Cigna 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

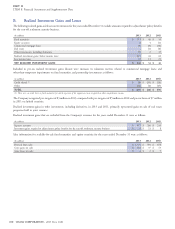

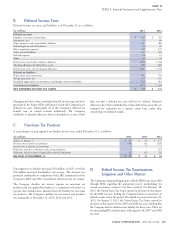

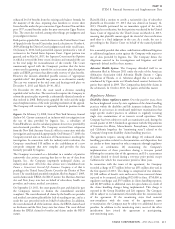

The table below shows the status of, and changes in, strategic performance shares during the last three years:

2013 2012 2011

Weighted Average Weighted Average Weighted Average

Fair Value at Fair Value at Fair Value at

(Awards in thousands)

Grants/Units Award Date Grants/Units Award Date Grants/Units Award Date

Outstanding – January 1 1,600 $ 41.92 834 $ 39.45 430 $ 34.73

Awarded 616 $ 59.84 842 $ 44.49 529 $ 42.92

Vested (448) $ 36.88 – $ – – $ –

Forfeited (196) $ 47.52 (76) $ 43.39 (125) $ 37.92

OUTSTANDING – DECEMBER 31 1,572 $ 49.67 1,600 $ 41.92 834 $ 39.45

The fair value of vested strategic performance shares was $42 million expense was expected to be recognized over the next two years. For

in 2013. No strategic performance shares vested in 2012 and 2011. strategic performance shares subject to a performance condition, the

amount of expense may vary based on actual performance in 2014

At the end of 2013, approximately 1,100 employees held 1.6 million and 2015.

strategic performance shares and $33 million of related compensation

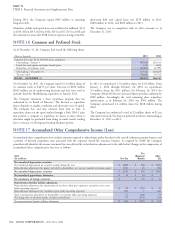

Leases and Rentals

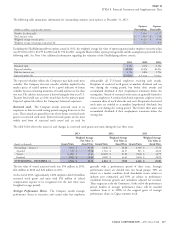

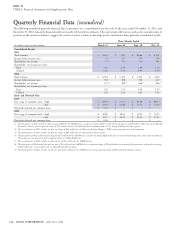

The Company’s operating leases are primarily for office space. Some $131 in 2014, $127 in 2015, $105 in 2016, $75 in 2017, $59

of these leases include renewal options and other incentives that are in 2018 and $144 thereafter.

amortized over the life of the lease. Rental expenses for operating The Company also has capital lease arrangements. See Note 8 and

leases amounted to $120 million in 2013, $130 million in 2012 and Note 15 for further information on assets recorded under capital

$115 million in 2011. As of December 31, 2013, future net leases and the related obligations.

minimum rental payments under non-cancelable operating leases

were approximately $641 million, payable as follows (in millions):

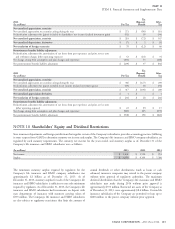

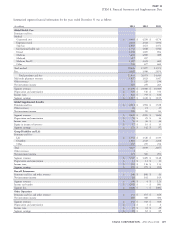

Segment Information

The financial results of the Company’s businesses are reported in the Other Operations consist of:

following segments: corporate-owned life insurance (‘‘COLI’’);

Global Health Care aggregates the Commercial and Government deferred gains recognized from the 1998 sale of the individual life

operating segments due to their similar economic characteristics, insurance and annuity business and the 2004 sale of the retirement

products and services and regulatory environment: benefits business; and

The Commercial operating segment encompasses both the U.S. run-off settlement annuity business.

commercial and certain international health care businesses serving

employers and their employees, other groups, and individuals. Corporate reflects amounts not allocated to other segments, such as

Products and services include medical, dental, behavioral health, net interest expense (defined as interest on corporate debt less net

vision, and prescription drug benefit plans, health advocacy investment income on investments not supporting segment

programs and other products and services to insured and operations), interest on uncertain tax positions, certain litigation

self-insured customers. matters, intersegment eliminations, compensation cost for stock

options, expense associated with its frozen pension plans, certain

The Government operating segment offers Medicare Advantage corporate project and overhead costs.

and Medicare Part D plans to seniors and Medicaid plans.

The Company measures the financial results of its segments using

Global Supplemental Benefits includes supplemental health, life ‘‘segment earnings (loss)’’, defined as shareholders’ income (loss) from

and accident insurance products offered in selected international continuing operations before after-tax realized investment results. The

markets and in the U.S. Company determines segment earnings (loss) consistent with

Group Disability and Life provides group long-term and short-term accounting policies used in preparing the consolidated financial

disability, group life, accident and specialty insurance products and statements, except that amounts included in Corporate are not

related services. allocated to segments. The Company allocates certain other operating

expenses, such as systems and other key corporate overhead expenses,

Run-off Reinsurance is predominantly comprised of GMDB and on systematic bases. Income taxes are generally computed as if each

GMIB business that was ceded to Berkshire on February 4, 2013. segment were filing a separate income tax return. The Company does

not report total assets by segment as this is not a metric used to

The Company also reports results in two other categories.

allocate resources or evaluate segment performance.

108 CIGNA CORPORATION - 2013 Form 10-K

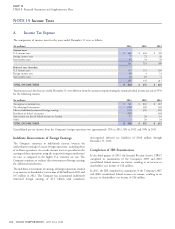

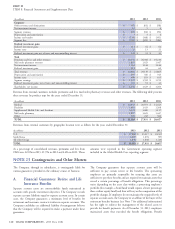

NOTE 21

NOTE 22

•

•

••

•