Chrysler 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

❚FiatAvio had revenues of 1,534 million euros in 2002.

The 6.2% decrease with respect to 2001 is attributable to the

lower volumes in the commercial segment which, beginning

from the second half of the year, suffered from the crisis in

the world commercial aircraft market. Furthermore, deliveries

of turbines derived from aircraft engines, used in industrial

applications, suffered the effects of lower demand in the

United States. Revenues from government programs

continued to grow thanks to sales of engines for the new

European fighter aircraft.

❚Toro Assicurazioni generated 4,916 million euros in

premium revenues during 2002, 10% less than in the previous

year due to a decline in life insurance premiums, largely in

the bancassurance channel. The Sector was unable to fully

exploit the opportunities offered by growth in the domestic

market due to ongoing restructuring of the Capitalia (formerly

Banca di Roma) distribution network following its integration

with the Fineco (formerly Bipop-Carire) banking group.

Premiums earned in casualty insurance were up both in Italy

and in France, virtually in line with the growth rates of the

respective markets.

❚Business Solutions posted revenues of 1,965 million euros,

for an 8.9% increase compared with the previous year. This

improvement was realized through development of business

for non-captive customers, whose proportion of total revenues

climbed to 51%. The increases were concentrated in the

areas of information technology, where the Sector provides

services through Global Value, a joint venture with IBM, and

expansion of its temporary employment agency services,

thanks in part to the acquisition of a company already

operating in this sector.

❚Itedi reported revenues of 360 million euros. The 3.7%

gain over fiscal 2001 is due to an increase in the price

charged for newspapers and new publishing ventures

that compensated for lower newspaper sales volumes.

Improvement also derived from higher advertising revenues in

some sectors, notwithstanding contraction in the advertising

market as a whole.

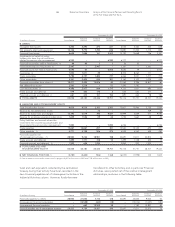

Operating Result

In 2002, the Fiat Group posted an operating loss of 762

million euros, compared with operating income of 318 million

euros in the previous year. The market downturn and intense

competition, with consequent pressure on prices, impacted the

profitability of the automotive Sectors, contributing in particular

to the loss reported by Fiat Auto. Certain Sectors were also

compelled to set aside greater provisions in operating reserves,

due in part to stiffer market conditions, such as extension of

vehicle warranties and lower prices for used cars.

The major commitment to realization of cost savings, including

the contribution of industrial synergies at CNH and Fiat Auto,

continued generating positive results.

During 2002, research and development outlays, which are

charged directly to income and thus included in the operating

result, totaled 1,748 million euros, or 69 million euros less than

in 2001. This decrease is mainly attributable to the change

in the scope of consolidation and the impact of variations

in foreign exchange translation rates. Fiat Auto confirmed

its commitment to renew its product line by maintaining its

spending on research and development at last year’s levels,

while Ferrari increased the resources it dedicates to

innovation.

The operating result broken down by Sector is illustrated as

follows:

❚Fiat Auto reported an operating loss of 1,343 million euros

in 2002, as compared with a loss of 549 million euros in 2001.

The principal reason for deterioration in this result is the

contraction of sales volumes, and more aggressive discount

20 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A.

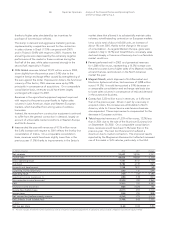

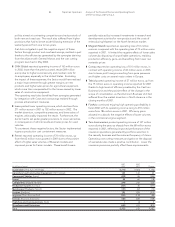

Revenues Revenues

(in millions of euros) 2002 2001 Change

Automobiles (Fiat Auto Holdings) 22,147 24,440 (2,293)

Agricultural and Construction Equipment (CNH Global) 10,513 10,777 (264)

Commercial Vehicles (Iveco) 9,136 8,650 486

Ferrari 1,208 1,058 150

Components (Magneti Marelli) 3,288 4,073 (785)

Production Systems (Comau) 2,320 2,218 102

Metallurgical Products (Teksid) 1,539 1,752 (213)

Aviation (FiatAvio) 1,534 1,636 (102)

Insurance (Toro Assicurazioni) 4,916 5,461 (545)

Services (Business Solutions) 1,965 1,805 160

Publishing and Communications (Itedi) 360 347 13

Miscellanea and Eliminations (3,277)(4,211) 934

Total 55,649 58,006 (2,357)