Chrysler 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

❚Business Solutions had operating income of 67 million euros

in 2002. The decrease from the 73 million euros reported

in the previous year stemmed from the combined effect of

reduction of the scope of consolidation (the 2001 figure

included the first half-year results of Fenice, which was

subsequently sold as part of the Italenergia transaction)

and lower prices caused by partial transfer of efficiency gains

to customers, which were partially offset by improvements

realized in the property management area.

❚Itedi reported operating income of 3 million euros in 2002,

against an operating loss of 2 million euros in the previous

year. This improvement largely reflected implementation

of product cost efficiency measures and higher sales prices

for the newspaper.

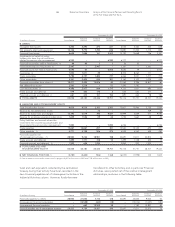

EBIT (Earnings Before Interest and Taxes)

Group EBIT totaled a negative 3,955 million euros (against a

positive 528 million euros in 2001). The severe worsening of

this result with respect to the previous year is largely attributable

to the rapid and generalized deterioration in the economic

conditions under which the Fiat Group operates, provoking an

especially severe downward spiral. Operating income was the

first area to suffer, declining sharply: the Automobile Sector,

which is exposed to the greatest competitive pressures, was

particularly hard hit.

The Fiat Group consequently launched several major industrial

restructuring initiatives, with the related extraordinary charges

further impacting the net result.

At the same time, it was necessary to acknowledge the loss

in value of numerous industrial and financial activities, which

were also impacted by the weakening economy.

Finally, in order to protect the assets and financial structure

of the Group, it was necessary to divest certain activities at

aloss and on unfavorable terms.

EBIT not only reflected the previously described deterioration

in operating income but was also influenced by the following

items:

Net investment expenses totaled 690 million euros, compared

with expenses of 149 million euros in 2001, reflecting higher

writedowns taken to mark to market the portfolio of listed

securities held by the Group’s insurance companies and the

negative results of certain companies valuated by the equity

method, particularly Italenergia Bis. The result of Italenergia

Bis affected the entire fiscal year in 2002, while the impact of

Italenergia S.p.A. (before contribution) was limited to the last

quarter of 2001.

The balance of non-operating income and expenses for 2002

was a negative 2,503 million euros, against a positive balance of

359 million euros in 2001. This item is broken down as follows:

❚A negative balance of 502 million euros for disposals,

reflecting the loss of 1,049 million euros upon sale of the

investment in General Motors at market prices, losses and

expenses incurred upon sale of the Teksid Aluminum Business

Unit (100 million euros) and the Electronic Systems Business

Unit of Magneti Marelli (150 million euros). These losses were

partially offset by the proceeds realized mainly from the sale

of 34% of Ferrari (671 million euros net of transaction costs),

14% of Italenergia Bis (189 million euros), Magneti Marelli’s

AfterMarket operations (26 million euros), the investment

in Europ Assistance (83 million euros) and other minor

investments with total net proceeds of 38 million euros.

Furthermore, following the preliminary agreements reached

during December 2002 for the sale of Fraikin and conclusion

of the relative contract of sale in the first quarter of 2003, the

book value of Iveco’s Fraikin operations was written down to

its presumed market value, resulting in total expenses for

Iveco of 210 million euros.

❚Restructuring expenses of 1,026 million euros, largely

connected with the industrial restructuring plan for Fiat Auto

and its effects on other Group Sectors. These expenses are

represented by the costs incurred or determined according

to plans for personnel laid off with long-term unemployment

benefits, severance incentives, and writedown of property,

plant and equipment and intangible fixed assets according

to new forecasts of their expected use by the Sectors during

restructuring. The foregoing amount includes approximately

550 million euros in expenses sustained by Fiat Auto and

by other component Sectors, especially Magneti Marelli

(approximately 320 million euros).

❚Other writedowns of assets to reflect the changed market

outlook and consequent new business plans, for a total of 311

million euros. This amount includes the writedown by Comau

of Pico’s goodwill, of several Magneti Marelli businesses, and

Iveco and Teksid assets. It also includes provisions for future

risks and charges for permanent loss in value of investments

in the telecommunications field (95 million euros).

❚Extraordinary provisions to reserves for future risks and

charges, other expenses and prior period expenses, net

of other extraordinary income and prior period income,

for 585 million euros.

❚Prior period tax liabilities for 79 million euros, 56 million

euros of which for charges assessed under the tax amnesty.

In 2001 the balance of non-operating items included the

proceeds realized upon sale of the Magneti Marelli Climate

Control Division, the residual 49% of Alstom Ferroviaria, the ITS

and GSA operations, and the operations of Fenice and certain

power plants as part of the transaction leading to the formation

of Italenergia, net of costs incurred for industrial streamlining

and restructuring.

Result for the Fiscal Year

The Group’s loss before taxes was 4,817 million euros (against

aloss of 497 million euros in 2001). The increased loss with

respect to the previous year stemmed from the previously

mentioned reduction in EBIT, while the impact of Group

financial expenses decreased.