Cigna 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

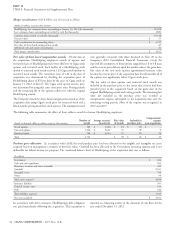

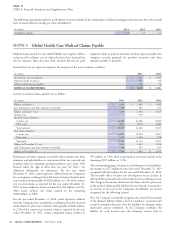

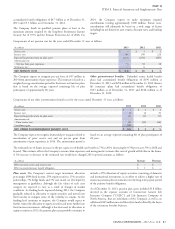

Merger consideration of $3.8 billion was determined as follows:

(Dollars in millions, except per share amounts)

HealthSpring, Inc. common shares outstanding at January 30, 2012 (In thousands) 67,828

Less: common shares outstanding not settled in cash (In thousands) (100)

Common shares settled in cash (In thousands) 67,728

Price per share $55

Cash consideration for outstanding shares $ 3,725

Fair value of share-based compensation awards 65

Additional cash and equity consideration 21

Total merger consideration $ 3,811

Fair value of share-based compensation awards. On the date of were generally consistent with those disclosed in Note 20 to the

the acquisition, HealthSpring employees’ awards of options and Company’s 2012 Consolidated Financial Statements, except the

restricted shares of HealthSpring stock were rolled over to Cigna stock expected life assumption of these options ranged from 1.8 to 4.8 years

options and restricted stock. Each holder of a HealthSpring stock and the exercise price did not equal the market value at the grant date.

option or restricted stock award received 1.24 Cigna stock options or Fair value of the new stock options approximated intrinsic value

restricted stock awards. The conversion ratio of 1.24 at the date of because the exercise price at the acquisition date for substantially all of

acquisition was determined by dividing the acquisition price of the options was significantly below Cigna’s stock price.

HealthSpring shares of $55 per share by the price of Cigna stock on The fair value of these options and restricted stock awards was

January 31, 2012 of $44.43. The Cigna stock option exercise price included in the purchase price to the extent that services had been

was determined by using this same conversion ratio. Vesting periods provided prior to the acquisition based on the grant date of the

and the remaining life of the options rolled over with the original original HealthSpring awards and vesting periods. The remaining fair

HealthSpring awards. value not included in the purchase price was recorded as

The Company valued the share-based compensation awards as of the compensation expense subsequent to the acquisition date over the

acquisition date using Cigna’s stock price for restricted stock and a remaining vesting periods. Most of the expense was recognized in

Black-Scholes pricing model for stock options. The assumptions used 2012 and 2013.

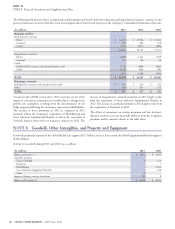

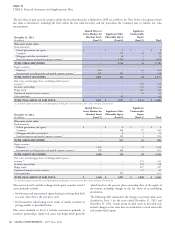

The following table summarizes the effect of these rollover awards for former HealthSpring employees.

Compensation

Number of Average exercise/ Fair value Included in expense

(Awards in thousands, dollars in millions, except per share amounts)

awards award price of awards purchase price post-acquisition

Vested options 589 $ 14.04 $ 18 $ 18 $ -

Unvested options 1,336 $ 16.21 37 28 9

Restricted stock 786 $ 44.43 35 19 16

Total 2,711 $ 90 $ 65 $ 25

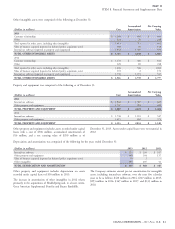

Purchase price allocation. In accordance with GAAP, the total purchase price has been allocated to the tangible and intangible net assets

acquired based on management’s estimates of their fair values. Goodwill has been allocated to the Government operating segment and is not

deductible for federal income tax purposes. The condensed balance sheet of HealthSpring at the acquisition date was as follows:

(In millions)

Investments $ 612

Cash and cash equivalents 492

Premiums, accounts and notes receivable 320

Goodwill 2,541

Intangible assets 795

Other 96

Total assets acquired 4,856

Insurance liabilities 505

Deferred income taxes 214

Debt 326

Total liabilities acquired 1,045

Net assets acquired $ 3,811

In accordance with debt covenants, HealthSpring’s debt obligation reported as a financing activity in the statement of cash flows for the

was paid immediately following the acquisition. This repayment is year ended December 31, 2012.

74 CIGNA CORPORATION - 2013 Form 10-K