Cigna 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

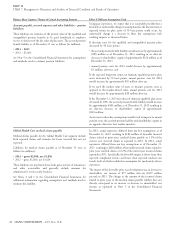

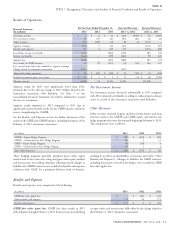

Balance Sheet Caption / Nature of Critical Accounting Estimate Effect if Different Assumptions Used

Valuation of fixed maturity investments Typically, the most significant input in the measurement of fair value is

the market interest rate used to discount the estimated future cash

Most fixed maturities are classified as available for sale and are carried flows from the instrument. Such market rates are derived by calculating

at fair value with changes in fair value recorded in accumulated other the appropriate spreads over comparable U.S. Treasury securities, based

comprehensive income (loss) within shareholders’ equity. on the credit quality, industry and structure of the asset.

Fair value is defined as the price at which an asset could be exchanged If the spreads used to calculate fair value increased by 100 basis points,

in an orderly transaction between market participants at the balance the fair value of the total fixed maturity portfolio of $16.5 billion

sheet date. would decrease by approximately $900 million.

Determining fair value for a financial instrument requires management

judgment. The degree of judgment involved generally correlates to the

level of pricing readily observable in the markets. Financial instruments

with quoted prices in active markets or with market observable inputs

to determine fair value, such as public securities, generally require less

judgment. Conversely, private placements including more complex

securities that are traded infrequently are typically measured using

pricing models that require more judgment as to the inputs and

assumptions used to estimate fair value. There may be a number of

alternative inputs to select, based on an understanding of the issuer, the

structure of the security and overall market conditions. In addition,

these factors are inherently variable in nature as they change frequently

in response to market conditions. Approximately two-thirds of our

fixed maturities are public securities, and one-third are private

placement securities.

See Note 10 to the Consolidated Financial Statements for a discussion

of our fair value measurements and the procedures performed by

management to determine that the amounts represent appropriate

estimates.

Assessment of ‘‘other-than-temporary’’ impairments of fixed For all fixed maturities with cost in excess of their fair value, if this

maturities excess was determined to be other-than-temporary, shareholders’ net

income for the year ended December 31, 2013 would have decreased

To determine whether a fixed maturity’s decline in fair value below its by approximately $65 million after-tax.

amortized cost is other than temporary, we must evaluate the expected

recovery in value and its intent to sell or the likelihood of a required

sale of the fixed maturity prior to an expected recovery. To make this

determination, we consider a number of general and specific factors

including the regulatory, economic and market environments, length

of time and severity of the decline, and the financial health and specific

near term prospects of the issuer.

See Notes 2 (C) and 11 to the Consolidated Financial Statements for

additional discussion of our review of declines in fair value, including

information regarding our accounting policies for fixed maturities.

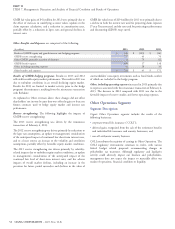

Segment Reporting

The following section of this MD&A discusses the results of each of profitability used by our management because it presents the

our reporting segments. We measure the financial results of our underlying results of operations of our businesses and permits analysis

segments using ‘‘segment earnings (loss)’’, defined as shareholders’ net of trends in underlying revenue, expenses and shareholders’ net

income (loss) before after-tax realized investment results. In the income. This measure is not determined in accordance with GAAP

following segment discussions, we also present information using and should not be viewed as a substitute for the most directly

‘‘adjusted income (loss) from operations’’, defined as segment earnings comparable GAAP measure that is shareholders’ net income. We

(loss) excluding special items and results of the GMIB business. exclude special items because management does not believe they are

Adjusted income (loss) from operations is another measure of representative of our underlying results of operations. We also exclude

CIGNA CORPORATION - 2013 Form 10-K 43