Chrysler 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

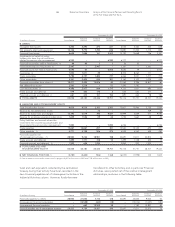

27 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

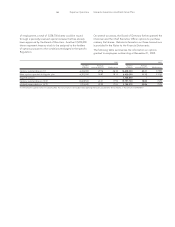

Consolidated Statement of cash flows

(in millions of euros) 2002 2001 2000

A)Cash at January 1 2,133 1,997 1,906

B)Cash flows provided by (used in) operating activities:

Net result before minority interest (4,263)(791) 578

Amortization and depreciation 2,614 2,880 3,052

Change in reserve for employee severance indemnities (70)(77) (56)

Change in deferred income taxes (884)(588) (289)

Gains on disposals 124 (1,749) (2,753)

Revaluations and writedowns of equity investments 525 372 73

Impairment 991 ––

Change in current assets and liabilities:

Trade receivables 423 583 572

Net inventories 1,325 (164) (973)

Trade payables (104)1,605 492

Other payables, receivables, accruals and deferrals (1) 184 609 1,040

Reserve for income taxes and other reserves 545 (413) 1,046

Changes in the scope of consolidation and others (357)168 (808)

Total 1,053 2,435 1,974

C)Total cash flows provided by (used in) investment activities:

Investiments in:

Fixed assets (2,771)(3,438) (3,236)

Investments (563)(1,524) (4,347)

Intangible assets and deferred charges (518)(473) (521)

Investment grants 90 100 135

Proceeds from the sale of fixed assets 3,231 2,652 1,601

Change in financial receivables 2,456 (189) (1,816)

Change in securities (175)(15) 159

Change in securities of insurance companies

net of policy liabilities and accruals 430 (97) (254)

Other (including effects of acquisitions and

other changes in the scope of consolidation) (84)(33) (260)

Total 2,096 (3,017) (8,539)

D)Total cash flows provided by (used in)financing activities:

Increase in borrowings 12,047 8,561 8,307

Repayment of borrowings (9,392)(6,057) (4,161)

Change in short-term borrowings (5,358)(1,140) 349

Increase in capital stock (2) 1,215 –2,603

Purchase of treasury stock (77)(266) (30)

Dividends paid (228)(380) (412)

Total (1,793)718 6,656

E)Total change in cash 1,356 136 91

F)Cash at December 31 3,489 2,133 1,997

(1) In 2002, this does not include payment of the balance of assets and liabilities contributed by Fiat Auto to the Fiat-GM Powertrain joint venture, which was posted at the item “Change in

the scope of consolidation and others.”

(2) In 2000 this represented acquisition of a 20% interest in Fiat Auto Holdings B.V. by General Motors.