Chrysler 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

ANALYSIS OF THE FINANCIAL POSITION AND OPERATING

RESULTS OF FIAT S.P.A.

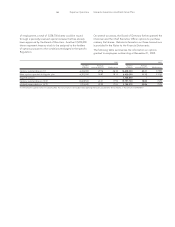

Statement of Operations

The net loss of the Parent Company for the fiscal year was

2,053 million euros, compared with net income of 379 million

euros in fiscal 2001.

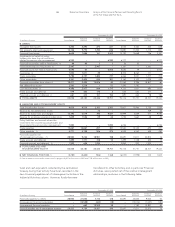

The following table contains a breakdown of this result:

(in millions of euros) 2002 2001

Investment income 278 713

Adjustments (2,866)(4)

Net financial expenses (26)(37)

Cost of personnel and services, less revenues (126)(95)

Net extraordinary income (expenses) 632 (1)

Income taxes 55 (197)

Net result (2,053)379

Net investment income totaled 278 million euros.

It consists of dividends, including the respective tax credits,

paid by subsidiaries and associated companies.

The decrease with respect to 2001 is mainly attributable to

the extraordinary dividend paid during the previous fiscal

year by Soparind S.p.A. (formerly Fiat Ferroviaria S.p.A.).

A breakdown of the dividends received in 2002 and 2001 is

provided in the Notes to the Financial Statements of Fiat S.p.A.

The adjustments of 2,866 million euros made in 2002 largely

reflect writedowns in the book value of the following subsidiaries:

Fiat Partecipazioni S.p.A. as a result of the negative performance

of the Automobile Sector (1,189 million euros), Fiat Netherlands

Holding N.V. due to losses by its Magneti Marelli and CNH

subsidiaries (732 million euros), Comau B.V. (350 million euros),

Sicind S.p.A. (291 million euros), and Iveco N.V. (280 million euros).

Net financial expenses totaled 26 million euros, or 11 million

euros less than the 37 million euros reported in 2001.

The cost of personnel and services,less revenues, totaled

126 million euros (95 million euros in 2001). In particular,

the cost of personnel and services totaled 221 million euros,

compared with 191 million euros in 2001. The 30 million

euro increase stems mainly from higher costs for services.

The average number of employees was 210 (including 16

seconded to the principal companies of the Group), compared

with 216 employees in 2001 (including 17 seconded employees).

Revenues totaled 95 million euros, in line with the previous

fiscal year. They included royalties from the right to use the

Fiat trademark, computed as a percentage of the sales of

the individual Group companies, and fees for services

rendered by management personnel.

Net extraordinary income totaled 632 million euros,

represented principally by the gain realized on the sale

of 34% of Ferrari shares to Mediobanca (630 million euros).

Net tax receivables totaled 55 million euros, compared with

197 million euros in net tax payables for 2001.

Taking into account tax credits on dividends, which are reflected

in “Investment income” (100 million euros in 2002), net tax

receivables totaled 155 million euros (48 million euros in 2001).

