CarMax 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

CIRCUIT CITY STORES, INC. 2001 ANNUAL REPORT

Circuit City Stores, Inc.

Circuit City Group

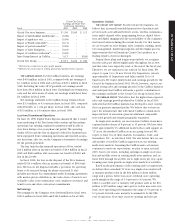

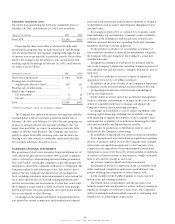

Earnings per Share from

Continuing Operations

Fiscal 2001 2000 1999

Circuit City store business ........................ $ 1.00 $1.60 $ 1.17

Impact of merchandise markdowns*........ (0.08) – –

Impact of appliance exit ........................... (0.09) – –

Impact of Florida remodels**..................... (0.13) – –

Impact of partial remodels**....................... (0.09) – –

Impact of sales disruption ........................ (0.03) – –

Impact of workforce reduction**............... (0.02) – –

Inter-Group Interest in CarMax............... 0.17 – (0.09)

Circuit City Group...................................... $ 0.73 $1.60 $ 1.08

** Reflected as a reduction in gross profit margins.

** Reflected as an increase in selling, general and administrative expenses.

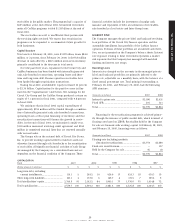

THE CARMAX GROUP. For the CarMax business, net earnings

were $45.6 million in fiscal 2001, compared with net earnings of

$1.1 million in fiscal 2000 and a net loss of $23.5 million in fiscal

1999. Excluding the write-off of goodwill, net earnings would

have been $51.0 million in fiscal 2001. Excluding lease termination

costs and the write-down of assets, net earnings would have been

$4.1 million in fiscal 2000.

Net earnings attributed to the CarMax Group Common Stock

were $11.6 million, or 43 cents per share, in fiscal 2001, compared

with $256,000, or 1 cent per share, in fiscal 2000, and a net loss

of $5.5 million, or 24 cents per share, in fiscal 1999.

Loss from Discontinued Operations

On June 16, 1999, Digital Video Express announced that it would

cease marketing of the Divx home video system and discontinue

operations, but existing, registered customers would be able to

view discs during a two-year phase-out period. The operating

results of Divx and the loss on disposal of the Divx business have

been segregated from continuing operations and reported as sepa-

rate line items, after tax, on the Company's statements of earnings

for the periods presented.

The loss from the discontinued operations of Divx totaled

$16.2 million after an income tax benefit of $9.9 million in fiscal

2000 and $68.5 million after an income tax benefit of $42.0 mil-

lion in fiscal 1999.

In fiscal 2000, the loss on the disposal of the Divx business

totaled $114.0 million after an income tax benefit of $69.9 mil-

lion. The loss on the disposal includes a provision for operating

losses to be incurred during the phase-out period. It also

includes provisions for commitments under licensing agreements

with motion picture distributors, the write-down of assets to net

realizable value, lease termination costs, employee severance and

benefit costs and other contractual commitments.

Net Earnings

Net earnings for the Company were $160.8 million in fiscal 2001,

$197.6 million in fiscal 2000 and $142.9 million in fiscal 1999.

Operations Outlook

THE CIRCUIT CITY GROUP. For the Circuit City business, we

believe that increased household penetration of products and

services such as broadband Internet access, wireless communica-

tions, multi-channel video programming devices, digital televi-

sion and digital imaging will drive profitability of the consumer

electronics business during the current decade. For that reason,

we are focused on store designs, sales counselor training, inven-

tory management, marketing programs and Six Sigma process

improvements that will maintain Circuit City’s position as a

leading retailer of new technologies.

Despite these plans and longer-term outlook, we recognize

that the sales pace shifted significantly throughout fiscal 2001

and that sales were especially weak at the end of the fiscal year.

Therefore, we are cautious in our outlook for fiscal 2002. We

expect to open 15 to 20 new Circuit City Superstores, relocate

approximately 10 Superstores and fully remodel 20 to 25

Superstores. We expect limited sales and earnings growth for the

Circuit City business in fiscal 2002. We do, however, expect con-

tinued strong sales and earnings growth for the CarMax business

and anticipate that CarMax will make a greater contribution to

the earnings attributed to the Circuit City Group in fiscal 2002.

THE CARMAX GROUP. We believe that the higher-than-expected

sales and earnings growth produced by CarMax in fiscal 2001

indicates that the CarMax business has developed a store concept

that can generate sustained profits. We believe that we have in

place the infrastructure that will enable CarMax to maintain its

improved level of execution, generate additional comparable

store sales growth and resume geographic expansion.

In single-store markets, our most mature CarMax stores have

captured market shares of 8 percent to 10 percent. We have iden-

tified approximately 35 additional markets that could support an

“A” store, the standard CarMax store size going forward. We

expect to enter two of these markets, Sacramento, Calif., and

Greensboro, N.C., in late fiscal 2002. We also believe that we can

add another 10 satellite CarMax superstores in our existing

multi-store markets. Assuming the CarMax used-car business

continues to meet our expectations, we plan to open, in fiscal

2003, four to six stores, including openings in single-store mar-

kets and satellite stores in existing multi-store markets, and, in

fiscal 2004 through fiscal 2006, six to eight stores per year, again

focusing near-term growth on single-store markets or satellites.

Based on the performance of the existing used-car superstores,

we believe that a standard “A” store in a single-store market will

at maturity produce sales in the $50 million to $100 million

range and a pretax, before non-store overhead, store operating

profit margin in the range of 5.0 percent to 9.5 percent. We

believe a satellite store at maturity will produce sales in the $36

million to $72 million range and a pretax, before non-store over-

head, store operating profit margin in the range of 5.0 percent to

9.3 percent. In both cases, maturity is assumed to be the fifth

year of operation. If we meet our store opening and sales per