Cigna 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

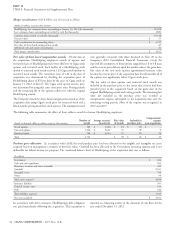

fair value is equal to the market price of the Company’s common stock carrying values of assets and liabilities. Deferred income taxes are

on the date of grant. Compensation expense for strategic performance established based upon enacted tax rates and laws. A valuation

shares is recorded over the performance period. For strategic allowance is recorded when the assessment of available evidence

performance shares with payment dependent on a market condition, indicates there is a less than 50% likelihood that a deferred tax asset

fair value is determined at the grant date using a Monte Carlo will be realized. Current income taxes generally represent amounts

simulation model and not subsequently adjusted regardless of the final owed to or due from taxing authorities as related to filed income tax

outcome. For strategic performance shares with payment dependent returns.

on performance conditions, expense is initially accrued based on the The Company records income taxes on the unremitted earnings of

most likely outcome, but evaluated for adjustment each period for certain foreign subsidiaries at the foreign jurisdiction tax rate which

updates in the expected outcome. At the end of the performance can be significantly lower than the U.S. statutory tax rate.

period, expense is adjusted to the actual outcome (number of shares

awarded times the share price at the grant date). Note 19 contains detailed information about the Company’s income

taxes.

The Company’s participating life insurance policies entitle

policyholders to earn dividends that represent a portion of the The Company computes basic earnings per share using the weighted-

earnings of the Company’s life insurance subsidiaries. Participating average number of unrestricted common and deferred shares

insurance accounted for approximately 1% of the Company’s total life outstanding. Diluted earnings per share also includes the dilutive

insurance in force at the end of 2013, 2012 and 2011. effect of outstanding employee stock options and unvested restricted

stock granted after 2009 using the treasury stock method and the

effect of strategic performance shares.

The Company generally recognizes deferred income taxes for

differences between the financial reporting and income tax reporting

Acquisitions and Dispositions

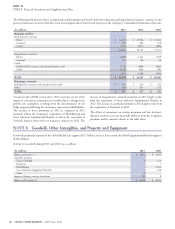

The Company may from time to time acquire or dispose of assets, allocated to the tangible and intangible net assets acquired based on

subsidiaries or lines of business. Significant transactions are described management’s estimates of their fair value. Accordingly,

below. approximately $113 million was allocated to identifiable intangible

assets, primarily a distribution relationship and the value of business

acquired (‘‘VOBA’’) that represents the present value of the estimated

A. Joint Venture Agreement with

net cash flows from the long duration contracts in force, with the

Finansbank

remaining $116 million allocated to goodwill. The identifiable

intangible assets will be amortized over an estimated useful life of

On November 9, 2012, the Company acquired 51% of the total approximately 10 years. Goodwill has been allocated to the Global

shares of Finans Emeklilik ve Hayat A.S. (‘‘Finans Emeklilik’’), a Supplemental Benefits segment and is not deductible for federal

Turkish insurance company, from Finansbank A.S. (‘‘Finansbank’’), a income tax purposes.

Turkish retail bank, for a cash purchase price of approximately

$116 million. Finansbank continues to hold 49% of the total shares. The redeemable noncontrolling interest is classified as temporary

Finans Emeklilik operates in life insurance, accident insurance and equity in the Company’s Consolidated Balance Sheet because

pension product markets. The acquisition provides Cigna Finansbank has the right to require the Company to purchase its 49%

opportunities to reach and serve the growing middle class market in interest for the value of its net assets and the inforce business in

Turkey through Finansbank’s network of retail banking branches. 15 years.

In accordance with GAAP, the total purchase price, including the

redeemable noncontrolling interest of $111 million, has been

72 CIGNA CORPORATION - 2013 Form 10-K

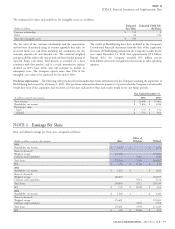

T. Participating Business V. Earnings Per Share

U. Income Taxes

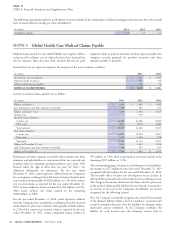

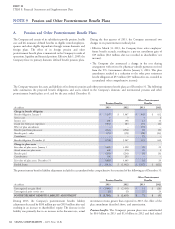

NOTE 3