Chrysler 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

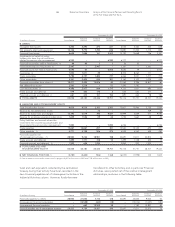

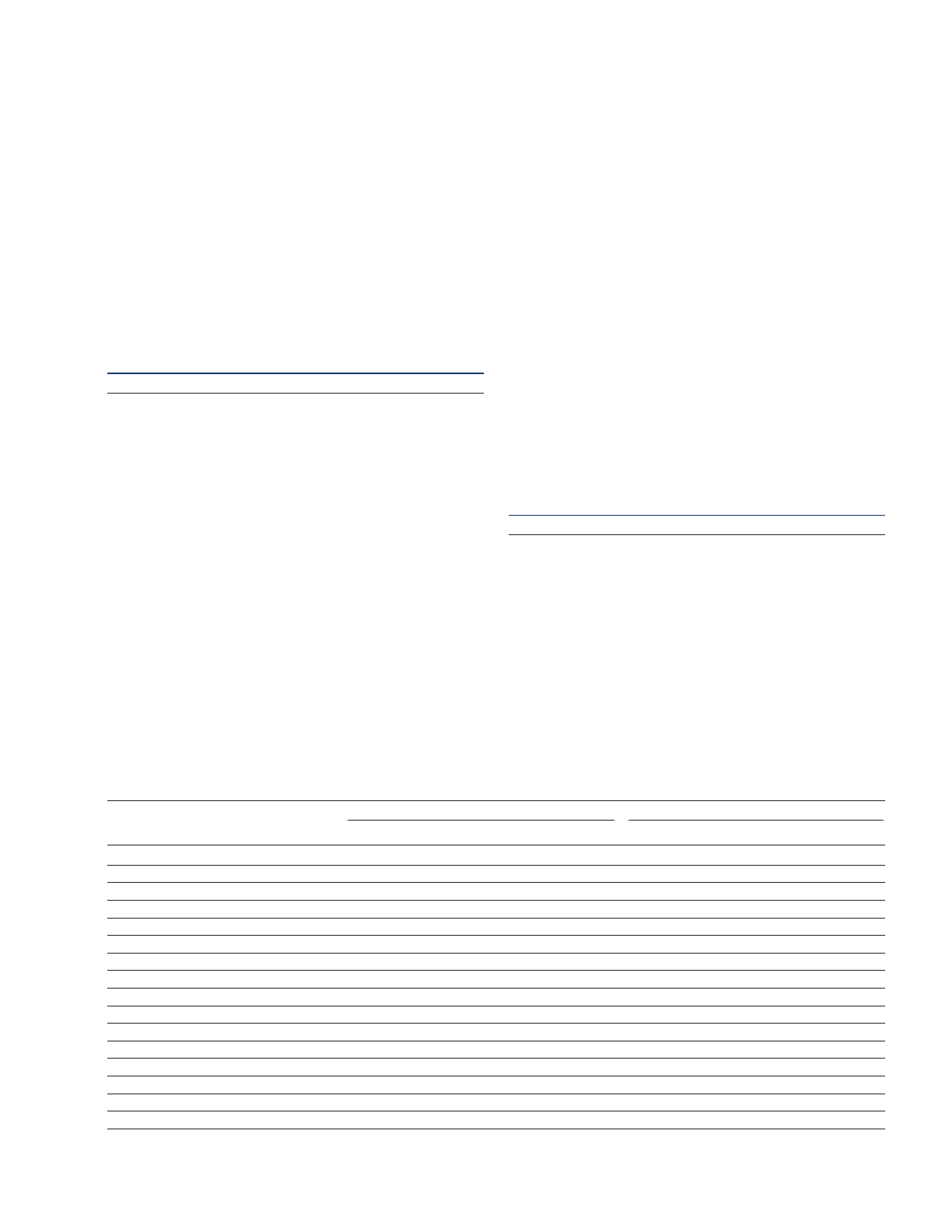

2002 2001

Industrial Financial Insurance Industrial Financial Insurance

(in millions of euros) Consolidated Activities Activities Activities Consolidated Activities Activities Activities

