Cigna 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

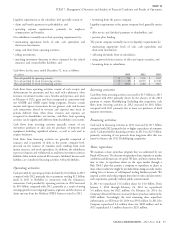

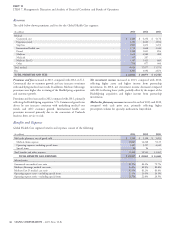

Off-Balance Sheet:

Purchase obligations. As of December 31, 2013, purchase obligations consisted of estimated payments required under contractual arrangements

for future services and investment commitments as follows:

(In millions)

Fixed maturities $56

Commercial mortgage loans 7

Real estate 3

Limited liability entities (other long-term investments) 643

Total investment commitments 709

Future service commitments 169

TOTAL PURCHASE OBLIGATIONS $ 878

We had commitments to invest in limited liability entities that hold Operating leases. For additional information, see Note 21 to the

real estate, loans to real estate entities or securities. See Note 11(D) to Consolidated Financial Statements.

the Consolidated Financial Statements for additional information.

Our estimated future service commitments primarily represent

Guarantees

contracts for certain outsourced business processes and IT We are contingently liable for various financial and other guarantees

maintenance and support. We generally have the ability to terminate provided in the ordinary course of business. See Note 23 to the

these agreements, but do not anticipate doing so at this time. Purchase Consolidated Financial Statements for additional information on

obligations exclude contracts that are cancelable without penalty and guarantees.

those that do not specify minimum levels of goods or services to be

purchased.

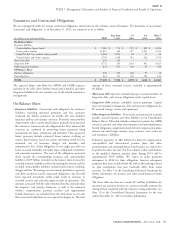

Critical Accounting Estimates

The preparation of Consolidated Financial Statements in accordance Consolidated Financial Statements, including estimates of liabilities

with GAAP requires management to make estimates and assumptions for future policy benefits, as well as estimates with respect to unpaid

that affect reported amounts and related disclosures in the claims and claim expenses, postemployment and postretirement

Consolidated Financial Statements. Management considers an benefits other than pensions, certain compensation accruals, and

accounting estimate to be critical if: income taxes.

it requires assumptions to be made that were uncertain at the time Management believes the current assumptions used to estimate

the estimate was made; and amounts reflected in our Consolidated Financial Statements are

appropriate. However, if actual experience differs from the

changes in the estimate or different estimates that could have been assumptions used in estimating amounts reflected in our

selected could have a material effect on our consolidated results of Consolidated Financial Statements, the resulting changes could have a

operations or financial condition. material adverse effect on our consolidated results of operations and,

in certain situations, could have a material adverse effect on our

Management has discussed the development and selection of its

liquidity and financial condition.

critical accounting estimates with the Audit Committee of our Board

of Directors and the Audit Committee has reviewed the disclosures See Note 2 to the Consolidated Financial Statements for further

presented below. information on significant accounting policies.

In addition to the estimates presented in the following table, there are

other accounting estimates used in the preparation of our

40 CIGNA CORPORATION - 2013 Form 10-K

•

•