Chrysler 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sales performance

The global market for agricultural equipment expanded by

4.9% compared with 2001, due to strong demand in Western

Europe (+5.3%) and Latin America (+15%). In North America,

the overall market held relatively steady, but demand for

combine harvesters was down sharply.

Sales of agricultural equipment rose by 10.7% compared

with 2001, reflecting strong gains in Brazil and especially

in Asia, where the new Chinese operations made a positive

contribution. In Western Europe, the Sector’s continuing

success with its combine harvesters enabled it to increase its

share of that market, but tractor sales were down due to the

limited availability of new models. In North America, sales of

combine harvesters held steady compared with 2001 despite a

contraction of the overall market. In this market as well, limited

availability of new products had a negative impact, especially

on shipments of high horsepower tractors.

In 2002, demand for construction equipment declined as

weakness in Western Europe (-6.1%) and North America (-9.4%)

was offset only in part by gains in Asia (+7%). Unit sales were

down 8.3% as the net result of a negative trend in Europe and

North America and rising demand in Asia. In this difficult

environment, CNH Global maintained its overall position

in the heavy equipment market.

Growth strategies

In 2002, the Sector continued to implement its integration

plan, focusing on three main areas: industrial restructuring,

purchasing and logistics. The restructuring of the manufacturing

organization and the streamlining of the product platforms,

which were cut from more than 100 to about 60 without

reducing the features that differentiate brand identities, offered

some of the best synergies created by the Case and New

Holland merger. The growing integration that is being realized

in the areas of purchasing, logistics and overhead is expected

to yield additional substantial savings.

Product innovation

In 2002, the Sector continued to introduce new products that

share common platforms. By the end of 2004, Case IH and

New Holland will have adopted new platforms for all of their

vehicle lines.

In 2002, Case IH presented two all-new high horsepower row

crop tractor ranges: the Magnum and the MXM Maxxum.

Joining the Case IH product offering were a new self-propelled

forage harvester, a new range of utility tractors and substantial

additions to its growing line of hay tools.

New Holland presented its new TG range, which became

available in early 2003, and launched a new, expanded TM

medium-high horsepower row crop tractor range. Also

introduced was the new CR range of rotary combines,

expanding the innovative styling and features that earned the

CX conventional combine the 2002 Industrial Design Excellence

Gold Award as well as the European Combine of the Year

Award. New round balers in Europe and North America, a

new range of utility combines, upgrades to the existing forage

harvester lines, and a significant expansion of the medium

and utility tractor ranges in Latin America completed the

New Holland offering.

In January 2002, CNH finalized its agreements with Kobelco

Construction Machinery Co. Ltd. (“Kobelco Japan”) and Kobe

46 Report on Operations

Agricultural and Construction Equipment — CNH Global

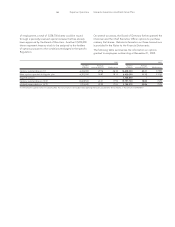

(in millions of euros)

2002

2001 2000

Net revenues 10,513 10,777 10,770

Operating result 163 209 45

EBIT 165 122 (436)

Net result before

minority interest (211)(291) (754)

Cash flow 330 262 (192)

Capital expenditures 431 615 447

Research and development 300 341 366

Net invested capital 5,140 6,597 6,932

Number of employees 28,528 28,127 31,033

Highlights

Revenues by geographical

region of destination

Italy Rest of Europe Rest of the world

Employees by geographical

region

050% 100%