Chrysler 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

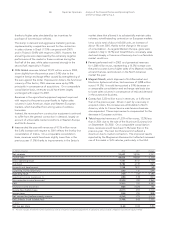

24 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

of the euro against the dollar), which was only partially offset by

the capital increases (at Fiat S.p.A. and CNH Global N.V.). The

Group’s interest in stockholders’ equity totaled 7,641 million euros,

compared with 12,170 million euros in the previous fiscal year.

Reserves and Allowances

Reserves and allowances totaled 16,999 million euros.

They included policy liabilities and accruals of the insurance

companies for 9,605 million euros, income tax (199 million

euros), warranty (841 million euros), restructuring (731 million

euros), pensions and similar obligations (1,459 million euros),

employee severance indemnities for employees in Italy (1,609

million euros), and other risks and charges (2,555 million euros).

The 265 million euro increase with respect to the 16,734 million

euros reported at the end of 2001 was caused by the increase

in contract, commercial, and litigation risk reserves.

Working Capital

The Group’s working capital decreased by 1,381 million euros

to a negative 2,773 million euros, down from the negative

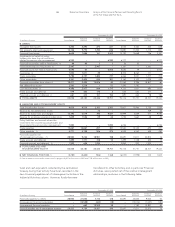

(in millions of euros)

December 31, 2002 December 31, 2001 Change

❚ASSETS

Intangible fixed assets 5,200 6,535 (1,335)

Property, plant and equipment 12,106 13,887 (1,781)

Financial fixed assets 6,638 10,190 (3,552)

Investments on behalf of policy holders who bear the risk

and those related to pension plan management 6,930 6,177 753

Financial receivables held as fixed assets (*) 48 56 (8)

Financial leasing of Group assets (*) 2,947 3,367 (420)

Financial assets not held as fixed assets 6,094 5,620 474

Inventories (1) 7,050 8,375 (1,325)

Trade receivables 5,784 6,466 (682)

Other receivables 3,351 3,162 189

Financial receivables (*) 18,411 21,263 (2,852)

Net deferred tax assets 2,263 1,595 668

Cash and securities (*) 4,996 4,133 863

Trade accruals and deferrals 579 653 (74)

Financial accruals and deferrals (*) 661 697 (36)

❚TOTAL ASSETS 83,058 92,176 (9,118)

❚LIABILITIES AND STOCKHOLDERS’ EQUITY

Total Stockholders’ Equity 8,679 13,607 (4,928)

Reserve for future risks and charges 15,390 14,999 391

Reserve for employee severance indemnities 1,609 1,735 (126)

Policy liabilities and accruals where the investment risk is borne by

policyholders and those related to pension plan management 7,000 6,236 764

Trade payables 13,267 13,520 (253)

Other payables (1) 4,771 5,029 (258)

Financial payables (*) 28,923 32,697 (3,774)

Trade accruals and deferrals 1,499 1,499 –

Financial accruals and deferrals (*) 1,920 2,854 (934)

❚TOTAL LIABILITIES

AND STOCKHOLDERS’ EQUITY 83,058 92,176 (9,118)

❚NET FINANCIAL POSITION (*) (3,780) (6,035) 2,255

(1) Net of advances received for contract work in progress (8,227 million euros in 2002 and 7,135 million euros in 2001)