Chrysler 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

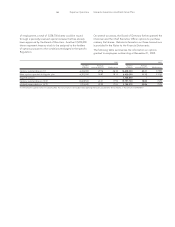

Cash and cash equivalent collected by the centralized

treasury during their activity have been recorded in the

item Financial payables net of intersegment activities in the

Industrial Activities column. However, funds that were

30 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

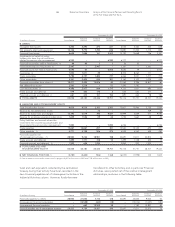

December 31, 2002 December 31, 2001

Industrial Financial Insurance Industrial Financial Insurance

(in millions of euros) Consolidated Activities Activities Activities Consolidated Activities Activities Activities

Financial payables to others 28,923 21,630 7,115 178 32,697 23,645 9,000 52

(Intersegment financial receivables) –(12,548) (643) (18) –(13,016) (1,027) (120)

Intersegment financial payables –662 12,509 38 –1,182 12,897 84

Financial payables net of intersegment activities

28,923 9,744 18,981 198 32,697 11,811 20,870 16

December 31, 2002 December 31, 2001

Industrial Financial Insurance Industrial Financial Insurance

(in millions of euros) Consolidated Activities Activities Activities Consolidated Activities Activities Activities

❚ASSETS

Intangible fixed assets 5,200 4,295 274 631 6,535 5,332 545 658

Net property, plant and equipment 12,106 9,770 1,700 636 13,887 11,352 1,714 821

Financial fixed assets 6,638 7,886 161 3,043 10,190 12,668 146 3,341

Investments on behalf of policy

holders who bear the risk and those

related to pension plan management 6,930 – – 6,930 6,177 – – 6,177

Financial receivables held as fixed assets (*) 48 46 1 1 56 55 – 1

Financial leasing of Group assets (*) 2,947 – 2,947 – 3,367 – 3,367 –

Financial assets not held as fixed assets 6,094 45 – 6,054 5,620 79 – 5,541

Inventories (1) 7,050 7,011 39 – 8,375 8,264 111 –

Trade receivables 5,784 4,157 1,482 737 6,466 5,031 1,417 703

Other receivables 3,351 2,405 835 301 3,162 2,102 1,025 242

Financial receivables from others (*) 18,411 2,495 15,876 40 21,263 2,396 18,807 60

Net deferred tax assets 2,263 2,278 – 57 1,595 1,750 – –

Cash and securities (*)4,996 2,977 844 1,175 4,133 1,831 680 1,622

Trade accruals and deferrals 579 405 176 2 653 434 217 2

Financial accruals and deferrals (*) 661 410 101 150 697 463 78 156

❚TOTAL ASSETS 83,058 44,180 24,436 19,757 92,176 51,757 28,107 19,324

❚LIABILITIES AND STOCKHOLDERS’ EQUITY

Total Stockholders’ Equity 8,679 8,519 2,183 2,262 13,607 13,466 3,130 2,839

Reserve for net deferred tax assets ––72 – ––109 46

Reserve for future risks and charges 15,390 5,519 396 9,647 14,999 5,069 471 9,596

Reserve for employee severance indemnities 1,609 1,536 29 44 1,735 1,664 28 43

Policy liabilities and accruals where the

investment risk is borne by policyholders and

those related to pension plan management 7,000 – – 7,000 6,236 – – 6,236

Trade payables 13,267 12,867 657 321 13,520 13,125 690 247

Other payables (1) 4,771 4,198 506 275 5,029 4,552 545 282

Financial payables net

of intersegment activities (*) 28,923 9,744 18,981 198 32,697 11,811 20,870 16

Trade accruals and deferrals 1,499 1,171 318 10 1,499 1,138 342 19

Financial accruals and deferrals (*) 1,920 626 1,294 – 2,854 932 1,922 –

❚TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY 83,058 44,180 24,436 19,757 92,176 51,757 28,107 19,324

❚NET FINANCIAL POSITION (*) (3,780) (4,442) (506) 1,168 (6,035) (7,998) 140 1,823

(1) Net of advances received for contract work in progress (8,227 million euros in 2002 and 7,135 million euros in 2001).

transferred to other Activities, and in particular Financial

Activities, were posted net of the relative intersegment

relationships, as shown in the following table: