Cigna 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

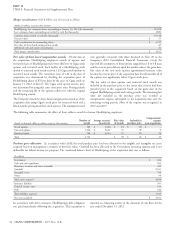

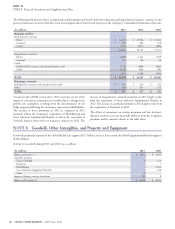

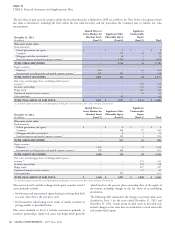

The estimated fair values and useful lives for intangible assets are as follows:

Estimated Estimated Useful Life

(Dollars in millions)

Fair Value (In Years)

Customer relationships $ 711 8

Other 84 3-10

Total other intangible assets $ 795

The fair value of the customer relationship and the amortization The results of HealthSpring have been included in the Company’s

method were determined using an income approach that relies on Consolidated Financial Statements from the date of the acquisition.

projected future net cash flows including key assumptions for the Revenues of HealthSpring included in the Company’s results for the

customer attrition rate and discount rate. The estimated weighted year ended December 31, 2012 were approximately $5.4 billion.

average useful life reflects the time period and front-loaded pattern of During 2012, the Company recorded $53 million pre-tax

expected future cash flows. Amortization is recorded on a basis ($40 million after-tax) of acquisition-related costs in other operating

consistent with that pattern, and as a result amortization expense expenses.

declined in 2013 from 2012, and will continue to decline in

subsequent years. The Company expects more than 50% of the

intangible asset value to be amortized by the end of 2014.

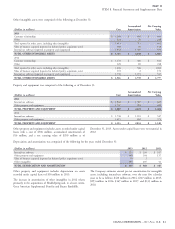

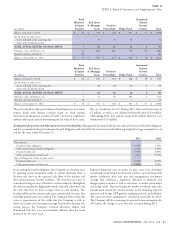

Pro forma information. The following table presents selected unaudited pro forma information for the Company assuming the acquisition of

HealthSpring had occurred as of January 1, 2011. This pro forma information does not purport to represent what the Company’s actual results

would have been if the acquisition had occurred as of the date indicated or what such results would be for any future periods.

Year Ended December 31,

(In millions, except per share amounts)

2012 2011

Total revenues $ 29,608 $ 27,461

Shareholders’ net income $ 1,633 $ 1,456

Earnings per share:

