Chrysler 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

improvement in its composition, with a reduction in short-term

debt by 6,098 million euros, only partially offset by an increase

of 2,324 million euros in “long-term debt.”

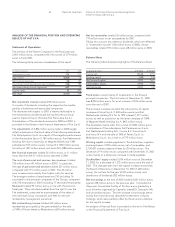

(in millions of euros) Dec. 31, 2002 Dec. 31, 2001

Cash 3,489 2,133

Marketable securities 1,507 2,000

Financial receivables

and leased assets 21,406 24,686

Accrued financial income 543 560

Deferred financial income (1,135)(2,057)

Total financial assets (A) 25,810 27,322

Short-term debt (8,310)(14,408)

Long-term debt (20,613)(18,289)

Accrued financial expenses (785)(797)

Prepaid financial expenses 118 137

Total financial liabilities (B) (29,590)(33,357)

Net financial position (A-B) (3,780)(6,035)

The new long-term loans provided in 2002 include the 3 billion

euro mandatory convertible facility, the loan from Citigroup

(lead manager of a restricted pool of banks) secured by the

agreements with EDF in connection with the Italenergia Bis

transaction (1,150 million euros), and the loan cum warrant

for General Motors shares (2,229 million euros).

The Group fully realized its target of reducing pro-forma net

debt to 3 billion euros, as agreed with the banks. In fact,

these agreements expressly state that for the computation

of fulfillment of such target, the net debt (3,780 million euros)

will include the proceeds deriving from binding agreements,

even if they have not yet been executed, and the proceeds

collected in consequence of the Italenergia Bis transaction,

including the aforementioned Citigroup loan (1,150 million

euros).

It is also expected that the target of reducing gross

indebtedness to 23.6 billion euros will be achieved upon

conclusion of the sale of 51% of Fidis Retail Italia to Capitalia,

Banca Intesa, Sanpaolo IMI, and Unicredito, as stated in the

agreement.

Between December 2002 and March 2003, the leading rating

agencies lowered their rating of Fiat to below investment grade.

Therefore, if this situation persists, in July 2004 the banks may

convert up to 2 billion euros of the principal loaned into equity.

