Cigna 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

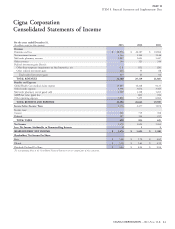

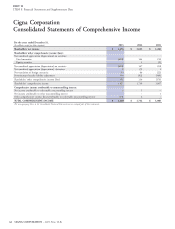

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

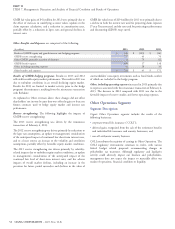

GMIB fair value gains of $41 million for 2012 were primarily due to GMIB fair value losses of $234 million for 2011 were primarily due to

the effect of increases in underlying account values, updates in the a decline in both the interest rate used for projecting claim exposure

claim exposure calculation, and a reduction in annuitization rates, (7-year Treasury rates) and the rate used for projecting market returns

partially offset by a reduction in lapse rates and general declines in and discounting (LIBOR swap curve).

interest rates.

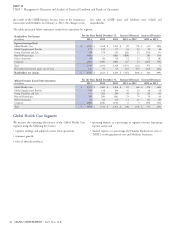

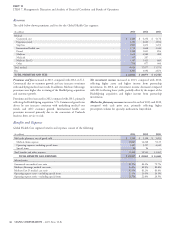

Other Benefits and Expenses are comprised of the following:

(In millions)

2013 2012 2011

Results of GMDB equity and growth interest rate hedging programs $ (32) $ (105) $ (14)

GMDB reserve strengthening 727 43 70

Other GMDB, primarily accretion of discount 4 79 82

GMDB benefit expense 699 17 138

Other, including operating expenses 32 28 33

Other benefits and expenses $ 731 $ 45 $ 171

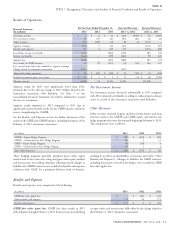

Results of GMDB hedging programs. Results in 2013 and 2012 contractholders’ non-equity investments such as bond funds, neither

reflected favorable equity market performance. The result in 2011 was of which are included in the hedge program.

due to turbulent conditions in an overall declining equity market. Other, including operating expenses increased in 2013 primarily due

Results for 2013 are limited to market activity prior to the hedge to expenses associated with the reinsurance transaction of February 4,

program’s discontinuance resulting from the reinsurance transaction 2013. The decrease in 2012 compared with 2011 was due to the

with Berkshire. favorable impact of reserve studies and lower operating expenses.

As explained in Other revenues above, these changes did not affect

shareholders’ net income because they were offset by gains or losses on

Other Operations Segment

futures contracts used to hedge equity market and interest rate

performance.

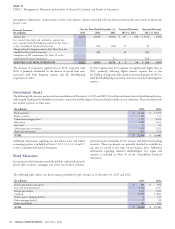

Segment Description

Reserve strengthening. The following highlights the impacts of Cigna’s Other Operations segment includes the results of the

GMDB reserve strengthening: following businesses:

The 2013 reserve strengthening was driven by the reinsurance corporate-owned life insurance (‘‘COLI’’);

transaction of February 4, 2013. deferred gains recognized from the sale of the retirement benefits

The 2012 reserve strengthening was driven primarily by reductions to and individual life insurance and annuity businesses; and

the lapse rate assumptions, an update to management’s consideration run-off settlement annuity business.

of the anticipated impact of continued low short-term interest rates,

and to a lesser extent, an increase to the volatility and correlation COLI contributes the majority of earnings in Other Operations. The

assumptions, partially offset by favorable equity market conditions. COLI regulatory environment continues to evolve, with various

federal budget related proposals recommending changes in

The 2011 reserve strengthening was driven primarily by volatility- policyholder tax treatment. Although regulatory and legislative

related impacts due to turbulent equity market conditions, an update activity could adversely impact our business and policyholders,

to management’s consideration of the anticipated impact of the management does not expect the impact to materially affect our

continued low level of short-term interest rates, and the adverse results of operations, financial condition or liquidity.

impacts of overall market declines, including an increase in the

provision for future partial surrenders and declines in the value of

52 CIGNA CORPORATION - 2013 Form 10-K

•

•

•