Chrysler 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

thanks to higher sales stimulated by tax incentives for

purchase of low-emission vehicles.

The slump in demand and aggressive marketing policies

implemented by competitors account for the contraction

in sales volumes in Brazil (-13.9% compared with 2001)

and in Poland (-20.4% with respect to 2001). However, the

annual figures were depressed by the extremely negative

performance of the market in these countries during the

first half of the year, while sales recovered strongly in the

second half, especially in Poland.

❚CNH Global revenues totaled 10,513 million euros in 2002,

down slightly from the previous year (-2.4%) due to the

negative foreign exchange effect caused by strengthening of

the euro against the dollar. Expressed in dollars, the functional

currency of this Sector, CNH revenues were up by 2.8%

principally in consequence of acquisitions. On a comparable

consolidation basis, revenues would have been largely

unchanged with respect to 2001.

Revenues in the agricultural equipment segment improved

with respect to the previous year thanks to higher sales

volumes in Latin American, Asian and Western European

markets, which benefited from strong sales of combine

harvesters.

Instead, the revenues from construction equipment continued

to suffer from the general contraction in demand, largely on

account of unfavorable market conditions in Western Europe

and North America.

❚Iveco ended the year with revenues of 9,136 million euros:

the 5.6% increase with respect to 2001 reflects the line-by-line

consolidation of Irisbus. On a comparable consolidation

basis, revenues would have been slightly lower than in the

previous year (-1.5%) thanks to improvements in the Sector’s

market share that allowed it to substantially maintain sales

volumes, notwithstanding contraction on European markets.

Iveco sold a total of about 162,000 units, an increase of

about 1% over 2001, thanks to the change in the scope

of consolidation. As regards Western Europe, gains were

realized in Italy (+12.7%) and Great Britain; conversely, sales

declined steeply in France and Germany due to unfavorable

market conditions.

❚Ferrari performed well in 2002 and generated revenues

for 1,208 million euros, representing a 14.2% increase over

the previous year due to higher sales of its Maserati models,

abrand that was reintroduced on the North American

market this year.

❚Magneti Marelli, which disposed of its Aftermarket and

Electronic Systems activities, had revenues of 3,288 million

euros (-19.3%). It would have posted a 5.9% decrease on

acomparable consolidation and exchange rate basis due

to lower sales volumes in consequence of reduced demand

in the automotive business.

❚Comau had 2,320 million euros in revenues, or 4.6% more

than in the previous year. Driven in part by a recovery in

acquired orders, this increase was attributable to North

America, while its Comau Service maintenance business

also expanded. These improvements compensated for the

decrease in European activities.

❚Teksid reported revenues of 1,539 million euros, 12.2% less

than in 2001 due to the sale of the Aluminum Business Unit

on September 30, 2002. On a comparable consolidation

basis, revenues would have been 5.3% lower than in the

previous year. The Cast Iron Business Unit suffered a

downturn due to market contraction. The improved results

reported by the Magnesium Business Unit reflected increased

use of this metal in SUV vehicles, particularly in the USA.

19 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

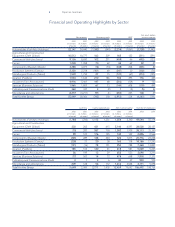

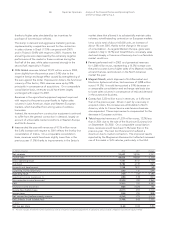

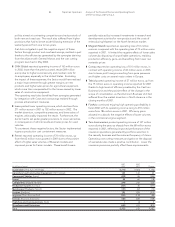

(in millions of euros) 2002 2001 Change

Net revenues 55,649 58,006 (2,357)

Cost of sales 48,619 49,854 (1,235)

Gross operating result 7,030 8,152 (1,122)

Overhead 5,782 6,149 (367)

Research and development 1,748 1,817 (69)

Operating income (expenses) (262)132 (394)

Operating result (762)318 (1,080)

Investment income (expenses) (*) (690)(149) (541)

Non-operating income (expenses) (2,503)359 (2,862)

EBIT (3,955)528 (4,483)

Financial income (expenses) (862)(1,025) 163

Income (loss) before taxes (4,817)(497) (4,320)

Income taxes (554)294 (848)

Net income (loss) before minority interest (4,263)(791) (3,472)

Fiat’s interest in net income (loss) (3,948)(445) (3,503)

(in euros)

Net loss per share (6.66)(0.84) (5.82)

(*) This item includes investment income (expenses) as well as writedowns and upward adjustments in subsidiaries and associated companies valued by the equity method.