Chrysler 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

1,392 million euros reported at the end of 2001. Changes in

the scope of consolidation and payment of the balance of

assets and liabilities contributed by Fiat Auto to the Fiat-GM

Powertrain joint venture caused an aggregate increase of 447

million euros. On a comparable basis, the reduction in working

capital would have been 1,828 million euros. This decrease

mainly stemmed from cutbacks in inventories and, to a lesser

extent, positive exchange rate effects.

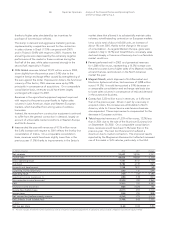

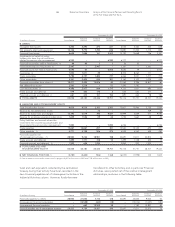

The following table illustrates the composition of working

capital during the two fiscal years:

(in millions of euros)

At 12/31/2002 At 12/31/2001

Change

Net inventories 7,050 8,375 (1,325)

Trade receivables 5,784 6,466 (682)

Trade payables (13,267)(13,520) 253

Other receivables (payables) (2,340)(2,713) 373

Working capital (2,773)(1,392) (1,381)

An analysis of the changes affecting the main components

of working capital is provided below.

Inventories (raw materials, finished products, and work in

progress), net of advances received for contract work in

progress, totaled 7,050 million euros, against 8,375 million euros

at the end of 2001. This decrease is principally attributable to

the effects of finished product inventory reductions carried out

by Fiat Auto and CNH.

Trade receivables totaled 5,784 million euros, 682 million euros

less than the 6,466 million euros reported at the end of 2001.

This decrease reflects the lower levels of activity and reduction

in receivables from the Fiat Auto dealer network, associated

with cutbacks in dealership inventories. The change in the

scope of consolidation entailed a reduction of 259 million euros.

Trade payables totaled 13,267 million euros, 253 million euros

less than the 13,520 million euros reported at the end of 2001.

The change is due to the lower level of activity at Fiat Auto

and changes in the scope of consolidation, which resulted in

areduction of 149 million euros.

Other receivables (payables), which also include trade accruals

and deferrals, improved from -2,713 million euros at the end

of 2001 to -2,340 million euros, largely due to the payment of

approximately 450 million euros for the balance of assets and

liabilities contributed by Fiat Auto to the Fiat-GM Powertrain

joint venture.

Net Invested Capital

Net invested capital totaled 12,459 million euros,

compared with 19,642 million euros at the end of 2001.

The decrease of 7,183 million euros is attributable to the

reduction in working capital, the previously mentioned

divestitures of business assets and investments, writedowns

during the year and changes in exchange rates due to

appreciation of the euro.

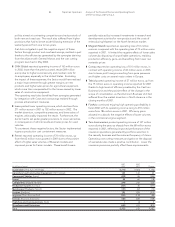

The following table illustrates the composition of net invested

capital at the end of 2002 and 2001:

(in millions of euros)

At 12/31/2002 At 12/31/2001

Change

Intangible fixed assets 5,200 6,535 (1,335)

Property, plant and equipment 12,106 13,887 (1,781)

Financial fixed assets 6,638 10,190 (3,552)

Investments on behalf

of policyholders who bear

the risk and those related to

pension plan management 6,930 6,177 753

Financial assets not

held as fixed assets 6,094 5,620 474

Net deferred tax assets 2,263 1,595 668

Reserves (16,999)(16,734) (265)

Policy liabilities and accruals

where the investment risk

is borne by policyholders

and those related to

pension plan management (7,000)(6,236) (764)

Working capital (2,773)(1,392) (1,381)

Net invested capital 12,459 19,642 (7,183)

Net Financial Position of the Group

The net financial position (cash, marketable securities, financial

receivables net of short and medium-long term payables and

related accruals and deferrals) at the end of December 2002

showed net debt of 3,780 million euros, 2,255 million euros less

than at the end of 2001 (6,035 million euros).

The improvement mainly resulted from the divestiture of

business lines and investments (3,231 million euros), capital

increases during the year (1,215 million euros), and the reduction

in working capital. These positive effects were partially offset by

liquidity absorbed by operating activities.

As a result of the Group’s financial restructuring plan, the net

financial position, illustrated in the following table, shows an