Columbia Sportswear 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

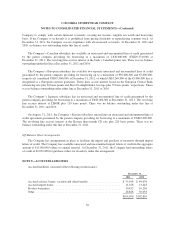

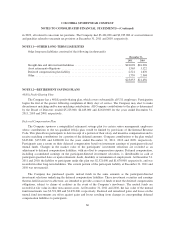

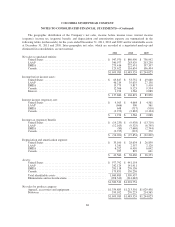

NOTE 16—EARNINGS PER SHARE

Earnings per share (“EPS”),is presented on both a basic and diluted basis. Basic EPS is based on the

weighted average number of common shares outstanding. Diluted EPS reflects the potential dilution that could

occur if outstanding securities or other contracts to issue common stock were exercised or converted into

common stock. For the calculation of diluted EPS, the basic weighted average number of shares is increased by

the dilutive effect of stock options and restricted stock units determined using the treasury stock method.

A reconciliation of the common shares used in the denominator for computing basic and diluted EPS is as

follows (in thousands, except per share amounts):

Year Ended December 31,

2011 2010 2009

Weighted average common shares outstanding, used in computing basic earnings

per share ........................................................ 33,808 33,725 33,846

Effect of dilutive stock options and restricted stock units .................... 396 367 135

Weighted-average common shares outstanding, used in computing diluted

earnings per share ................................................. 34,204 34,092 33,981

Earnings per share of common stock:

Basic ......................................................... $ 3.06 $ 2.28 $ 1.98

Diluted ....................................................... 3.03 2.26 1.97

Stock options and service-based restricted stock units representing 452,907, 480,707 and 1,562,064 shares

of common stock for the years ended December 31, 2011, 2010 and 2009, respectively, were outstanding but

were excluded in the computation of diluted EPS because their effect would be anti-dilutive as a result of

applying the treasury stock method. In addition, performance-based restricted stock units representing 34,448,

43,323 and 44,043 shares for the years ended December 31, 2011, 2010 and 2009, respectively, were outstanding

but were excluded from the computation of diluted EPS because these shares were subject to performance

conditions that had not been met.

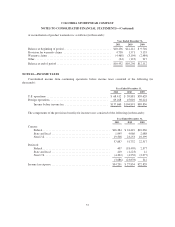

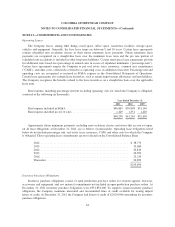

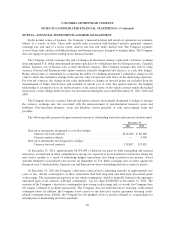

NOTE 17—COMPREHENSIVE INCOME

Accumulated other comprehensive income, net of applicable taxes, reported on the Company’s

Consolidated Balance Sheets consists of unrealized gains and losses on available-for-sale securities, unrealized

gains and losses on derivative transactions and foreign currency translation adjustments. A summary of

comprehensive income, net of related tax effects, for the years ended December 31, is as follows (in thousands):

2011 2010 2009

Net income ....................................................... $103,479 $77,037 $67,021

Other comprehensive income:

Unrealized holding gains (losses) on available-for-sale securities ........ (38) (28) 64

Unrealized derivative holding gains (losses) arising during period (net of

tax expense (benefit)) of $351, ($725) and ($1,054) in 2011, 2010 and

2009, respectively) ........................................... 3,489 1,167 (3,024)

Reclassification to net income of previously deferred (gains) losses on

derivative transactions (net of tax benefit of $1,507, $269 and $227 in

2011, 2010 and 2009, respectively) .............................. 5,432 (1,680) (616)

Foreign currency translation adjustments ........................... (8,701) 3,812 13,854

Other comprehensive income ......................................... 182 3,271 10,278

Comprehensive income ............................................. $103,661 $80,308 $77,299

66