Chrysler 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating performance

2002 was characterized by the continuing weakness in

worldwide demand for air travel, which started during the last

quarter of 2001. Demand for new engines and overhaul services

from commercial aviation customers felt the negative impact of

the downsizing imposed by airlines, especially in the West. The

governmental market, however, is expanding, both because

European Governments need to renew their military fleets and

because of the increased defense spending in the United

States.

Of importance, in the commercial aircraft market, is the entry

into service of the Trent 500 engines on the Airbus A340-600

and PW308 on the Dassault Falcon 2000 Ex, in addition to the

completion of flight certification activities on the GE90-115B

engine for the Boeing B777-200ER and of the T700-T6E1 engine

for the Italian helicopter NH90.

In the United States, in spite of the weak demand for power

generation units that use aircraft energy to produce electricity,

aletter of intent was signed with General Electric for the

development and manufacture of an innovative industrial

turbine with a power of over 100 MW (LM7000) whose initial

entry into service is expected for 2005–2006.

Work performed under government programs included

continued series production of EJ200 engines for the Typhoon

European fighter and collaboration with Honeywell for the F124

GA 200 turbofan engine for the Aermacchi M346 advanced

trainer. In 2002 FiatAvio also defined important collaboration

agreements with General Electric and Rolls-Royce North

America for the development and production of the F136

engine destined to the American fighters F-35 (JSF).

Naval programs continue with the delivery of the propulsion

system for the Italian Navy’s new aircraft carrier and for the new

Orizzonte Class frigates for the Italian and French Navies (a total

number of 12 LM2500 Turbines). The first “Power by the Hour”

contract for services integrated with the ISIS (In Service

Information System), was signed with the Italian Air Force.

Positive developments in the Commercial Engine Overhaul

Division included agreements reached for the maintenance of

JT8D-200 engines with customers in Asia (Indonesia) and North

America (United States). The maintenance agreement with Air

Dolomiti for the PW100 engines was extended to five years.

Moreover, the first contracts with Italian operators for the

overhaul of CFM56-7 and CFM56-3 were signed.

As to the Space Business Unit, Arianespace maintained a market

share of 50%, completing 4 launches with the Ariane 5 and 7

with the Ariane 4.

Following the problems with the new cryogenic engine, noted

during the Ariane 5 launch of December 2002, corrective actions

are underway and flights are due to resume with the standard

version of the launcher.

Within the “VEGA” program, detailed design of the Zefiro 23

and Zefiro 9 engines began in the fourth quarter of 2002, while

the design of the solid fueled rocket P80 has entered the

operative phase.

Results for the year

In 2002, the Sector had revenues of 1,534 million euros, down

6.2% from 2001 mainly due to the slowdown in the commercial

aircraft market.

The year ended with an increase in operating income,

amounting to 210 million euros (13.7% of revenues) as opposed

to 186 million euros (11.4% of revenues) of 2001, thanks mostly

to the efficiency gains achieved and the containment of

operating expenses.

Depreciation and amortization totaled 69 million euros (89

million euros in 2001) and research and development outlays

amounted to 145 million euros (132 million euros in 2001).

Net income for the year amounted to 116 million euros, down

from 425 million euro posted the previous year, which however

benefited from a capital gain of 328 million euros achieved by

the contribution of Fiat Energia to Italenergia.

Cash flow in 2002 was 185 million euros, lower than 2001 when

the Sector had benefited from the aforesaid extraordinary

capital gain.

