Columbia Sportswear 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

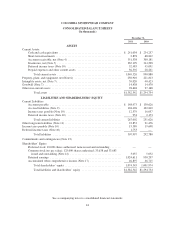

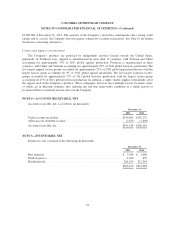

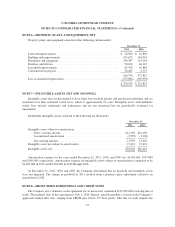

COLUMBIA SPORTSWEAR COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2011 2010 2009

Cash flows from operating activities:

Net income ................................................ $103,479 $ 77,037 $ 67,021

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization ............................ 43,560 38,430 36,253

Loss on disposal or impairment of property, plant, and

equipment .......................................... 6,485 3,331 1,828

Deferred income taxes ................................... (3,582) (22,610) 55

Stock-based compensation ............................... 7,870 6,730 6,353

Excess tax benefit from employee stock plans ................ (1,828) (498) (41)

Changes in operating assets and liabilities:

Accounts receivable ................................. (54,334) (69,500) 77,490

Inventories ........................................ (55,223) (87,265) 38,831

Prepaid expenses and other current assets ................ (10,186) 3,856 (1,695)

Other assets ....................................... (4,520) (1,566) (5,179)

Accounts payable ................................... 19,081 26,028 (16,944)

Accrued liabilities .................................. 17,630 34,224 7,563

Income taxes payable ................................ (7,010) 9,018 (1,558)

Other liabilities .................................... 2,374 6,302 4,395

Net cash provided by operating activities ............ 63,796 23,517 214,372

Cash flows from investing activities:

Purchases of short-term investments ............................ (46,349) (81,671) (25,305)

Sales of short-term investments ................................ 112,070 35,601 25,163

Capital expenditures ........................................ (78,404) (28,838) (33,074)

Proceeds from sale of property, plant, and equipment .............. 168 42 31

Acquisitions, net of cash acquired .............................. — (16,315) —

Net cash used in investing activities ................ (12,515) (91,181) (33,185)

Cash flows from financing activities:

Proceeds from credit facilities ................................. 119,384 31,680 57,588

Repayments on credit facilities ................................ (119,384) (31,680) (57,588)

Repayment on other long-term liabilities ........................ — — (4)

Proceeds from issuance of common stock under employee stock

plans ................................................... 10,991 7,333 710

Tax payments related to restricted stock unit issuances ............. (2,974) (853) (624)

Excess tax benefit from employee stock plans .................... 1,828 498 41

Repurchase of common stock ................................. (20,000) (13,838) (7,399)

Cash dividends paid ......................................... (29,075) (75,439) (22,331)

Net cash used in financing activities ................ (39,230) (82,299) (29,607)

Net effect of exchange rate changes on cash ........................ (5,274) (2,444) 4,467

Net increase (decrease) in cash and cash equivalents ................. 6,777 (152,407) 156,047

Cash and cash equivalents, beginning of year ...................... 234,257 386,664 230,617

Cash and cash equivalents, end of year ............................ $241,034 $ 234,257 $386,664

Supplemental disclosures of cash flow information:

Cash paid during the year for interest ........................... $ 183 $ 76 $ 35

Cash paid during the year for income taxes ...................... 42,405 34,924 31,284

Supplemental disclosures of non-cash investing activities:

Capital expenditures incurred but not yet paid .................... 952 1,001 7,852

See accompanying notes to consolidated financial statements

46