Chrysler 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

Property, Plant and Equipment

Property, plant and equipment totaled 12,106 million euros

(13,887 million euros at the end of 2001). The decrease (-1,781

million euros) principally reflects the effect of changes in both

exchange rates and the scope of consolidation (sale of Magneti

Marelli’s Electronic Systems activities and Teksid’s Aluminum

Business Unit), disposal of real estate and writedowns during

the fiscal year.

In 2002, overall investments in fixed assets totaled 2,771 million

euros (3,438 million euros in 2001), including 844 million euros

(1,124 million euros in 2001) for investments in long-term

leases.

Depreciation of property, plant, and equipment totaled 2,019

million euros (2,287 million euros in 2001).

At the end of December 2002, accumulated depreciation and

writedowns totaled 18,223 million euros, corresponding to 60%

of gross fixed assets, compared with approximately 57% at the

end of 2001.

Financial Fixed Assets

Financial fixed assets totaled 6,638 million euros, compared

with 10,190 million euros at the end of 2001, reflecting a

significant 3,552 million euro decrease that was mainly due to

the divestiture of investments (General Motors, a 14% interest

in Italenergia Bis, and other minor investments), as well as the

effect of net losses posted at certain companies carried at

equity and losses in value for companies valued at cost.

Financial Assets not Held as Fixed Assets

Financial assets not held as fixed assets totaled 6,094 million

euros, which represents an increase of 474 million euros from

the 5,620 million euros reported at the end of 2001 as a result

of higher investments made by the insurance companies to

cover their policy liabilities and accruals, net of writedowns

taken to mark to market securities.

Net Deferred Tax Assets

Net deferred tax assets totaled 2,263 million euros,

up from 1,595 million euros at the end of 2001. This net

increase is largely due to the recording of deferred tax

assets to account for tax losses whose recovery is considered

reasonably certain.

Stockholders’ Equity

Consolidated stockholders’ equity totaled 8,679 million

euros (13,607 million euros at the end of 2001). The decrease

reflects the net loss, payment of dividends for fiscal 2001,

and the reduction resulting from changes in exchange rates (in

consequence of devaluation of the Brazilian real and appreciation

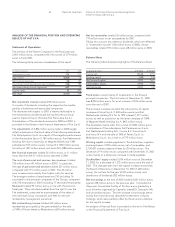

Net financial expenses totaled 862 million euros in 2002,

showing an improvement from the 1,025 million euros in 2001,

mainly due to lower interest rates on the principal capital

markets, which were partially offset by higher corporate spread.

The net income tax effect for the year was a credit of 554

million euros, up from a liability of 294 million euros in 2001.

The income taxes due for fiscal 2002 include: 141 million

euros (156 million euros in 2001) for IRAP, the regional tax

on production activities in Italy; 192 million euros (652 million

euros in 2001) for other current taxes; and 887 million euros in

deferred tax assets (against a positive 514 million euros in 2001).

The potential future benefits resulting from the loss for the fiscal

year were not accrued unless there was a reasonable certainty

that they would be recovered. Nevertheless, total deferred tax

assets completely offset tax liability recorded in the period.

The consolidated net loss before minority interest was 4,263

million euros, compared with a loss of 791 million euros in 2001.

The Group’s interest in net loss was 3,948 million euros (loss

of 445 million euros in 2001).

As a result of the Group’s interest in net loss, there was a net

loss per share of 6.66 euros, compared with a net loss of 0.841

euros per share in 2001.

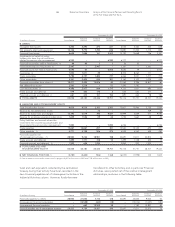

Balance sheet

The financial position shows items on both the assets and

liabilities side. Nevertheless, the following pages provide the

information necessary for correlation with the principal items

of the schemes used in previous years, such as working capital

and net invested capital.

As illustrated in the Notes to the Consolidated Financial

Statements, the investments managed by the insurance

companies on behalf of insured policyholders who bear the

relative risk and that have a balancing entry substantially for the

same amount in the insurance policy liabilities and accruals are

posted at a specific item. In previous years, these investments

were classified according to their nature and thus posted at

various items under fixed assets, which were correspondingly

reclassified without however impacting net invested capital

and the net financial position.

For a more complete analysis of those items, please see

the Notes to the Consolidated Financial Statements.

Intangible Fixed Assets

Intangible fixed assets (start-up and expansion costs, goodwill,

construction in progress and others) amount to 5,200 million

euros, 1,335 million euros less than the 6,535 million euros

reported at the end of 2001, mainly on account of the reduction

in value of goodwill due to changes in foreign exchange rates

and writedowns.