Cigna 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

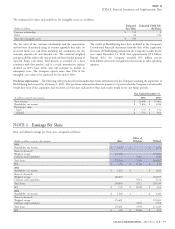

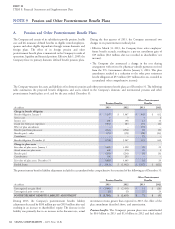

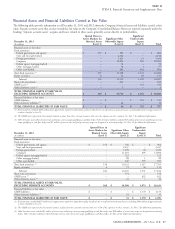

Fixed Guaranteed

Maturities Real Estate Deposit

& Equity & Mortgage Securities Account

(In millions)

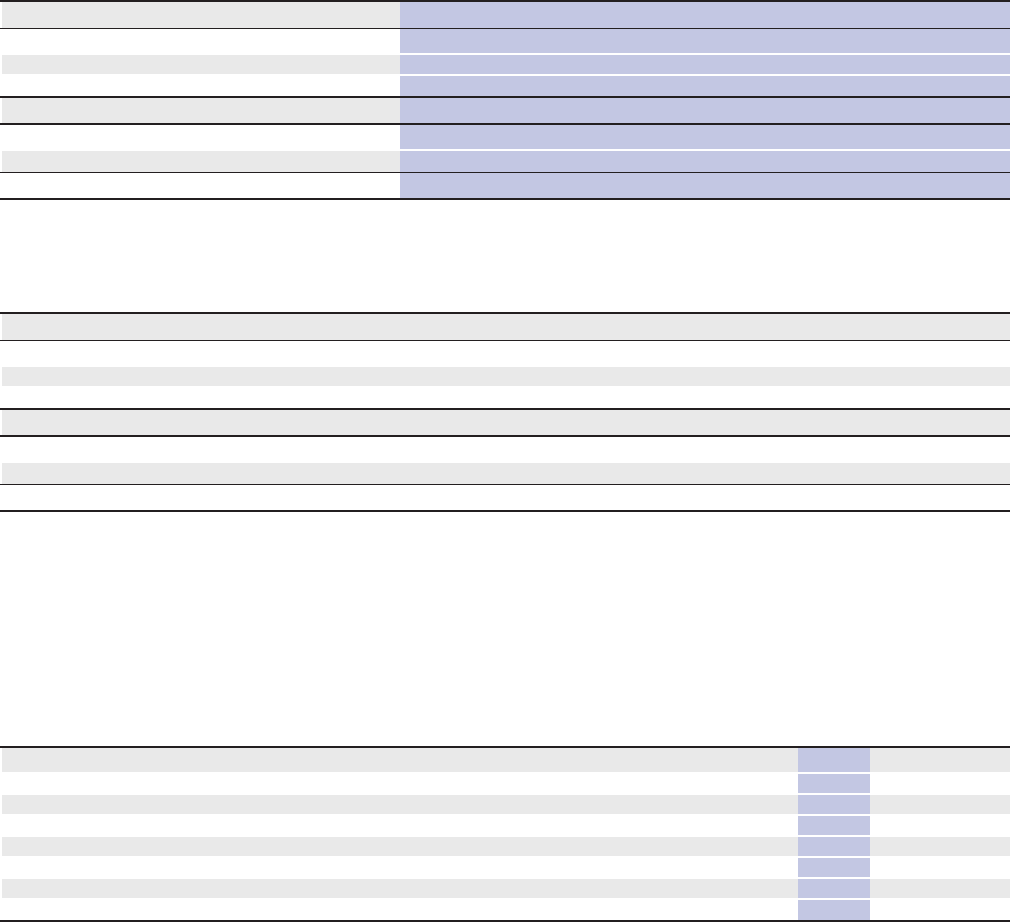

Securities Loans Partnerships Hedge Funds Contract Total

Balance at January 1, 2013 $ 44 $ 352 $ 328 $ 327 $ 47 $ 1,098

Actual return on plan assets:

Assets still held at the reporting date – 29 16 38 1 84

Assets sold during the period 7 – – – – 7

TOTAL ACTUAL RETURN ON PLAN ASSETS 7 29 16 38 1 91

Purchases, sales, settlements, net 25 (42) (40) (5) (4) (66)

Transfers into/out of Level 3 (2) – – – – (2)

