CarMax 2001 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

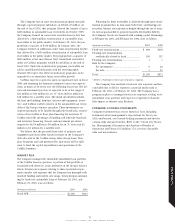

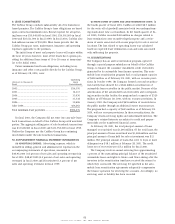

6. INCOME TAXES

The components of the income tax provision (benefit) on net

earnings (loss) are as follows:

Years Ended February 28 or 29

(Amounts in thousands) 2001 2000 1999

Current:

Federal ..................................... $16,986 $(1,395) $(23,773)

State ......................................... 2,174 855 (2,546)

19,160 (540) (26,319)

Deferred:

Federal ..................................... 8,494 1,190 10,945

State ......................................... 264 35 339

8,758 1,225 11,284

Income tax provision (benefit).... $27,918 $ 685 $(15,035)

The effective income tax rate differed from the federal statu-

tory income tax rate as follows:

Years Ended February 28 or 29

2001 2000 1999

Federal statutory income tax rate ........ 35% 35% 35%

State and local income taxes,

net of federal benefit ........................ 3% 3% 4%

Effective income tax rate....................... 38% 38% 39%

In accordance with SFAS No. 109, the tax effects of temporary

differences that give rise to a significant portion of the deferred

tax assets and liabilities at February 28 or 29 are as follows:

(Amounts in thousands) 2001 2000

Deferred tax assets:

Accrued expenses ........................................ $ 5,173 $ 5,510

Other.............................................................. 235 309

Total gross deferred tax assets............. 5,408 5,819

Deferred tax liabilities:

Depreciation ................................................. 3,850 6,181

Securitized receivables................................ 15,262 4,919

Inventory ...................................................... 6,449 4,655

Prepaid expenses ......................................... 1,629 3,088

Total gross deferred tax liabilities....... 27,190 18,843

Net deferred tax liability.................................. $21,782 $13,024

In assessing the realizability of deferred tax assets, manage-

ment considers the scheduled reversal of deferred tax liabilities,

projected future taxable income and tax planning strategies.

Based on these considerations, management believes that it is

more likely than not that the gross deferred tax assets at February

28, 2001, and February 29, 2000, will be realized by the CarMax

Group; therefore, no valuation allowance is necessary.

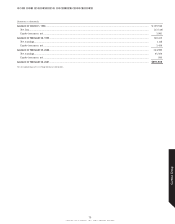

7. ASSOCIATE BENEFIT AND STOCK INCENTIVE PLANS

(A) 401(k) PLAN: Effective August 1, 1999, the Company began

sponsoring a 401(k) Plan for all employees meeting certain eligi-

bility criteria. Under the Plan, eligible employees can contribute

up to 15 percent of their salaries, and the Company matches a

portion of those associate contributions. The Company's expense

for this plan for CarMax Group associates was $686,000 in fiscal

2001 and $317,000 in fiscal 2000.

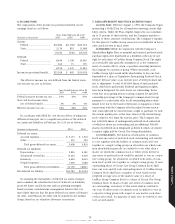

(B) PREFERRED STOCK: In conjunction with the Company’s

Shareholders Rights Plan as amended and restated, preferred stock

purchase rights were distributed as a dividend at the rate of one

right for each share of CarMax Group Common Stock. The rights

are exercisable only upon the attainment of, or the commence-

ment of a tender offer to attain, a specified ownership interest in

the Company by a person or group. When exercisable, each

CarMax Group right would entitle shareholders to buy one four-

hundredth of a share of Cumulative Participating Preferred Stock,

Series F, $20 par value, at an exercise price of $100 per share sub-

ject to adjustment. A total of 500,000 shares of such preferred

stock, which have preferential dividend and liquidation rights,

have been designated. No such shares are outstanding. In the

event that an acquiring person or group acquires the specified

ownership percentage of the Company’s common stock (except

pursuant to a cash tender offer for all outstanding shares deter-

mined to be fair by the board of directors) or engages in certain

transactions with the Company after the rights become exercis-

able, each right will be converted into a right to purchase, for half

the current market price at that time, shares of the related Group

stock valued at two times the exercise price. The Company also

has 1,000,000 shares of undesignated preferred stock authorized

of which no shares are outstanding and an additional 500,000

shares of preferred stock designated as Series E, which are related

to similar rights held by Circuit City Group shareholders.

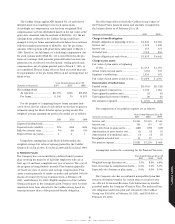

(C) VOTING RIGHTS: The holders of both series of common

stock and any series of preferred stock outstanding and entitled

to vote together with the holders of common stock will vote

together as a single voting group on all matters on which com-

mon shareholders generally are entitled to vote other than a

matter on which the common stock or either series thereof or

any series of preferred stock would be entitled to vote as a sepa-

rate voting group. On all matters on which both series of com-

mon stock would vote together as a single voting group, (i) each

outstanding share of Circuit City Group Common Stock shall

have one vote and (ii) each outstanding share of CarMax Group

Common Stock shall have a number of votes based on the

weighted average ratio of the market value of a share of

CarMax Group Common Stock to a share of Circuit City Group

Common Stock. If shares of only one series of common stock

are outstanding, each share of that series shall be entitled to

one vote. If either series of common stock is entitled to vote as

a separate voting group with respect to any matter, each share

of that series shall, for purposes of such vote, be entitled to one

vote on such matter.

79

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT

Carmax Group