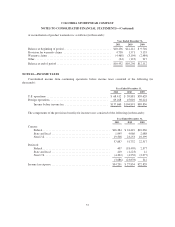

Columbia Sportswear 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

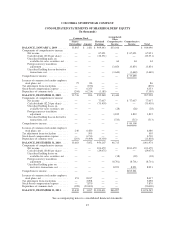

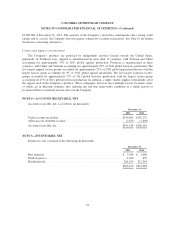

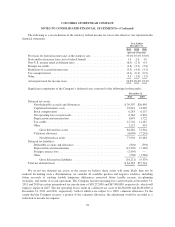

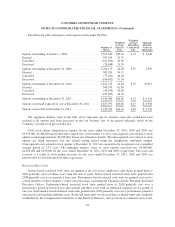

NOTE 6—PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consisted of the following (in thousands):

December 31,

2011 2010

Land and improvements ........................................... $ 20,690 $ 16,898

Building and improvements ........................................ 155,672 144,004

Machinery and equipment ......................................... 198,387 193,104

Furniture and fixtures ............................................. 50,108 46,147

Leasehold improvements .......................................... 65,476 62,884

Construction in progress ........................................... 36,463 9,775

526,796 472,812

Less accumulated depreciation ...................................... (275,886) (250,999)

$ 250,910 $ 221,813

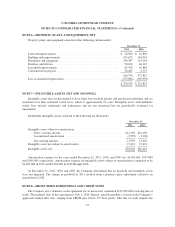

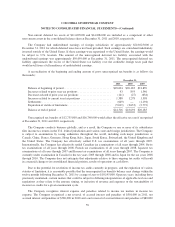

NOTE 7—INTANGIBLE ASSETS, NET AND GOODWILL

Intangible assets that are determined to have finite lives include patents and purchased technology and are

amortized over their estimated useful lives, which is approximately 10 years. Intangible assets with indefinite

useful lives include trademarks and tradenames and are not amortized but are periodically evaluated for

impairment.

Identifiable intangible assets consisted of the following (in thousands):

December 31,

2011 2010

Intangible assets subject to amortization:

Gross carrying amount ........................................... $14,198 $14,198

Accumulated amortization ........................................ (2,599) (1,196)

Net carrying amount ............................................. 11,599 13,002

Intangible assets not subject to amortization .............................. 27,421 27,421

Intangible assets, net ................................................. $39,020 $40,423

Amortization expense for the years ended December 31, 2011, 2010, and 2009 was $1,403,000, $553,000

and $109,000, respectively. Amortization expense for intangible assets subject to amortization is estimated to be

$1,402,000 in 2012 and $1,330,000 in 2013 through 2016.

At December 31, 2011, 2010 and 2009, the Company determined that its goodwill and intangible assets

were not impaired. The change in goodwill in 2011 resulted from a purchase price adjustment related to an

acquisition in 2010.

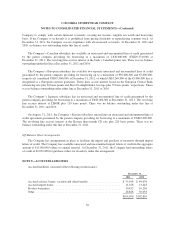

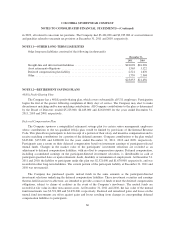

NOTE 8—SHORT-TERM BORROWINGS AND CREDIT LINES

The Company has a domestic credit agreement for an unsecured, committed $125,000,000 revolving line of

credit. The maturity date of this agreement is July 1, 2016. Interest, payable monthly, is based on the Company’s

applicable funded debt ratio, ranging from LIBOR plus 100 to 175 basis points. This line of credit requires the

55