Columbia Sportswear 2011 Annual Report Download - page 42

Download and view the complete annual report

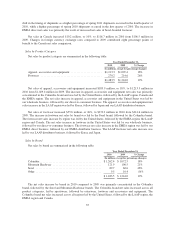

Please find page 42 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2011 compared to 2010

Net cash provided by operating activities was $63.8 million in 2011 compared to $23.5 million in 2010. The

increase in cash provided by operating activities was primarily due to increased income from operations,

combined with a reduction in the rate of growth of accounts receivable and inventory; partially offset by a

reduction in the rate of growth of accounts payable and accrued liabilities, an increase in prepaid expenses and an

increase in income taxes paid compared to 2010.

Net cash used in investing activities was $12.5 million in 2011 compared to $91.2 million in 2010. For

2011, net cash used in investing activities primarily consisted of $78.4 million for capital expenditures, partially

offset by $65.7 million for net sales of short-term investments. For 2010, net cash used in investing activities

primarily consisted of $46.1 million for net purchases of short-term investments, $28.8 million for capital

expenditures and $16.3 million for acquisitions.

Net cash used in financing activities was $39.2 million in 2011 compared to $82.3 million in 2010. For

2011, net cash used in financing activities primarily consisted of dividend payments of $29.1 million and the

repurchase of common stock at an aggregate price of $20.0 million, partially offset by net proceeds of $8.0

million from the issuance of common stock. For 2010, net cash used in financing activities primarily consisted of

dividend payments of $75.4 million, including a $50.5 million special dividend paid in December 2010, and the

repurchase of common stock at an aggregate price of $13.8 million, partially offset by net proceeds of $6.5

million from the issuance of common stock.

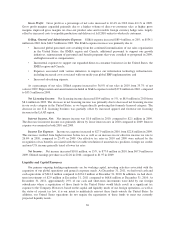

2010 compared to 2009

Net cash provided by operating activities was $23.5 million in 2010 compared to $214.4 million in 2009.

The decrease in cash provided by operating activities was primarily the result of increases in inventory and

accounts receivable in 2010 compared to decreases in accounts receivable and inventory in 2009, partially offset

by increases in accounts payable and accrued liabilities in 2010 compared to a net decrease in accounts payable

and accrued liabilities in 2009. The increase in inventory was due to a larger volume of excess fall 2010

inventory designated for sale primarily through our own outlet retail stores compared to fall 2009 inventory,

earlier receipt of spring 2011 inventory compared to spring 2010 inventory, increased 2010 replenishment

inventory compared to 2009 and incremental inventory to support increased direct-to-consumer sales. The

increase in accounts receivable was in line with the 19% increase in net sales and was also due to an increase in

close-out product sales and shipment of spring 2011 advance orders close to the end of the 2010 period.

Net cash used in investing activities was $91.2 million in 2010 compared to net cash used in investing

activities of $33.2 million in 2009. For the 2010 period, net cash used in investing activities primarily consisted

of $46.1 million for the net purchases of short-term investments, $28.8 million for capital expenditures and $16.3

million for acquisitions. For the 2009 period, net cash used in investing activities primarily consisted of capital

expenditures of $33.1 million.

Net cash used in financing activities was $82.3 million in 2010 compared to $29.6 million in 2009. For the

2010 period, net cash used in financing activities primarily consisted of dividend payments of $75.4 million,

including a $50.5 million special dividend paid in December 2010, and the repurchase of common stock at an

aggregate price of $13.8 million, partially offset by proceeds from issuance of common stock of $6.5 million. For

the 2009 period, net cash used in financing activities included dividend payments of $22.3 million and the

repurchase of common stock at an aggregate price of $7.4 million.

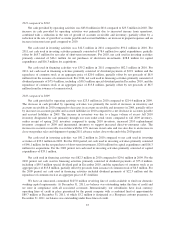

We have an unsecured, committed $125.0 million revolving line of credit available to fund our domestic

working capital requirements. At December 31, 2011, no balance was outstanding under this line of credit and

we were in compliance with all associated covenants. Internationally, our subsidiaries have local currency

operating lines of credit in place guaranteed by the parent company with a combined limit of approximately

$89.7 million at December 31, 2011, of which $3.2 million is designated as a European customs guarantee. At

December 31, 2011, no balance was outstanding under these lines of credit.

37