Net revenues 55,649 48,149 3,910 4,921 58,006 49,892 3,946 5,491

Cost of sales 48,619 42,398 3,024 4,528 49,854 43,246 2,774 5,157

Gross operating result 7,030 5,751 886 393 8,152 6,646 1,172 334

Overhead 5,782 4,868 594 320 6,149 5,121 688 340

Research and development 1,748 1,748 – – 1,817 1,817 – –

Operating income (expenses) (262)(516)184 70 132 19 40 73

Operating result (762)(1,381)476 143 318 (273) 524 67

Investment income (expenses) (*) (690)(338)3(355)(149) 4 43 (196)

Non-operating income (expenses) (2,503)(2,319)(194)10 359 455 (89) (7)

EBIT (3,955)(4,038)285 (202)528 186 478 (136)

Financial income (expenses) (862)(995)(93)226 (1,025) (1,261) (132) 368

Income (loss) before taxes (4,817)(5,033)192 24 (497) (1,075) 346 232

Income taxes (554)(669)109 6 294 97 126 71

Net result of normal operations (4,263)(4,364)83 18 (791) (1,172) 220 161

Result of intersegment investments –95(286)(14)–398 32 2

Net income (loss) before minority interest (4,263)(4,269)(203)4(791) (774) 252 163

(*) Includes investment income and writedowns and revaluations to align non-intersegment investments valued at equity.

Financial position and operating results by activity segment

For the first time, financial and operating figures are classified

according to Industrial, Financial and Insurance activities of the

Group in order to present a clearer picture of its performance.

Financial activities include the Fiat Auto, CNH, and Iveco

companies that operate financing, leasing, and rental activities,

while Insurance activities include Toro Assicurazioni Group and

Neptunia Assicurazioni Marittime S.A.

Principles of Analysis

The aforesaid classification was realized by defining specific

sub-consolidated financial statements for the three activity

segments according to the normal business performed by

each Group company.

The equity investments held by companies belonging to an

activity segment in companies included in another segment

were valued according to the equity method.

To avoid skewing the operating result of normal operations

to be represented here, the effect of this valuation on the

statement of operations is illustrated at a special item,

“Result of intersegment investments.”

The holding companies (Fiat S.p.A., Sicind S.p.A, IHF -International

Holding Fiat S.A., Fiat Partecipazioni S.p.A., Fiat Netherlands

Holding N.V) were classified in the Industrial Activity segment.

The Industrial Activity segment also includes companies that

operate centralized cash management activities, i.e. that raise

financial resources on the market and finance Group companies,

without providing financial services to others.

When the sub-consolidated figures for the various segments

were elaborated, the relative goodwill was allocated to the

activities themselves. Note that the goodwill connected with

the acquisition of and the tender offer for Toro Assicurazioni,

which was reported under holding companies in previous years,

is now allocated to Insurance Activities. Therefore, the 2001

figures have been reclassified accordingly.

The factoring transactions executed at market conditions

between the industrial and financial companies of the Group

are posted as financial receivables and payables under Financial

Activities. The portion of these items that, according to the last

contractual relationship established with others, is still of a

commercial nature, insofar as it does not yield interest, was

reclassified directly in the sub-consolidated results of Financial

Activities under trade receivables and payables.

Operating Performance by Activity Segment

Industrial Activities

The net revenues for Industrial Activities, including changes

in contract work in progress, totaled 48,149 million euros, for

adecrease of 3.5% with respect to the previous year, due to

the market slowdown that impacted the automotive sector,

while the reduction caused by the divestiture of business lines

at Magneti Marelli and Teksid was offset by the consolidation

of Kobelco America by CNH Global and the line-by-line

consolidation of Irisbus by Iveco.

28 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.