Cigna 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

intersegment eliminations, compensation cost for stock options, expense associated with our frozen pension plans and certain overhead and

project costs.

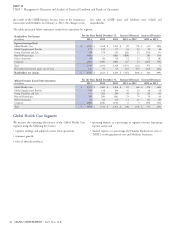

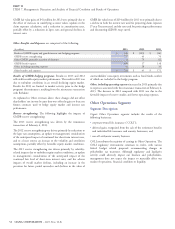

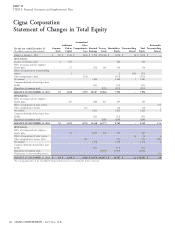

For the Years Ended December 31, Increase/(Decrease) Increase/(Decrease)

Financial Summary

(In millions) 2013 2012 2011 2013 vs. 2012 2012 vs. 2011

Segment loss $(222) $(329) $(184) $ 107 33% $ (145) (79)%

Less: special items (after-tax) included in segment loss:

Cost associated with HealthSpring acquisition (See Note 3

to the Consolidated Financial Statements) (33) (28) 33 (5)

Charges related to litigation matters (See Note 23 to the

Consolidated Financial Statements) (68) 68 (68)

Completion of IRS examination (See Note 19 to the

Consolidated Financial Statements) 14 – (14)

ADJUSTED LOSS FROM OPERATIONS $(222) $(228) $(170) $ 6 3% $ (58) (34)%

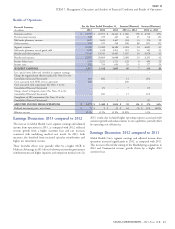

The decrease in Corporate’s segment loss in 2013, compared with In 2012, segment loss for Corporate was significantly higher than in

2012, is primarily attributable to the absence of special item costs 2011, primarily reflecting higher interest expense due to the

associated with both litigation matters and the HealthSpring $2.1 billion of long-term debt issued in the fourth quarter of 2011 to

acquisition in 2012. fund the HealthSpring acquisition, and costs associated with litigation

matters.

