Chrysler 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

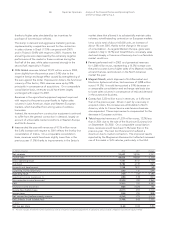

The operating loss reported by companies in the Industrial

Activity segment totaled 1,381 million euros in 2002,

represented a deterioration from the operating loss of 273

million euros incurred in the previous year. This result was due

to the increasingly difficult economic environment, negatively

impacting the volumes and profitability of the automotive

Sectors.

In 2002 the EBIT of Industrial Activities totaled a negative 4,038

million euros, as compared with a positive result of 186 million

euros in 2001.

The severe reduction compared to the previous year is

largely attributable to the rapid and general deterioration

of the economy, whose impact on the operating profitability

of the Automobile Sector was particularly acute. The high

non-operating expenses connected with the major industrial

restructuring initiatives, losses in the book value of numerous

activities, and the divestiture of numerous activities at a loss

and on unfavorable terms further penalized income in this

segment.

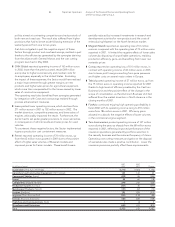

Financial Activities

Companies operating in the Financial Activities segment

generated 3,910 million euros in revenues during 2002,

almost the same as in 2001.

Revenues of the Financial Activities of the Automobile Sector,

which totaled 2,236 million euros (-3.3% compared with 2001),

were impacted by lower vehicle sale volumes and increased

selectivity to improve the quality of contract portfolios.

Financial Activities in the Agricultural and Construction

Equipment Sector generated a total of 680 million euros in

revenues (-20% with respect to 2001), due to the streamlining

of portfolio activities unrelated to Sector business, in addition

to divestiture of European activities as part of the joint venture

with BNP Paribas.

Financial Activities in the Commercial Vehicle Sector had

an increase in revenues, which rose from 787 million euros

in 2001 to 1,005 million euros in 2002 (+27.7%) attributable

to the consolidation of a company that also trades with

dealers outside Europe.

The income before taxes of the normal business of the

Financial Activities (not including the impact of income

or losses posted by intersegment investments in industrial

companies held by financial companies) totaled 192

million euros, compared with 346 million euros in 2001.

The income before taxes of Financial Activities in the

Automobile Sector totaled 285 million euros, almost

unchanged from the 290 million euros generated in 2001.

The financial activities of CNH Global generated a total

of 89 million euros in income before taxes, as compared with

10 million euros in 2001. This improvement in profitability is

aresult of strategies to focus the portfolio on its core business.

Conversely, the pre-tax result of the Financial Activities at

Iveco deteriorated, as it closed the fiscal year with a loss

of 183 million euros, as compared with income before taxes

of 46 million euros in 2001. The decrease was due to higher

non-operating expenses, including 210 million euros for

writing down the book value of Fraikin to its presumed

market value, in accordance with the agreement made

for its sale in the first quarter of 2003.

Insurance Activities

The premiums written by companies operating in the Insurance

Activities segment totaled 4,921 million euros in 2002, 10.4%

lower than in the previous year.

Life insurance premiums declined as a whole, particularly in

the bancassurance channel, partially due to restructuring of

the Capitalia distribution network following its merger with the

Fineco banking group. Consequently, Toro Assicurazioni was

unable to exploit the opportunities offered by growth in this

segment on the Italian market.

Volumes in the casualty business increased in both Italy and

France, virtually in line with market trends, notwithstanding

aselective approach to writing policies.

The income before taxes of Insurance Activities totaled 24

million euros, as compared with 232 million euros in 2001.

The decrease was mainly attributable to writedowns taken

to mark to market the portfolio of listed securities, which

was only partially offset by the growth in operating income

generated by improved performance of the casualty insurance

operations and higher proceeds from sale of real estate.

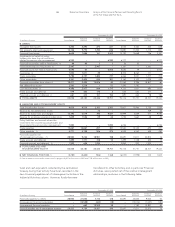

Balance Sheet by Activity Segment

Industrial Activities

Although cash increased by 1,146 million euros with respect

to December 31, 2001, the Financial payables net of

intersegment activities of Industrial Activities decreased by

2,067 million euros. This improvement is largely attributable

to the divestiture of lines of business and investments, capital

increases, and lower requirements for working capital, net of

the effects of operating performance during the period.

Financial Activities

Financial payables net of intersegment activities decreased

by 1,889 million euros, largely as a result of the reduction in

financial receivables and leasing portfolio caused by lower

volumes, the divestiture of certain activities (CNH agreements

with BNP Paribas in Europe and assignment of part of the Sava-

Leasing portfolio), increased securitization of receivables, and

foreign exchange translation effects of the euro, particularly

portfolios denominated in US dollars and the Brazilian real.

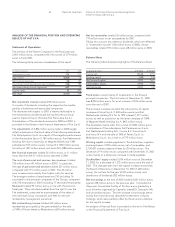

29 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.