Columbia Sportswear 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

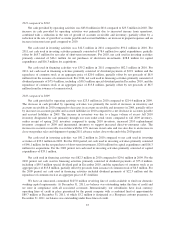

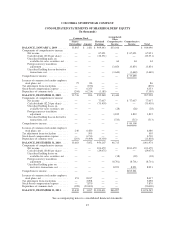

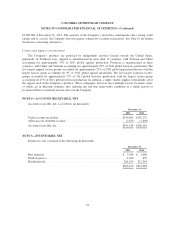

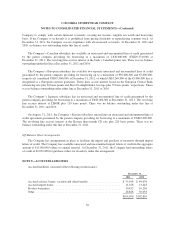

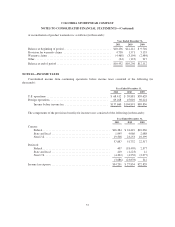

COLUMBIA SPORTSWEAR COMPANY

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands)

Common Stock

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Comprehensive

Income Total

Shares

Outstanding Amount

BALANCE, JANUARY 1, 2009 ........ 33,865 $ 1,481 $ 909,443 $33,166 $ 944,090

Components of comprehensive income:

Net income ..................... — — 67,021 — $ 67,021 67,021

Cash dividends ($0.66 per share) .... — — (22,331) — — (22,331)

Unrealized holding gains on

available-for-sales securities, net . . — — — 64 64 64

Foreign currency translation

adjustment .................... — — — 13,854 13,854 13,854

Unrealized holding loss on derivative

transactions, net ................ — — — (3,640) (3,640) (3,640)

Comprehensive income ................ — — — — $ 77,299

Issuance of common stock under employee

stock plans, net .................... 75 86 — — 86

Tax adjustment from stock plans ........ — (870) — — (870)

Stock-based compensation expense ...... — 6,353 — — 6,353

Repurchase of common stock ........... (204) (6,214) (1,185) — (7,399)

BALANCE, DECEMBER 31, 2009 ..... 33,736 836 952,948 43,444 997,228

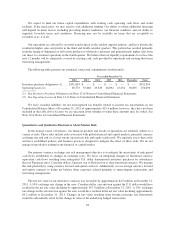

Components of comprehensive income:

Net income ..................... — — 77,037 — $ 77,037 77,037

Cash dividends ($2.24 per share) .... — — (75,439) — — (75,439)

Unrealized holding losses on

available-for-sales securities, net . . — — — (28) (28) (28)

Foreign currency translation

adjustment .................... — — — 3,812 3,812 3,812

Unrealized holding loss on derivative

transactions, net ................ — — — (513) (513) (513)

Comprehensive income ................ — — — — $ 80,308

Issuance of common stock under employee

stock plans, net .................... 240 6,480 — — 6,480

Tax adjustment from stock plans ........ — 505 — — 505

Stock-based compensation expense ...... — 6,730 — — 6,730

Repurchase of common stock ........... (293) (9,499) (4,339) — (13,838)

BALANCE, DECEMBER 31, 2010 ..... 33,683 5,052 950,207 46,715 1,001,974

Components of comprehensive income:

Net income ..................... — — 103,479 — $103,479 103,479

Cash dividends ($0.86 per share) .... — — (29,075) — — (29,075)

Unrealized holding losses on

available-for-sales securities, net . . — — — (38) (38) (38)

Foreign currency translation

adjustment .................... — — — (8,701) (8,701) (8,701)

Unrealized holding gains on

derivative transactions, net ....... — — — 8,921 8,921 8,921

Comprehensive income ................ — — — — $103,661

Issuance of common stock under employee

stock plans, net .................... 353 8,017 — — 8,017

Tax adjustment from stock plans ........ — 2,098 — — 2,098

Stock-based compensation expense ...... — 7,870 — — 7,870

Repurchase of common stock ........... (398) (20,000) — — (20,000)

BALANCE, DECEMBER 31, 2011 ..... 33,638 $ 3,037 $1,024,611 $46,897 $1,074,545

See accompanying notes to consolidated financial statements

47