CarMax 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

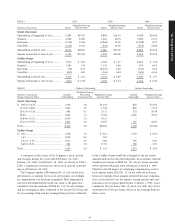

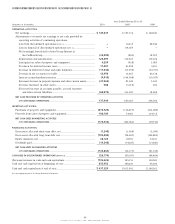

Circuit City Group

The improvement in the gross profit margin from fiscal 1999

to fiscal 2000 primarily reflected the higher percentage of sales

from better-featured products and newer technologies, which

carry higher gross profit margins, and continued improvements

in inventory management partly offset by the strength in per-

sonal computer sales, which carry lower gross margins. In fiscal

2001, the decline in the gross profit margin was limited by

lower personal computer sales and by continued double-digit

sales growth in new technologies and in higher margin cate-

gories where selection was expanded as part of the exit from

the appliance business. The impact of the appliance category

and the high proportion of sales represented by traditional

products more than offset these factors.

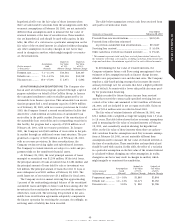

Selling, General and Administrative Expenses

Selling, general and administrative expenses were 21.7 percent of

sales in fiscal 2001, compared with 19.6 percent of sales in fiscal

2000 and 20.1 percent of sales in fiscal 1999. The fiscal 2001

increase reflects the decline in comparable store sales, $41.9 mil-

lion in remodeling costs for the Florida stores, $30.0 million in

costs related to the partial remodels and $5.0 million in sever-

ance costs associated with the fourth quarter workforce reduc-

tion. Excluding these costs and the estimated sales disruption

during the seven to 10 days of partial remodeling that occurred

primarily in the third quarter, the fiscal 2001 expense ratio would

have been 20.9 percent of sales. The improvement in the expense

ratio from fiscal 1999 to fiscal 2000 primarily reflects leverage

gained from the fiscal 2000 comparable store sales increase.

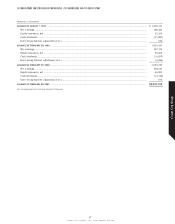

EXPENSE RATIO COMPONENTS

Fiscal 2001 2000 1999

Circuit City store business ........... 20.9% 19.6% 20.1%

Florida remodel costs ................... 0.4% — —

Partial remodel costs .................... 0.3% — —

Sales disruption impact................ 0.1% — —

Expense ratio ................................. 21.7% 19.6% 20.1%

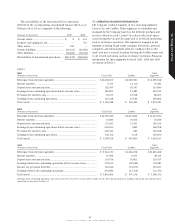

Interest Expense

Interest expense was relatively unchanged as a percent of sales

across the three-year period at 0.1 percent of sales in fiscal 2001

and fiscal 2000 and 0.2 percent of sales in fiscal 1999. Interest

expense was incurred on allocated debt used to fund store expan-

sion, remodeling and working capital, including inventory.

Income Taxes

The Group’s effective income tax rate was 38.0 percent in fiscal

2001 and fiscal 2000 and 38.1 percent in fiscal 1999.

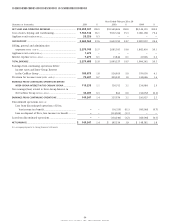

Earnings from Continuing Operations Before Inter-Group Interest

in the CarMax Group

Earnings from continuing operations before the Inter-Group

Interest in the CarMax Group were $115.2 million in fiscal 2001,

compared with $326.7 million in fiscal 2000 and $235.0 million

in fiscal 1999. Excluding the estimated sales disruption during

the seven to 10 days of partial remodeling, the appliance mer-

chandise markdowns, exit costs, remodel expenses and severance

costs related to the workforce reduction, earnings from continu-

ing operations before the Inter-Group Interest in the CarMax

Group would have been $205.1 million in fiscal 2001.

Net Earnings (Loss) Related to Inter-Group Interest

in the CarMax Group

The net earnings attributed to the Circuit City Group’s Inter-Group

Interest in the CarMax Group were $34.0 million in fiscal 2001,

compared with net earnings of $862,000 in fiscal 2000 and a net

loss of $18.1 million in fiscal 1999.

Earnings from Continuing Operations

Earnings from continuing operations attributed to the Circuit

City Group were $149.2 million in fiscal 2001, $327.6 million in

fiscal 2000 and $216.9 million in fiscal 1999.

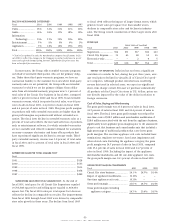

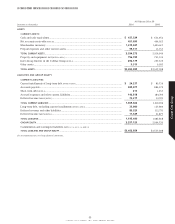

Loss from Discontinued Operations

On June 16, 1999, Digital Video Express announced that it would

cease marketing of the Divx home video system and discontinue

operations, but existing, registered customers would be able to

view discs during a two-year phase-out period. The operating

results of Divx and the loss on disposal of the Divx business have

been segregated from continuing operations and reported as sep-

arate line items, after tax, on the Circuit City Group statements of

earnings for the periods presented.

The loss from the discontinued operations of Divx totaled

$16.2 million after an income tax benefit of $9.9 million in fis-

cal 2000 and $68.5 million after an income tax benefit of $42.0

million in fiscal 1999.

In fiscal 2000, the loss on the disposal of the Divx business

totaled $114.0 million after an income tax benefit of $69.9 mil-

lion. The loss on the disposal includes a provision for operating

losses to be incurred during the phase-out period. It also includes

provisions for commitments under licensing agreements with

motion picture distributors, the write-down of assets to net real-

izable value, lease termination costs, employee severance and

benefit costs and other contractual commitments.

Net Earnings

Net earnings attributed to the Circuit City Group were $149.2

million in fiscal 2001, $197.3 million in fiscal 2000 and $148.4

million in fiscal 1999.

51

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT