Columbia Sportswear 2011 Annual Report Download - page 41

Download and view the complete annual report

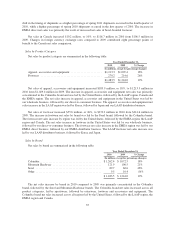

Please find page 41 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross Profit: Gross profit as a percentage of net sales increased to 42.4% in 2010 from 42.1% in 2009.

Gross profit margins expanded primarily due to a higher volume of direct-to-consumer sales at higher gross

margins, improved gross margins on close-out product sales and favorable foreign currency hedge rates, largely

offset by increased costs to expedite production and delivery of fall 2010 orders to wholesale customers.

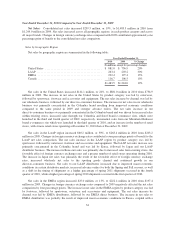

Selling, General and Administrative Expense: SG&A expense increased $89.4 million, or 20%, to $534.1

million in 2010 from $444.7 million in 2009. The SG&A expense increase was primarily due to:

• Increased global personnel costs resulting from the continued internalization of our sales organization

in the United States, the EMEA region and Canada, additional personnel to support our growth

initiatives, reinstatement of personnel and benefit programs that were curtailed or postponed in 2009,

and higher incentive compensation;

• Incremental expenses to support our expanded direct-to-consumer businesses in the United States, the

EMEA region and Canada;

• Expenses associated with various initiatives to improve our information technology infrastructure,

including increased costs associated with our multi-year global ERP implementation; and

• Increased advertising expense.

As a percentage of net sales, SG&A expense increased to 36.0% of net sales in 2010 from 35.7% of net

sales in 2009. Depreciation and amortization included in SG&A expense totaled $37.8 million in 2010, compared

to $35.5 million in 2009.

Net Licensing Income: Net licensing income decreased $0.4 million, or 5%, to $8.0 million in 2010 from

$8.4 million in 2009. The decrease in net licensing income was primarily due to decreased net licensing income

in our socks category in the United States, as we began directly producing this formerly licensed category. The

decrease in our U.S. licensing business was partially offset by increased apparel and footwear net licensing

income in the LAAP region.

Interest Income, Net: Net interest income was $1.6 million in 2010, compared to $2.1 million in 2009.

The decrease in interest income was primarily driven by lower interest rates in 2010 compared to 2009. Interest

expense was nominal in both 2010 and 2009.

Income Tax Expense: Income tax expense increased to $27.9 million in 2010 from $22.8 million in 2009.

This increase resulted from higher income before tax as well as an increase in our effective income tax rate to

26.6% in 2010, compared to 25.4% in 2009. Our effective tax rates in 2010 and 2009 were reduced by the

recognition of tax benefits associated with the favorable resolution of uncertain tax positions, foreign tax credits

and non-U.S. income generally taxed at lower tax rates.

Net Income: Net income increased $10.0 million, or 15%, to $77.0 million in 2010 from $67.0 million in

2009. Diluted earnings per share was $2.26 in 2010, compared to $1.97 in 2009.

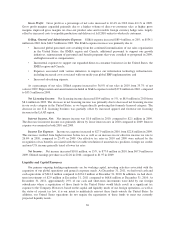

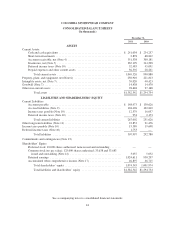

Liquidity and Capital Resources

Our primary ongoing funding requirements are for working capital, investing activities associated with the

expansion of our global operations and general corporate needs. At December 31, 2011, we had total cash and

cash equivalents of $241.0 million compared to $234.3 million at December 31, 2010. In addition, we had short-

term investments of $2.9 million at December 31, 2011 compared to $68.8 million at December 31, 2010. At

December 31, 2011, approximately 29% of our cash and short-term investments were held by our foreign

subsidiaries where a repatriation of those funds to the United States would likely result in a significant tax

expense to the Company. However, based on the capital and liquidity needs of our foreign operations, as well as

the status of current tax law, it is our intent to indefinitely reinvest these funds outside the United States. In

addition, our United States operations do not require the repatriation of these funds to meet our currently

projected liquidity needs.

36