Columbia Sportswear 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

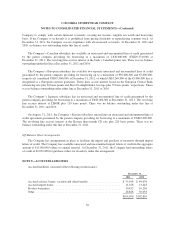

$3,000,000 at December 31, 2011. The majority of the Company’s derivative counterparties have strong credit

ratings and as a result, the Company does not require collateral to facilitate transactions. See Note 19 for further

disclosures concerning derivatives.

Country and supplier concentrations

The Company’s products are produced by independent factories located outside the United States,

principally in Southeast Asia. Apparel is manufactured in more than 15 countries, with Vietnam and China

accounting for approximately 73% of 2011 global apparel production. Footwear is manufactured in three

countries, with China and Vietnam accounting for approximately 92% of 2011 global footwear production. The

five largest apparel factory groups accounted for approximately 25% of 2011 global apparel production, with the

largest factory group accounting for 9% of 2011 global apparel production. The five largest footwear factory

groups accounted for approximately 72% of 2011 global footwear production, with the largest factory group

accounting for 25% of 2011 global footwear production. In addition, a single vendor supplies substantially all of

the zippers used in the Company’s products. These companies, however, have multiple factory locations, many

of which are in different countries, thus reducing the risk that unfavorable conditions at a single factory or

location will have a material adverse effect on the Company.

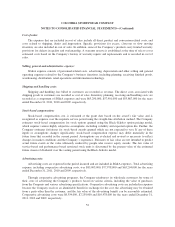

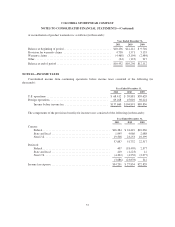

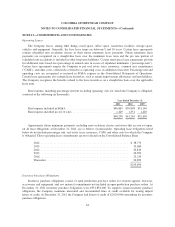

NOTE 4—ACCOUNTS RECEIVABLE, NET

Accounts receivable, net, is as follows (in thousands):

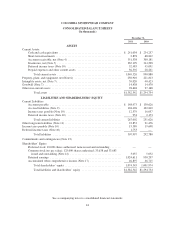

December 31,

2011 2010

Trade accounts receivable ........................................... $359,083 $307,279

Allowance for doubtful accounts ..................................... (7,545) (7,098)

Accounts receivable, net ............................................ $351,538 $300,181

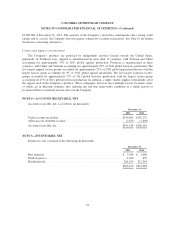

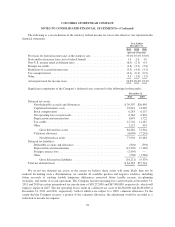

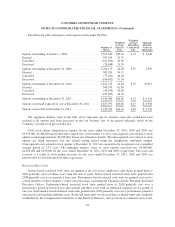

NOTE 5—INVENTORIES, NET

Inventories, net, consisted of the following (in thousands):

December 31,

2011 2010

Raw materials .................................................... $ 2,044 $ 1,096

Work in process ................................................... 1,240 659

Finished goods .................................................... 361,915 312,543

$365,199 $314,298

54