Chrysler 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

politics aimed at contrasting competitors and reduce stock of

both new and used cars. The result also suffered from higher

provisions that had to be set aside following extension of the

warranty period from one to two years.

Fiat Auto mitigated in part the negative impact of these

factors through product and overhead savings, realized in part

thanks to the efficiencies generated by the synergies deriving

from the alliance with General Motors and the cost cutting

program launched in May 2002.

❚CNH Global reported operating income of 163 million euros

in 2002, lower than the previous year’s result (209 million

euros) due to higher social security and medical costs for

its employees, especially in the United States. Excluding

the impact of these expenses, the Sector would have realized

a major improvement through greater margins on new

products and higher sales prices for agricultural equipment,

which more than compensated for the losses caused by lower

sales of construction equipment.

The operating result also benefited from synergies generated

by integration with Case and cost savings realized through

process enhancement measures.

❚Iveco posted lower operating income, which declined from

271 million euros in 2001 to 102 million euros in 2002. The

market downturn, competitive pressures, and lower sales of

engines unfavorably impacted the result. Furthermore, the

Sector had to set aside greater provisions to cover warranties

in consequence of vehicle recalls and lower prices for used

vehicles.

To counteract these negative factors, the Sector implemented

rigorous production cost containment measures.

❚Ferrari reported operating income of 70 million euros, up

from the 62 million euros posted in 2001 due to the positive

effect of higher sales volumes of Maserati models and

improved prices for Ferrari models. These benefits were

partially reduced by increased investments in research and

development activities for new products and the costs of

reintroducing Maserati on the North American market.

❚Magneti Marelli reported an operating loss of 16 million

euros as compared with the operating loss of 74 million euros

reported in 2001. It limited the negative effects of lower sales

volumes by disposing of unprofitable operations, realizing

production efficiency gains, and benefiting from lower raw

materials prices.

❚Comau reported an operating loss of 101 million euros, in

contrast with operating income of 60 million euros in 2001,

due to lower profit margins resulting from price pressures

and higher costs on several major orders in Europe.

❚Teksid posted operating income of 27 million euros, up from

the 15 million euros in operating income reported for 2001

thanks to high levels of efficiency realized by the Cast Iron

Business Unit and the positive effect of the change in the

scope of consolidation, as the Aluminum Business Unit had

suffered from the market downturn in North America in the

closing months of 2001.

❚FiatAvio continued enjoying high operating profitability in

fiscal 2002, with its operating income rising to 210 million

euros from 186 million euros in 2001. Efficiency gains

allowed it to absorb the negative effects of lower volumes

in the commercial engine segment.

❚Toro Assicurazioni posted operating income of 147 million

euros during the year, up sharply from the 68 million euros

reported in 2001, reflecting improved performance of the

insurance operations generated by portfolio selection in

the casualty business and the reduced frequency of claims.

Operating cost cutting measures and gains on the disposal

of real estate also made a positive contribution. Lower life

insurance premiums partially offset these improvements.

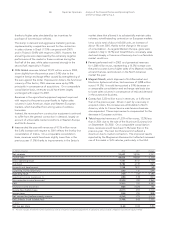

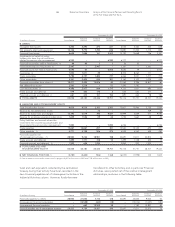

EBIT EBIT

(in millions of euros) 2002 2001 Change

Automobiles (Fiat Auto Holdings) (2,214)(1,061) (1,153)

Agricultural and Construction Equipment (CNH Global) 165 122 43

Commercial Vehicles (Iveco) (409)46(455)

Ferrari 44 62 (18)

Components (Magneti Marelli) (348)208 (556)

Production Systems (Comau) (247)30(277)

Metallurgical Products (Teksid) (137)(67) (70)

Aviation (FiatAvio) 183 495 (312)

Insurance (Toro Assicurazioni) (203)(134) (69)

Services (Business Solutions) (140)608 (748)

Publishing and Communications (Itedi) 1(4) 5

Miscellanea and Eliminations (650)223 (873)

Total (3,955)528 (4,483)