Columbia Sportswear 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

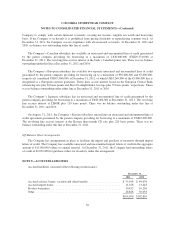

No stock-based compensation costs were capitalized for the years ended December 31, 2011, 2010 or 2009.

The Company realized a tax benefit for the deduction from stock-based award transactions of $4,702,000,

$1,909,000, and $851,000 for the years ended December 31, 2011, 2010 and 2009, respectively.

Stock Options

Options to purchase the Company’s common stock are granted at exercise prices equal to or greater than the

fair market value of the Company’s common stock on the date of grant. Options granted after 2000 and before

2009 generally vest and become exercisable over a period of four years (25 percent on the first anniversary date

following the date of grant and monthly thereafter) and expire ten years from the date of the grant, with the

exception of most options granted in 2005. Most options granted in 2005 vested and became exercisable one year

from the date of grant and expire ten years from the date of grant. Options granted after 2008 generally vest and

become exercisable ratably on an annual basis over a period of four years and expire ten years from the date of

the grant.

The Company estimates the fair value of stock options using the Black-Scholes model. Key inputs and

assumptions used to estimate the fair value of stock options include the exercise price of the award, the expected

option term, expected volatility of the Company’s stock over the option’s expected term, the risk-free interest

rate over the option’s expected term, and the Company’s expected annual dividend yield. Assumptions are

evaluated and revised as necessary to reflect changes in market conditions and the Company’s experience.

Estimates of fair value are not intended to predict actual future events or the value ultimately realized by people

who receive equity awards.

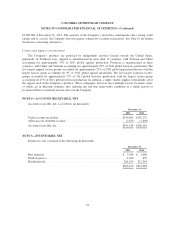

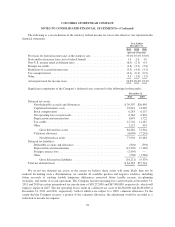

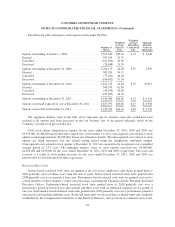

The following table presents the weighted average assumptions for the years ended December 31:

2011(1) 2010 2009

Expected term ............................................. 5.12 years 4.53 years 4.71 years

Expected stock price volatility ................................. 30.76% 28.79% 29.52%

Risk-free interest rate ........................................ 1.84% 1.91% 1.73%

Expected dividend yield ...................................... 1.31% 1.64% 2.17%

Weighted average grant date fair value .......................... $ 16.09 $ 10.08 $ 6.55

(1) During the year ended December 31, 2011, the Company granted two stock option awards totaling 53,720

shares that vest 100% on the fifth anniversary of the grant date. Because the Company did not have

sufficient historical exercise data to provide a reasonable basis upon which to estimate the expected term for

these grants, the Company utilized the simplified method in developing an estimate of the expected term of

these options.

63