57 Report on Operations

Aviation — FiatAvio

(in millions of euros)

2002

2001 2000

Net revenues 1,534 1,636 1,491

Operating result 210 186 143

EBIT 183 495 164

Net result before minority interest 116 425 83

Cash flow 185 514 173

Capital expenditures 130 41 36

Research and development 145 132 104

Net invested capital 618 587 71

Number of employees 5,049 5,243 5,362

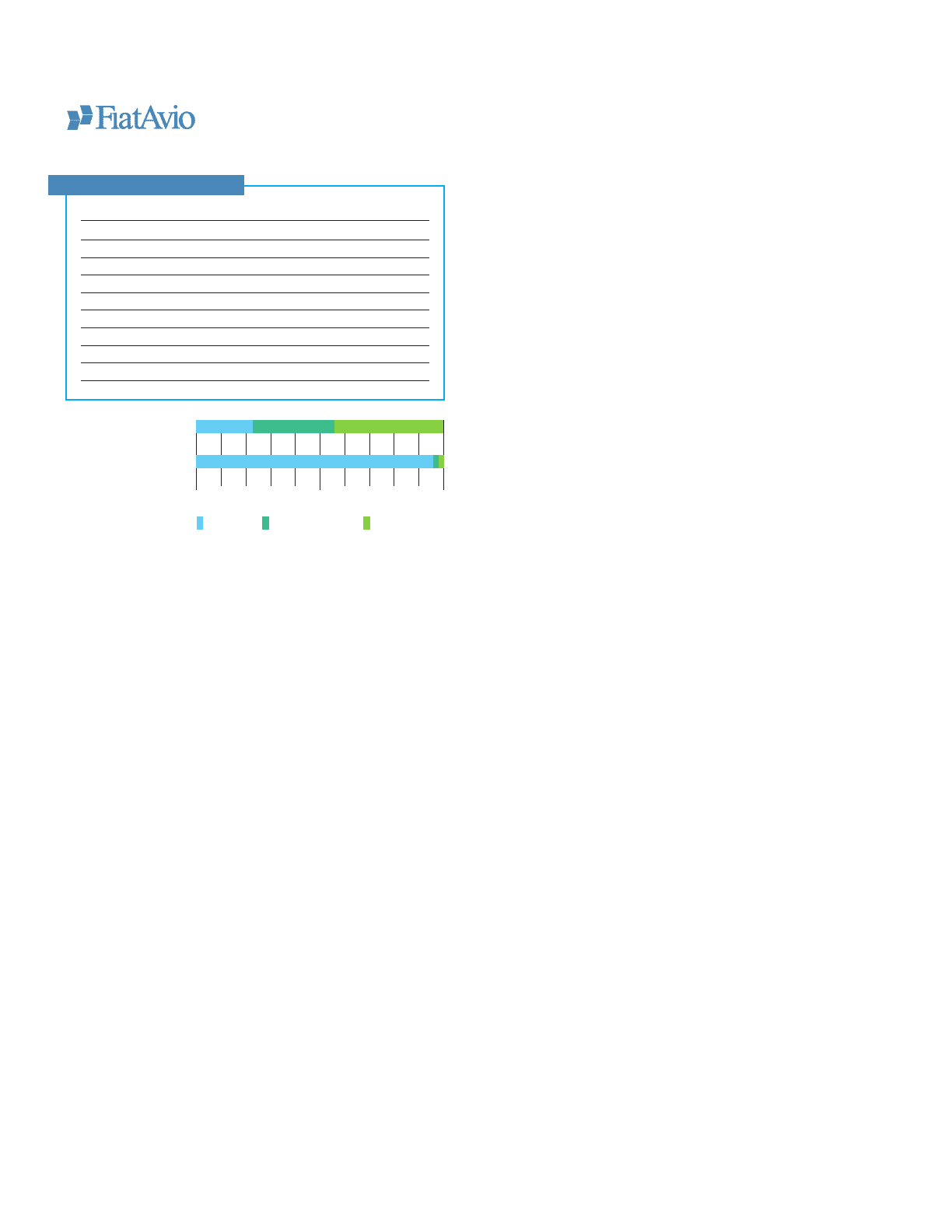

Highlights

050%

100%

Revenues by geographical

region of destination

Italy Rest of Europe Rest of the world

Employees by geographical

region