Basic $ 5.73 $ 5.11

Diluted $ 5.63 $ 5.02

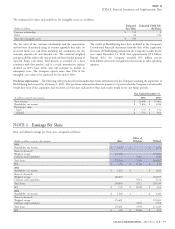

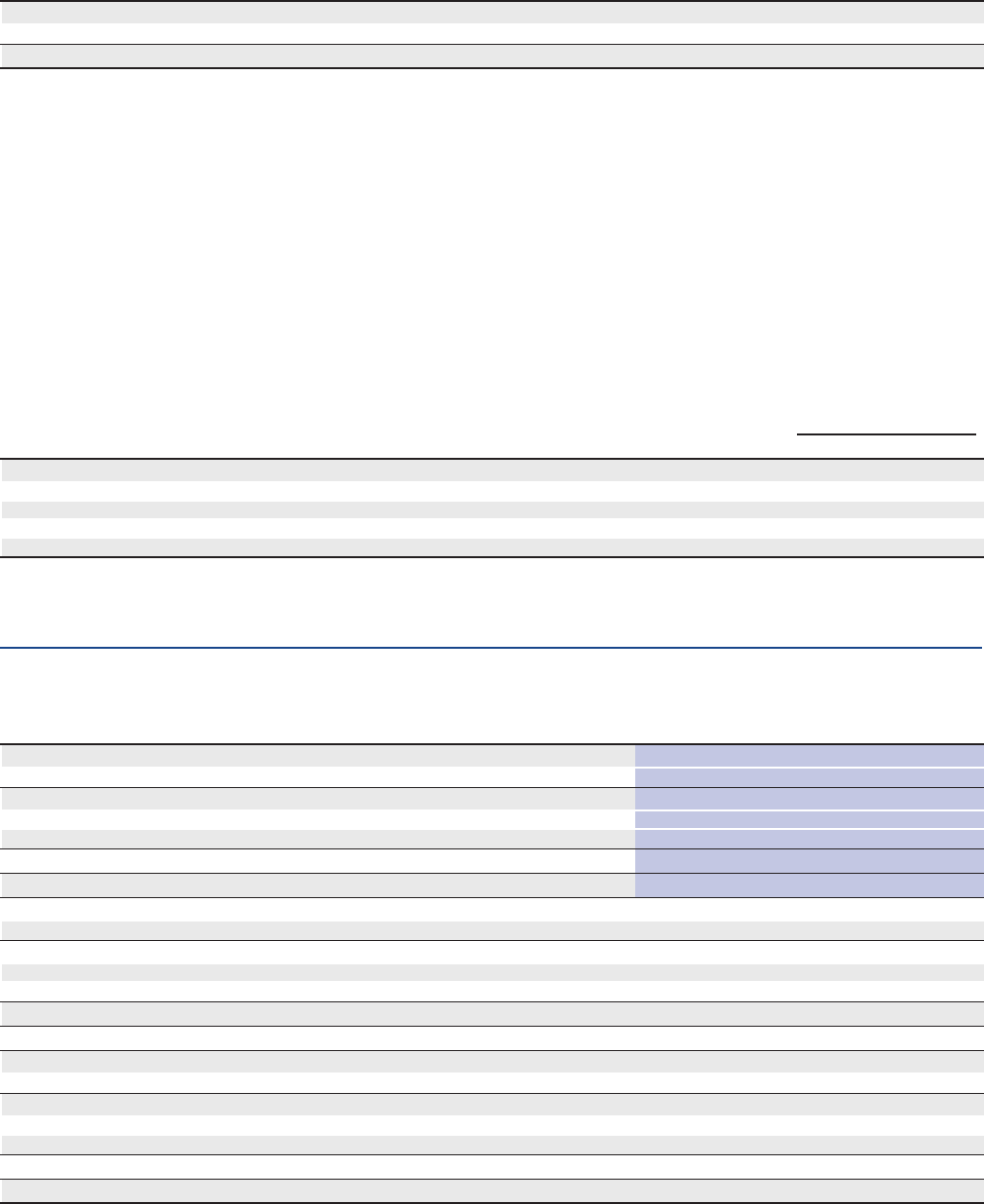

Earnings Per Share

Basic and diluted earnings per share were computed as follows:

Effect of

(Dollars in millions, except per share amounts)

Basic Dilution Diluted

2013

Shareholders’ net income $ 1,476 $ - $ 1,476

Shares(in thousands):

Weighted average 279,296 - 279,296

Common stock equivalents 5,389 5,389

Total shares 279,296 5,389 284,685

EPS $ 5.28 $ (0.10) $ 5.18

2012

Shareholders’ net income $ 1,623 $ - $ 1,623

Shares(in thousands):

Weighted average 284,819 - 284,819

Common stock equivalents 4,711 4,711

Total shares 284,819 4,711 289,530

EPS $ 5.70 $ (0.09) $ 5.61

2011

Shareholders’ net income $ 1,260 $ - $ 1,260

Shares(in thousands):

Weighted average 270,691 - 270,691

Common stock equivalents 3,558 3,558

Total shares 270,691 3,558 274,249

EPS $ 4.65 $ (0.06) $ 4.59

CIGNA CORPORATION - 2013 Form 10-K 75

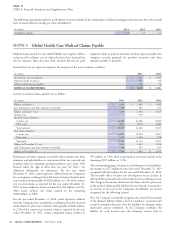

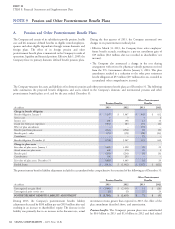

NOTE 4