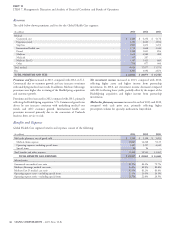

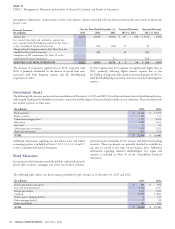

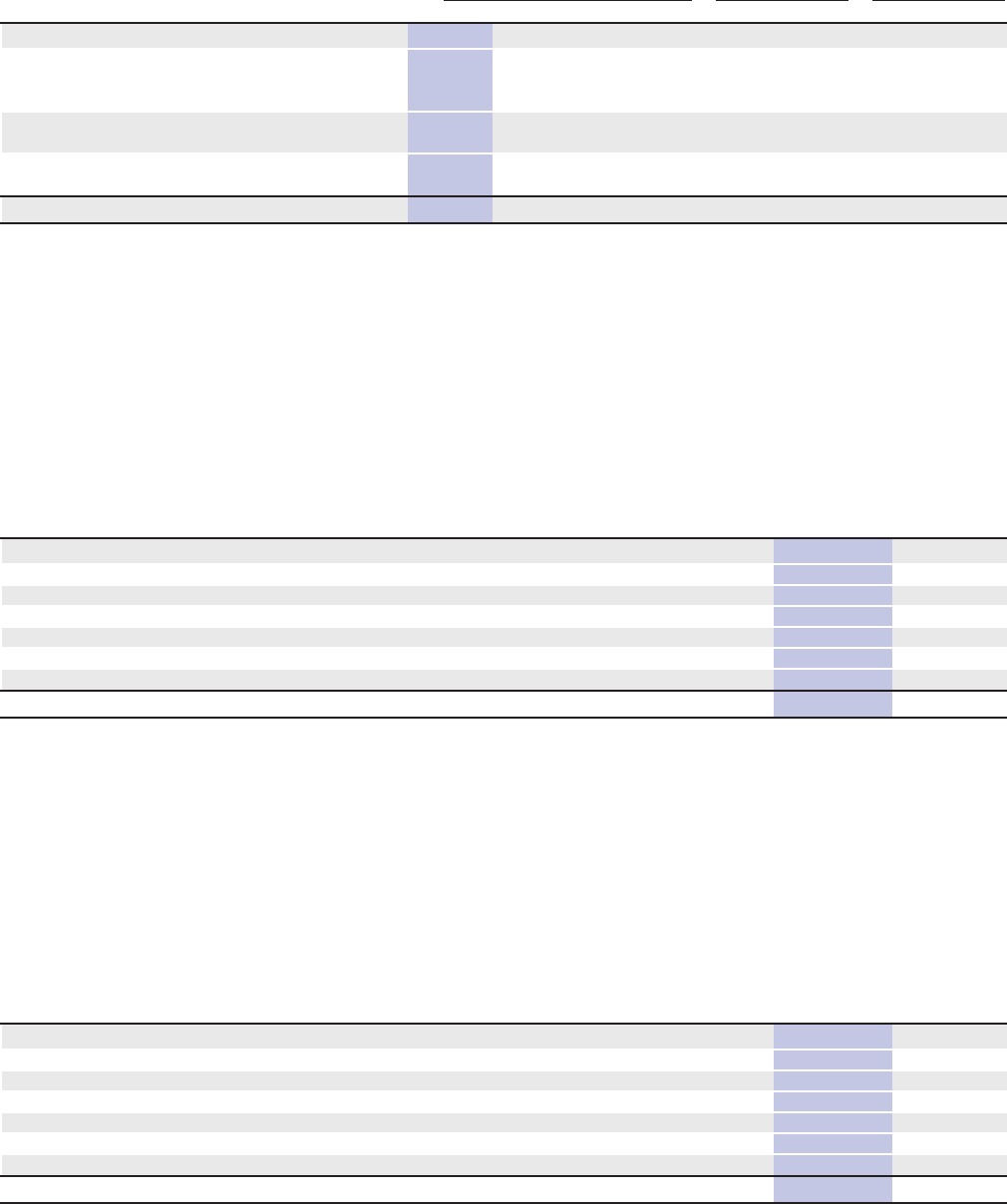

The following table presents our invested asset portfolio as of December 31, 2013 and 2012. Overall invested assets have declined during the year,

reflecting the funding of the Berkshire reinsurance transaction and the impact of increased market yields on asset valuations. These investments do

not include separate account assets.

(In millions) 2013 2012

Fixed maturities $ 16,486 $ 17,705

Equity securities 141 111

Commercial mortgage loans 2,252 2,851

Policy loans 1,485 1,501

Real estate 97 83

Other long-term investments 1,273 1,255

Short-term investments 631 154

TOTAL $ 22,365 $ 23,660

Additional information regarding our investment assets and related preferred stocks redeemable by the investor and hybrid and trading

accounting policies is included in Notes 2, 10, 11, 12, 13, 14 and 17 securities. These investments are generally classified as available for

to the Consolidated Financial Statements. sale and are carried at fair value on our balance sheet. Additional

information regarding valuation methodologies, key inputs and

controls is included in Note 10 of the Consolidated Financial

Fixed Maturities

Statements.

Investments in fixed maturities include publicly traded and privately

placed debt securities, mortgage and other asset-backed securities,

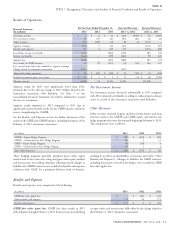

The following table reflects our fixed maturity portfolio by type of issuer as of December 31, 2013 and 2012.

(In millions) 2013 2012

Federal government and agency $ 880 $ 902

State and local government 2,144 2,437

Foreign government 1,444 1,322

Corporate 10,981 11,896

Federal agency mortgage-backed 76 122

Other mortgage-backed 77 89

Other asset-backed 884 937

TOTAL $ 16,486 $ 17,705

54 CIGNA CORPORATION - 2013 Form 10-K

Investment Assets