Category

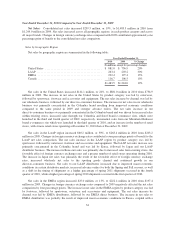

Net sales by product category are summarized in the following table:

Year Ended December 31,

2011 2010 % Change

(In millions, except for percentage changes)

Apparel, Accessories and Equipment ..................... $1,334.9 $ 1,213.3 10%

Footwear ........................................... 359.1 270.2 33%

$ 1,694.0 $ 1,483.5 14%

Net sales of apparel, accessories and equipments increased $121.6 million, or 10%, to $1,334.9 million in

2011 from $1,213.3 million in 2010. The increase in apparel, accessories and equipment net sales was primarily

concentrated in the Columbia brand and was led by the LAAP region, followed by the United States, the EMEA

region and Canada. The apparel, accessories and equipment net sales increase in the LAAP region was led by

Korea, followed by our LAAP distributor business and Japan. The net sales increase in apparel, accessories and

equipment in the United States was led by our direct-to-consumer business, partially offset by a net sales

decrease in our wholesale business.

Net sales of footwear increased $88.9 million, or 33%, to $359.1 million in 2011 from $270.2 million in

2010. The increase in footwear net sales by brand was led by the Sorel brand, followed by the Columbia brand.

The footwear net sales increase by region was led by the United States, followed by the EMEA region, the LAAP

region and Canada. The net sales increase in footwear in the United States was primarily driven by our wholesale

business, followed by our direct-to-consumer business. The footwear net sales increase in the EMEA region was

primarily driven by our EMEA direct business, followed by our EMEA distributor business. The LAAP footwear

net sales increase was led by Japan, followed by Korea and our LAAP distributor business.

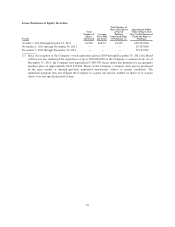

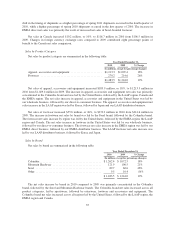

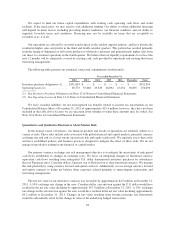

Sales by Brand

Net sales by brand are summarized in the following table:

Year Ended December 31,

2011 2010 % Change

(In millions, except for percentage changes)

Columbia ........................................... $1,391.5 $1,262.4 10%

Mountain Hardwear ................................... 142.3 121.9 17%

Sorel ............................................... 150.3 89.7 68%

Other .............................................. 9.9 9.5 4%

$1,694.0 $1,483.5 14%

The net sales increase in 2011 compared to 2010 was led by the Columbia brand, followed by the Sorel and

Mountain Hardwear brands. Columbia brand net sales increased in both product categories and across all regions,

led by the LAAP region, followed by the United States, the EMEA region and Canada. Sorel brand net sales

increased across all regions led by the EMEA region, followed by the United States, Canada, and the LAAP

region. Mountain Hardwear net sales increased in three regions, led by the United States, the LAAP region and

Canada, partially offset by a slight decline in the EMEA region.

32