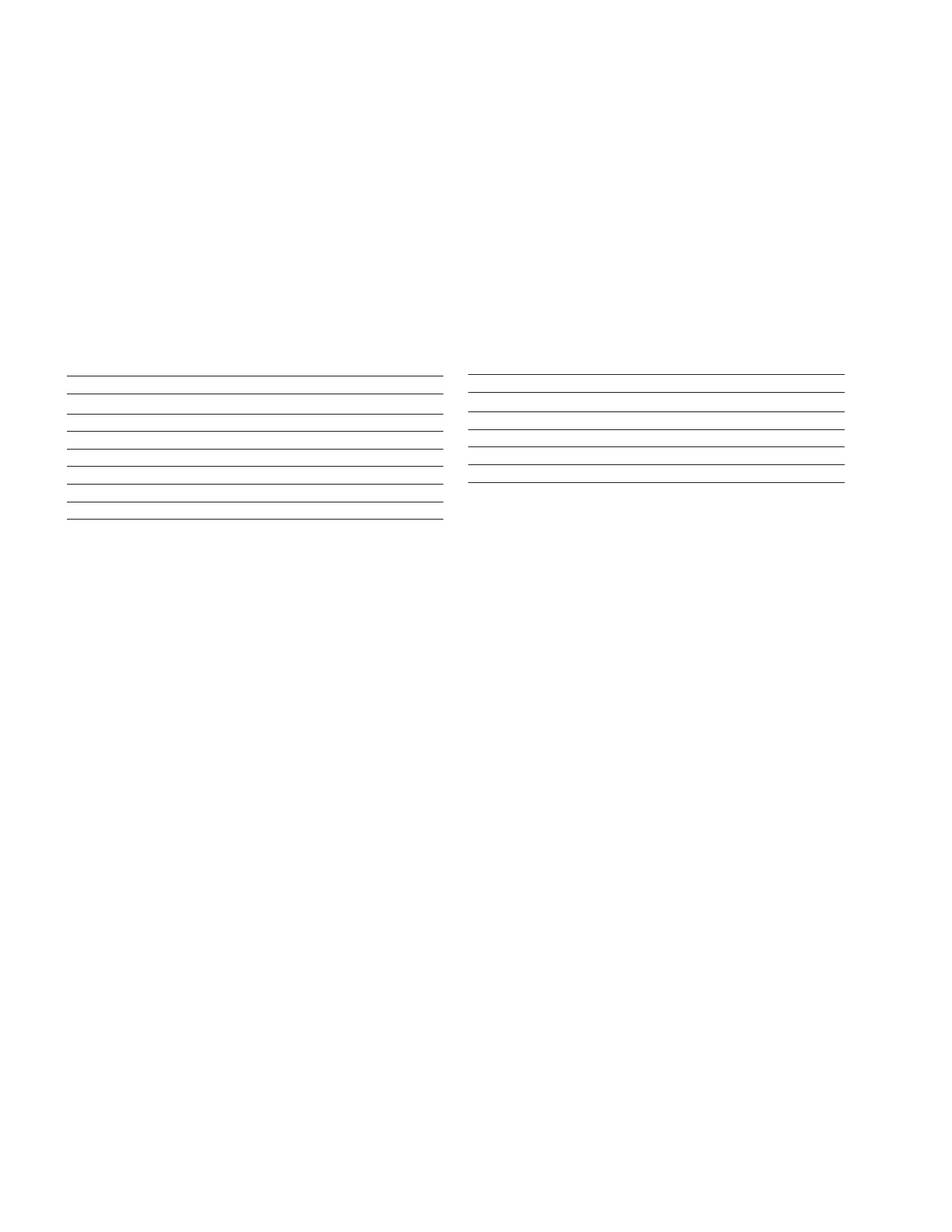

Balance Sheet

The following table illustrates highlights of the Balance Sheet:

(in millions of euros) 12/31/2002 12/31/2001

Fixed assets 8,144 7,757

Working capital (169)(150)

Net invested capital 7,975 7,607

Stockholders’ equity 5,934 7,169

Net borrowings 2,041 438

Fixed assets consist mainly of investments in the Group’s

principal companies. The total value at December 31, 2002

was 8,050 million euros, for a net increase of 344 million euros

since the end of 2001.

The principal increases involved the subscription of capital

increases at Sicind S.p.A. (1,400 million euros) and Fiat

Netherlands Holding N.V. for its 74% interest (1,017 million

euros), as well as acquisition by the latter company of 100%

of Magneti Marelli Holding S.p.A. (803 million euros).

The decreases mainly stem from a total of 2,846 million euros

in writedowns of the subsidiaries Fiat Partecipazioni S.p.A.,

Fiat Netherlands Holding N.V., Comau B.V., Sicind S.p.A.

and Iveco N.V. and the sale of 34% of Ferrari S.p.A. to

Mediobanca S.p.A., for a cash-in of 775 million euros.

Working capital includes payables to Tax Authorities, suppliers,

and employees of 189 million euros, net of receivables, and

2,330,420 ordinary treasury shares for 20 million euros. The

decrease of 19 million euros compared with December 31, 2001

is due mainly to a temporary increase in trade payables.

Stockholders’ equity totaled 5,934 million euros at December

31, 2002, for a decrease of 1,235 million euros since the end of

2001. The changes stem from the capital increase resolved by

the Board of Directors on December 10, 2001 (1,020 million

euros), the net loss for the year (2,053 million euros), and

distribution of dividends (202 million euros).

Net borrowings at the end of 2002 totaled 2,041 million euros,

against 438 million euros in the previous year. It includes the

three-year Convertible Facility of 3 billion euros granted by a

pool of banks organized by Capitalia, IntesaBCI, Sanpaolo IMI,

and Unicredito Italiano. The net increase in borrowings stems

mainly from the previously described investments in equity

holdings, which were partially offset by the amounts collected

for the capital increase.

An analysis of financial flows is provided at the end of the Notes

to the Financial Statements of Fiat S.p.A.