Columbia Sportswear 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 13—COMMITMENTS AND CONTINGENCIES

Operating Leases

The Company leases, among other things, retail space, office space, warehouse facilities, storage space,

vehicles and equipment. Generally, the base lease terms are between 5 and 10 years. Certain lease agreements

contain scheduled rent escalation clauses in their future minimum lease payments. Future minimum lease

payments are recognized on a straight-line basis over the minimum lease term and the pro rata portion of

scheduled rent escalations is included in other long-term liabilities. Certain retail space lease agreements provide

for additional rents based on a percentage of annual sales in excess of stipulated minimums (“percentage rent”).

Certain lease agreements require the Company to pay real estate taxes, insurance, common area maintenance

(“CAM”), and other costs, collectively referred to as operating costs, in addition to base rent. Percentage rent and

operating costs are recognized as incurred in SG&A expense in the Consolidated Statements of Operations.

Certain lease agreements also contain lease incentives, such as tenant improvement allowances and rent holidays.

The Company recognizes the benefits related to the lease incentives on a straight-line basis over the applicable

lease term.

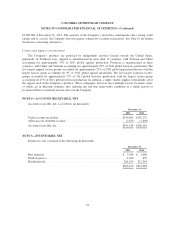

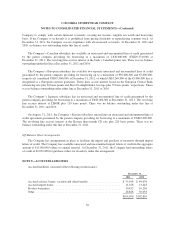

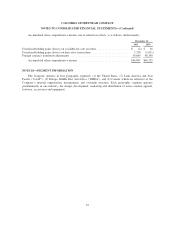

Rent expense, including percentage rent but excluding operating costs for which the Company is obligated,

consisted of the following (in thousands):

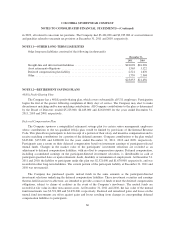

Year Ended December 31,

2011 2010 2009

Rent expense included in SG&A ............................... $46,869 $39,898 $31,140

Rent expense included in cost of sales ........................... 1,429 1,351 1,465

$48,298 $41,249 $32,605

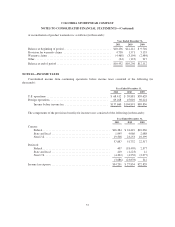

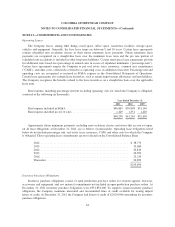

Approximate future minimum payments, including rent escalation clauses and stores that are not yet open,

on all lease obligations at December 31, 2011, are as follows (in thousands). Operating lease obligations listed

below do not include percentage rent, real estate taxes, insurance, CAM, and other costs for which the Company

is obligated. These operating lease commitments are not reflected on the Consolidated Balance Sheet.

2012 ............................................................. $ 38,773

2013 ............................................................. 35,060

2014 ............................................................. 29,819

2015 ............................................................. 26,892

2016 ............................................................. 25,254

Thereafter ......................................................... 94,892

$250,690

Inventory Purchase Obligations

Inventory purchase obligations consist of open production purchase orders for sourced apparel, footwear,

accessories and equipment, and raw material commitments not included in open production purchase orders. At

December 31, 2011 inventory purchase obligations were $351,854,000. To support certain inventory purchase

obligations, the Company maintains unsecured and uncommitted lines of credit available for issuing import

letters of credit. At December 31, 2011 the Company had letters of credit of $2,029,000 outstanding for inventory

purchase obligations.

61