Columbia Sportswear 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

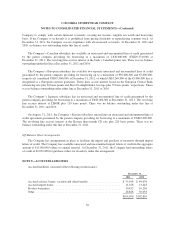

in 2009, all related to uncertain tax positions. The Company had $3,434,000 and $3,935,000 of accrued interest

and penalties related to uncertain tax positions at December 31, 2011 and 2010, respectively.

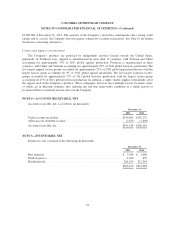

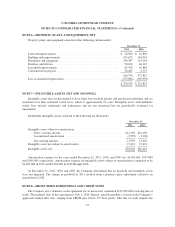

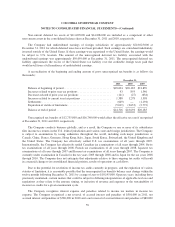

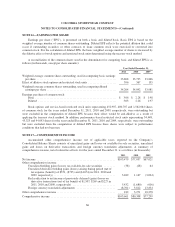

NOTE 11—OTHER LONG-TERM LIABILITIES

Other long-term liabilities consisted of the following (in thousands):

December 31,

2011 2010

Straight-line and deferred rent liabilities .................................. $18,028 $16,296

Asset retirement obligations ........................................... 1,565 1,122

Deferred compensation plan liability .................................... 2,521 1,670

Other ............................................................. 1,739 2,368

$23,853 $21,456

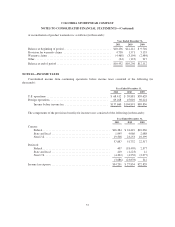

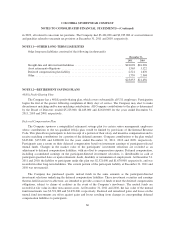

NOTE 12—RETIREMENT SAVINGS PLANS

401(k) Profit-Sharing Plan

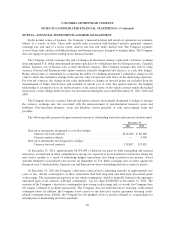

The Company has a 401(k) profit-sharing plan, which covers substantially all U.S. employees. Participation

begins the first of the quarter following completion of thirty days of service. The Company may elect to make

discretionary matching and/or non-matching contributions. All Company contributions to the plan as determined

by the Board of Directors totaled $5,223,000, $4,443,000 and $2,610,000 for the years ended December 31,

2011, 2010 and 2009, respectively.

Deferred Compensation Plan

The Company sponsors a nonqualified retirement savings plan for certain senior management employees

whose contributions to the tax qualified 401(k) plan would be limited by provisions of the Internal Revenue

Code. This plan allows participants to defer receipt of a portion of their salary and incentive compensation and to

receive matching contributions for a portion of the deferred amounts. Company contributions to the plan totaled

$245,000, $155,000 and $108,000 for the years ended December 31, 2011, 2010 and 2009, respectively.

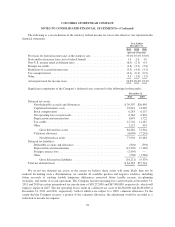

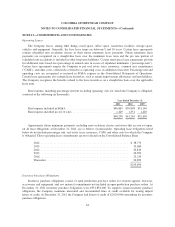

Participants earn a return on their deferred compensation based on investment earnings of participant-selected

mutual funds. Changes in the market value of the participants’ investment selections are recorded as an

adjustment to deferred compensation liabilities, with an offset to compensation expense. Deferred compensation,

including accumulated earnings on the participant-directed investment selections, is distributable in cash at

participant-specified dates or upon retirement, death, disability or termination of employment. At December 31,

2011 and 2010, the liability to participants under this plan was $2,521,000 and $1,670,000, respectively, and was

recorded in other long-term liabilities. The current portion of the participant liability at December 31, 2011 and

2010 was not material.

The Company has purchased specific mutual funds in the same amounts as the participant-directed

investment selections underlying the deferred compensation liabilities. These investment securities and earnings

thereon, held in an irrevocable trust, are intended to provide a source of funds to meet the deferred compensation

obligations, subject to claims of creditors in the event of the Company’s insolvency. The mutual funds are

recorded at fair value in other non-current assets. At December 31, 2011 and 2010, the fair value of the mutual

fund investments was $2,521,000 and $1,670,000, respectively. Realized and unrealized gains and losses on the

mutual fund investments are offset against gains and losses resulting from changes in corresponding deferred

compensation liabilities to participants.

60