Cigna 2013 Annual Report Download - page 103

Download and view the complete annual report

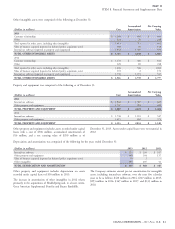

Please find page 103 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

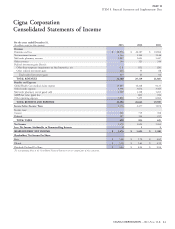

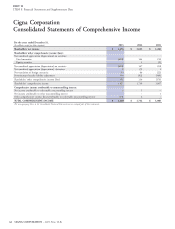

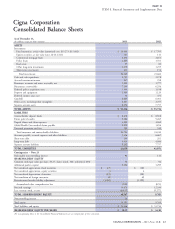

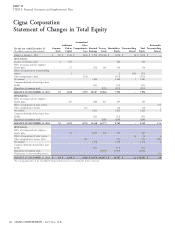

ITEM 8. Financial Statements and Supplementary Data

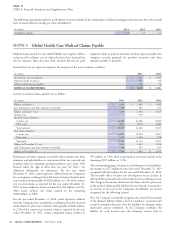

an adjustment to increase the redeemable noncontrolling interest will collection is reasonably assured. Additionally, Medicare Part D

be recorded by charging shareholders’ net income. includes payments from CMS for risk sharing adjustments. The risk

sharing adjustments that are estimated quarterly based on claim

experience, compare actual incurred drug benefit costs to estimated

costs submitted in original contracts and may result in more or less

revenue from CMS. Final revenue adjustments are determined

through an annual settlement with CMS that occurs after the contract

Accounts payable, accrued expenses and other liabilities consist year.

principally of liabilities for pension, other postretirement and

postemployment benefits (see Note 9), GMIB contracts (see Revenue for investment-related products is recognized as follows:

Note 10), self-insured exposures, management compensation, cash Net investment income on assets supporting investment-related

overdraft positions and various insurance-related liabilities, including products is recognized as earned.

experience rated refunds, the minimum medical loss ratio rebate

accrual under Health Care Reform, and reinsurance contracts. Legal Contract fees that are based upon related administrative expenses

costs to defend the Company’s litigation and arbitration matters are are recognized in premiums and fees as they are earned ratably over

expensed when incurred in cases where the Company cannot the contract period.

reasonably estimate the ultimate cost to defend. In cases where the Benefits and expenses for investment-related products consist

Company can reasonably estimate the cost to defend, a liability for primarily of income credited to policyholders in accordance with

these costs is accrued when the claim is reported. contract provisions.

Revenue for universal life products is recognized as follows:

Net investment income on assets supporting universal life products

The Company generally conducts its international business through is recognized as earned.

foreign operating entities that maintain assets and liabilities in local

currencies that are generally their functional currencies. The Fees for mortality and surrender charges are recognized as assessed,

Company uses exchange rates as of the balance sheet date to translate that is as earned.

assets and liabilities into U.S. dollars. Translation gains or losses on Administration fees are recognized as services are provided.

functional currencies, net of applicable taxes, are recorded in

accumulated other comprehensive income (loss). The Company uses Benefits and expenses for universal life products consist of benefit

average monthly exchange rates during the year to translate revenues claims in excess of policyholder account balances. Expenses are

and expenses into U.S. dollars. recognized when claims are submitted, and income is credited to

policyholders in accordance with contract provisions.

Contract fees and expenses for administrative services only (‘‘ASO’’)

programs and pharmacy programs and services are recognized as

services are provided net of estimated refunds under performance

Premiums for group life, accident and health insurance and managed guarantees. In some cases, the Company provides performance

care coverages are recognized as revenue on a pro rata basis over the guarantees associated with meeting certain service standards, clinical

contract period. Benefits and expenses are recognized when incurred. outcomes or financial metrics. If these service standards, clinical

For experience-rated contracts, premium revenue includes an outcomes or financial metrics are not met, the Company may be

adjustment for experience-rated refunds which is calculated according financially at risk up to a stated percentage of the contracted fee or a

to contract terms and using the customer’s experience (including stated dollar amount. The Company establishes deferred revenues for

estimates of incurred but not reported claims). Premium revenue also estimated payouts associated with these performance guarantees.

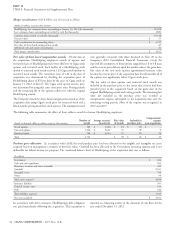

includes an adjustment to reflect the estimated effect of rebates due to Approximately 14% of ASO fees reported for the year ended

customers under the commercial minimum medical loss ratio December 31, 2013 were at risk, with reimbursements estimated to be

provisions of Health Care Reform. approximately 1%.

Premiums for individual life, accident and supplemental health The unrecognized portion of premiums and fees received is recorded

insurance and annuity products, excluding universal life and as unearned premiums and fees.

investment-related products, are recognized as revenue when due.

Mail order pharmacy revenues and cost of goods sold are recognized as

Benefits and expenses are matched with premiums.

each prescription is shipped.

Premiums and fees received for the Company’s Medicare Advantage

Plans and Medicare Part D products from customers and the Centers

for Medicare and Medicaid Services (‘‘CMS’’) are recognized as

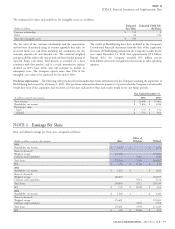

revenue ratably over the contract period. CMS provides risk-adjusted The Company records compensation expense for stock awards and

premium payments for the Medicare Advantage Plans and Medicare options over their vesting periods primarily based on the estimated fair

Part D products, based on the demographics and health severity of value at the grant date. For stock options, fair value is estimated using

enrollees. The Company recognizes periodic changes to risk-adjusted an option-pricing model, whereas for restricted stock grants and units

premiums as revenue when the amounts are determinable and

CIGNA CORPORATION - 2013 Form 10-K 71

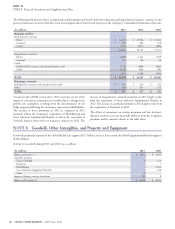

P. Accounts Payable, Accrued Expenses and

Other Liabilities

•

•

Q. Translation of Foreign Currencies

•

•

•

R. Premiums and Fees, Revenues and

Related Expenses

S. Stock Compensation