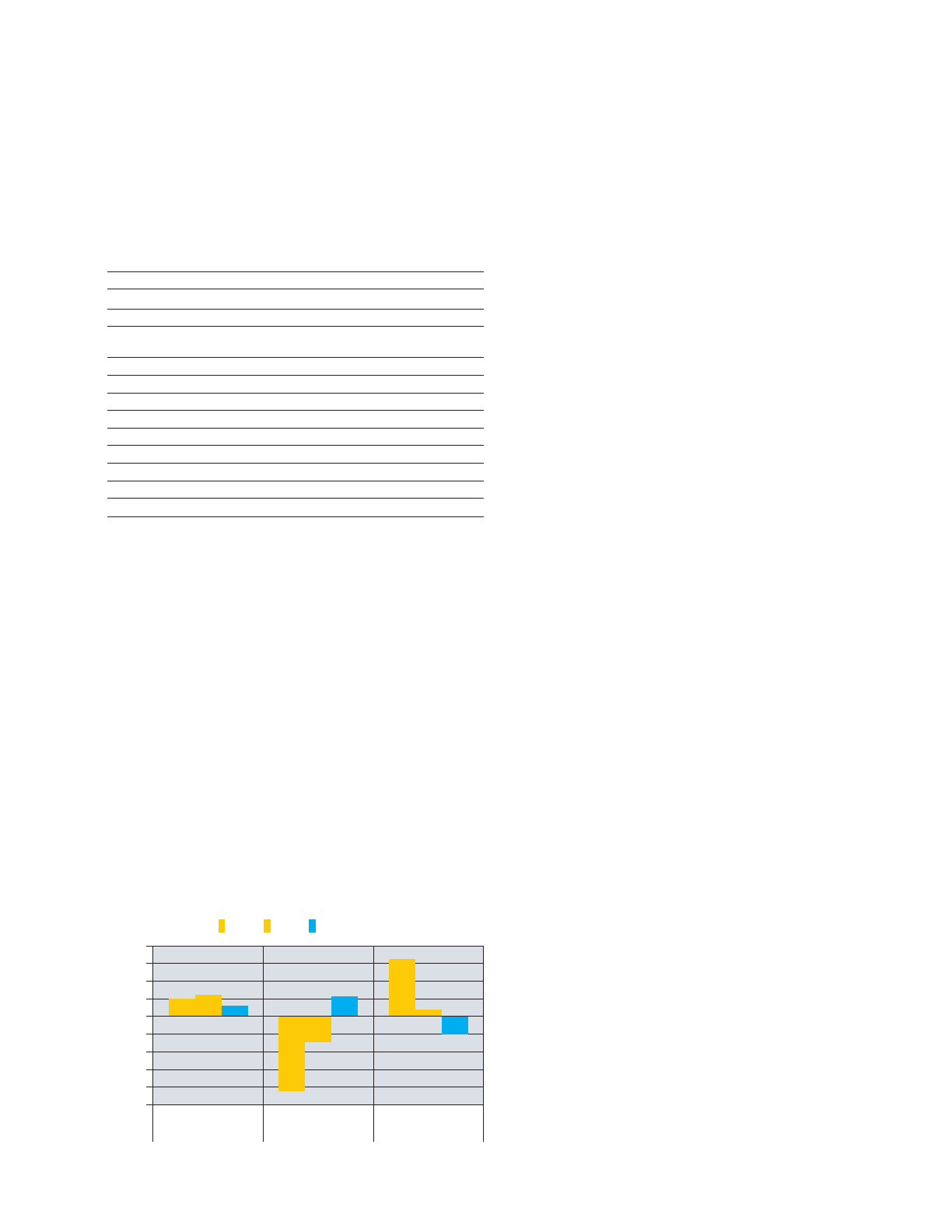

Consolidated statement of cash flows

The Group’s cash increased by 1,356 million euros, rising from

2,133 million euros at the end of 2001 to 3,489 million euros

at December 31, 2002 as a result of cash flow generated by

operating and investment activities, which was partially offset

by financing activities to reduce the level of financial debt.

The Group’s liquidity generated by operating activities totaled

1,053 million euros (compared with 2,435 million euros

generated in 2001).

Liquidity during the year was affected by the negative effect

of the net loss plus amortization and depreciation totaling 534

million euros, net of the balance of gains and losses realized

from divestitures and expenses for writedowns that did not

involve cash outlays (compared with positive cash flow of 340

million euros in 2001). Positive cash flow was generated by the

positive change in working capital that, on a comparable basis,

produced a benefit of 1,828 million euros (with respect to a

benefit of 2,633 million euros in 2001).

Investment activities generated cash flow of 2,096 million euros

in 2002 (compared with investment flows of 3,017 million euros

in 2001).

Investment flows during the year resulted from disposals of

assets and investments that, net of acquisitions, totaled 2,668

million euros, compared with a positive balance of 1,128 million

euros in 2001. The net reduction in financial receivables which

reflected, in particular, slowdown in activity of certain financial

companies and portfolio disposals, generated 2,456 million

euros in available funds, as compared with applications of 189

million euros in 2001.

The principal applications of funds during the year consisted

of 2,771 million euros in property, plant, and equipment,

including investments in vehicles to be leased on a long-

term basis, and 518 million euros in intangible fixed assets,

down from the aggregate total of 3,911 million euros

reported in 2001.

Financing activities absorbed 1,793 million euros (compared

with a benefit of 718 million euros in 2001).

Newly obtained loans, net of repayments, generated cash

flow of 2,655 million euros, up from the 2,504 million euros

reported in 2001, and the capital increases at Fiat S.p.A.

and CNH Global N.V., which generated 1,215 million euros,

were absorbed by the reduction in short-term debt, which

decreased by 5,358 million euros (compared with a reduction

of 1,140 million euros in 2001).

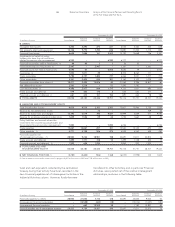

26 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

Flow generated by

operating activities

during the year

(10,000)

20012000 (in millions of euros)

2002

Flow generated by

investment activity

Flow generated by

financing activity

(8,000)

(6,000)

(4,000)

(2,000)

0

2,000

4,000

6,000

8,000