Balance at December 31, 2013 $ 74 $ 339 $ 304 $ 360 $ 44 $ 1,121

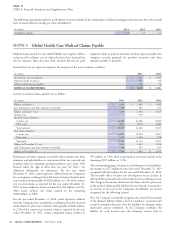

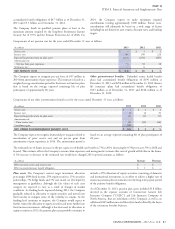

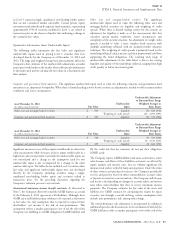

Fixed Guaranteed

Maturities Real Estate Deposit

& Equity & Mortgage Securities Account

(In millions)

Securities Loans Partnerships Hedge Funds Contract Total

Balance at January 1, 2012 $ 26 $ 303 $ 314 $ 148 $ 39 $ 830

Actual return on plan assets:

Assets still held at the reporting date – 38 18 10 3 69

Assets sold during the period – – – – – –

TOTAL ACTUAL RETURN ON PLAN ASSETS – 38 18 10 3 69

Purchases, sales, settlements, net 5 11 (4) 169 5 186

Transfers into/out of Level 3 13 – – – – 13

Balance at December 31, 2012 $ 44 $ 352 $ 328 $ 327 $ 47 $ 1,098

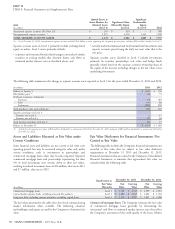

The assets related to other postretirement benefit plans are invested in they are classified as Level 3. During 2013, these assets had a loss of

deposit funds with interest credited based on fixed income $1 million, as well as a net withdrawal from the fund of $3 million,

investments in the general account of CGLIC. As there are significant while during 2012, they earned a return of $1 million, offset by a net

unobservable inputs used in determining the fair value of these assets, withdrawal of $3 million.

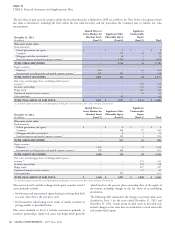

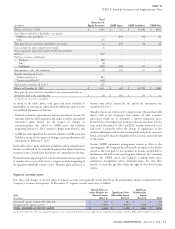

Assumptions for pension and other postretirement benefit plans. Management determined the present value of the projected benefit obligation

and the accumulated other postretirement benefit obligation and related benefit costs based on the following weighted average assumptions as of

and for the years ended December 31:

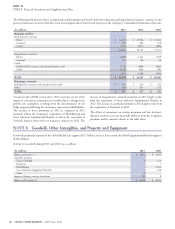

2013 2012

Discount rate:

Pension benefit obligation 4.50% 3.50%

Other postretirement benefit obligation 4.00% 3.25%

Pension benefit cost 3.50% 4.00%

Other postretirement benefit cost 3.25% 3.75%

Expected long-term return on plan assets:

Pension benefit cost 8.00% 8.00%

Other postretirement benefit cost 5.00% 5.00%

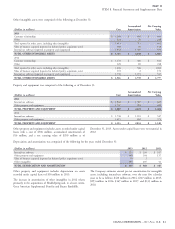

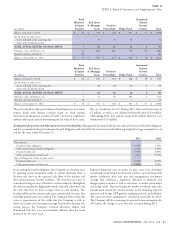

In measuring the benefit obligation, the Company sets discount rates Expected long-term rates of return on plan assets were developed

by applying actual annualized yields at various durations from a considering actual long-term historical returns, expected long-term

discount rate curve to the expected cash flows of the pension and market conditions, plan asset mix and management’s investment

other postretirement benefits liabilities. The discount rate curve is strategy, that continues a significant allocation to domestic and

constructed using an array of bonds in various industries throughout foreign equity securities as well as real estate, securities partnerships

the domestic market for high quality bonds, but only selects those for and hedge funds. Expected long-term market conditions take into

the curve that have an above average return at each duration. The consideration certain key macroeconomic trends including expected

bond portfolio used to construct the curve is monitored to ensure that domestic and foreign GDP growth, employment levels and inflation.

only high quality issues are included. The Company believes that this The expected return assumption is considered reasonable for 2013.

curve is representative of the yields that the Company is able to The Company will be re-assessing its expected return assumption for

achieve in its plan asset investment strategy. As part of its discount rate 2014 given the change in asset mix that occurred during 2013.

setting process, the Company reviewed alternative indices and

determined that they were not materially different than the result

produced by the curve used.

CIGNA CORPORATION - 2013 Form 10-K 85