CarMax 2001 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(D) RESTRICTED STOCK: The Company has issued restricted

stock under the provisions of the 1994 Stock Incentive Plan

whereby management and key employees are granted restricted

shares of CarMax Group Common Stock. Shares are awarded in

the name of the employee, who has all the rights of a share-

holder, subject to certain restrictions or forfeitures. Restrictions

on the awards generally expire four to five years from the date of

grant. The market value at the date of grant of these shares has

been recorded as unearned compensation and is a component of

Group equity. Unearned compensation is expensed over the

restriction periods. In fiscal 2001, a total of $153,500 was

charged to operations ($447,200 in fiscal 2000 and $426,600 in

fiscal 1999). As of February 28, 2001, 56,667 restricted shares

were outstanding.

(E) EMPLOYEE STOCK PURCHASE PLAN: The Company has

Employee Stock Purchase Plans for all employees meeting certain

eligibility criteria. The CarMax Group Plan allows eligible employ-

ees to purchase shares of CarMax Group Common Stock, subject

to certain limitations. For each $1.00 contributed by employees

under the Plan, the Company matches $0.15. Purchases are limited

to 10 percent of an employee’s eligible compensation, up to a

maximum of $7,500 per year. At February 28, 2001, a total of

581,599 shares remained available under the CarMax Group Plan.

During fiscal 2001, 477,094 shares were issued to or purchased on

the open market on behalf of employees (580,000 in fiscal 2000

and 268,532 in fiscal 1999). The average price per share purchased

under the Plan was $4.18 in fiscal 2001, $3.68 in fiscal 2000 and

$7.56 in fiscal 1999. The Company match or purchase price dis-

count for the CarMax Group totaled $247,000 in fiscal 2001,

$221,500 in fiscal 2000 and $268,100 in fiscal 1999.

(F) STOCK INCENTIVE PLANS: Under the Company’s stock incen-

tive plans, nonqualified stock options may be granted to man-

agement, key employees and outside directors to purchase shares

of CarMax Group Common Stock. The exercise price for non-

qualified options is equal to, or greater than, the market value at

the date of grant. Options generally are exercisable over various

periods ranging from one to seven years from the date of grant.

A summary of the status of the CarMax Group’s stock options

and changes during the years ended February 28, 2001, February

29, 2000, and February 28, 1999, are shown in Table 1. Table 2

summarizes information about stock options outstanding as of

February 28, 2001.

80

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT

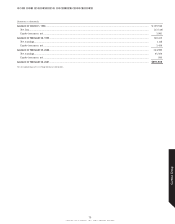

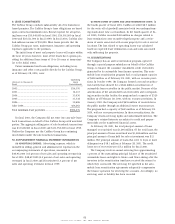

TABLE 1 2001 2000 1999

Weighted Average Weighted Average Weighted Average

(Shares in thousands) Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding at beginning of year ................. 3,324 $3.87 4,380 $1.77 4,822 $ 1.49

Granted .............................................................. 1,281 1.70 1,132 5.89 205 8.63

Exercised............................................................ (56) 0.22 (2,027) 0.22 (543) 0.22

Cancelled ........................................................... (442) 4.67 (161) 6.94 (104) 10.54

Outstanding at end of year............................. 4,107 $3.16 3,324 $3.87 4,380 $ 1.77

Options exercisable at end of year ................ 1,943 $2.94 1,203 $2.54 1,566 $ 0.96

TABLE 2 Options Outstanding Options Exercisable

Weighted Average

(Shares in thousands) Number Remaining Weighted Average Number Weighted Average

Range of Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

$ 0.22 ............................................................... 1,578 1.0 $ 0.22 1,338 $ 0.22

1.63 ............................................................... 1,094 6.0 1.63 — —

3.22 to 6.25................................................ 1,011 4.7 5.89 305 6.07

8.68 to 16.31 ................................................ 424 3.4 11.55 300 11.91

Total.................................................................... 4,107 3.5 $ 3.16 1,943 $ 2.94